Minimum Social Security Benefit for 10 Years of Work

In this article, we will discuss the minimum social security benefit for individuals who have worked for 10 years. Understanding the minimum social security benefit is crucial for those planning their retirement and seeking financial stability in their later years.

What is the Minimum Social Security Benefit?

The minimum social security benefit is the lowest amount of monthly payment an individual can receive from the Social Security Administration (SSA) based on their work history and earnings. It is designed to provide a safety net for those who have worked for a minimum number of years but may not have earned substantial income during their working lives.

Eligibility for the Minimum Social Security Benefit

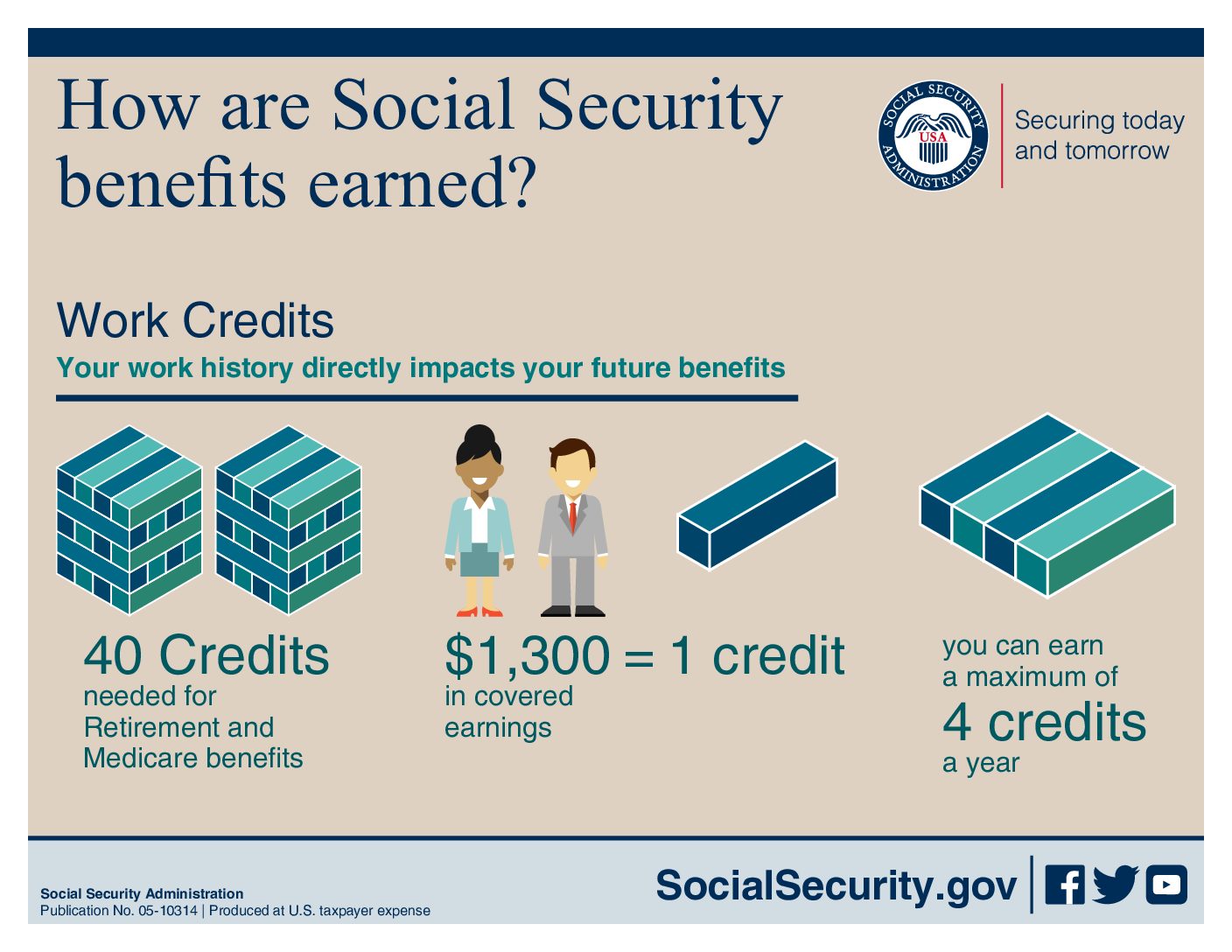

To be eligible for the minimum social security benefit, an individual must have worked and paid Social Security taxes for at least 10 years. These years of work are commonly referred to as “credits.” Each year, a certain amount of earnings is required to earn one credit. The specific earnings requirement for a credit may change annually, so it is essential to stay updated with the latest information provided by the SSA.

Calculating the Minimum Social Security Benefit

The exact calculation of the minimum social security benefit is complex and depends on various factors, including the individual’s earnings history and the year they turn 62, which is the earliest age at which one can claim social security benefits. However, we can provide a general overview of how the minimum benefit is determined.

The SSA uses a formula called the Primary Insurance Amount (PIA) to calculate social security benefits. The PIA takes into account the individual’s average indexed monthly earnings (AIME) and applies a formula to determine the monthly benefit amount.

For individuals who have worked for 10 years, the minimum social security benefit is typically calculated as a percentage of the PIA. It is important to note that the actual amount may vary based on individual circumstances, such as the number of credits earned and the specific year of retirement.

Importance of the Minimum Social Security Benefit

The minimum social security benefit plays a crucial role in providing financial stability for individuals who have worked for a minimum of 10 years. It ensures that even those with lower lifetime earnings can receive a minimum level of support during their retirement years.

Without the minimum benefit, individuals who have worked for several years but earned modest incomes may struggle to meet their basic needs and cover essential expenses. The minimum social security benefit helps bridge the gap and provides a foundation for a more secure retirement.

In conclusion, the minimum social security benefit is a vital component of the Social Security program, providing a safety net for individuals who have worked for at least 10 years. It ensures that even those with lower earnings can receive a minimum level of financial support during their retirement years. Understanding the eligibility criteria and calculation methods for the minimum benefit is crucial for individuals planning their retirement and seeking financial stability.

Frequently Asked Questions about Minimum Social Security Benefit for 10 Years of Work

1. What is the minimum social security benefit for 10 years of work?

The minimum social security benefit for 10 years of work is the lowest amount of monthly income you can receive from Social Security based on your work history.

2. How is the minimum social security benefit calculated?

The minimum social security benefit is calculated based on your average indexed monthly earnings (AIME) and the number of years you have paid into Social Security.

3. Can I receive the minimum social security benefit if I only worked for 10 years?

If you have worked for at least 10 years and earned enough credits, you may be eligible for the minimum social security benefit. However, the exact amount will depend on your earnings history.

4. Is the minimum social security benefit enough to live on?

The minimum social security benefit is designed to provide a basic level of income, but it may not be enough to cover all living expenses. It is important to plan for additional sources of income or savings to supplement your Social Security benefits.

5. Can the minimum social security benefit increase over time?

Yes, the minimum social security benefit can increase over time due to cost-of-living adjustments (COLAs) that are applied to Social Security benefits to account for inflation.

6. How does the minimum social security benefit compare to the average benefit?

The minimum social security benefit is generally lower than the average benefit amount, as it is based on a shorter work history. The average benefit is calculated using a formula that takes into account your highest earning years.

7. Are there any exceptions to the minimum social security benefit rules?

There may be exceptions to the minimum social security benefit rules for certain individuals, such as those who receive a pension from work not covered by Social Security or who are eligible for other types of government assistance.

8. Can I qualify for other benefits in addition to the minimum social security benefit?

Yes, you may be eligible for other benefits in addition to the minimum social security benefit, such as spousal benefits or survivor benefits. These additional benefits can provide extra income based on your circumstances.

9. How can I find out what my estimated minimum social security benefit will be?

You can create an account on the official Social Security Administration website or contact their office to obtain an estimate of your minimum social security benefit based on your work history.

10. Can I increase my minimum social security benefit by working longer?

Yes, working longer can increase your minimum social security benefit as it allows you to earn more credits and potentially have a higher average indexed monthly earnings (AIME), which is used in the benefit calculation.