Navigating Compensation: Understanding the Average Cost of Benefits Per Employee

In the intricate landscape of employee compensation, comprehending the average cost of benefits per employee is paramount. Let’s embark on a journey to decode the nuances, factors, and benchmarks that shape this crucial aspect of workforce management.

Unraveling Employee Benefit Costs

In the dynamic realm of human resources, understanding the financial intricacies of employee compensation is fundamental. The average cost of benefits per employee is a key metric that goes beyond salary considerations, encompassing health insurance, retirement plans, and various perks. This guide aims to unravel the complexities surrounding benefit costs, shedding light on why it’s crucial for businesses of all sizes.

Factors Influencing Benefit Costs

The average cost of benefits per employee is not a one-size-fits-all metric. Several factors contribute to the variance in these costs, and businesses must navigate these intricacies effectively. From the size and industry of the company to its geographical location, each element plays a role in determining the financial commitment to employee benefits. Understanding these factors is the first step towards creating a tailored and sustainable benefits package.

Benchmarking: How Does Your Company Compare?

In the ever-evolving landscape of compensation strategy, benchmarking plays a pivotal role. How does your company’s average cost of benefits per employee compare to industry standards and best practices? Benchmarking provides valuable insights, allowing businesses to gauge their competitiveness, attract top talent, and ensure that their benefit offerings align with employee expectations. Let’s delve into the significance of benchmarking and how it can drive informed decision-making in benefit-cost management.

Types of Employee Benefits and Their Costs

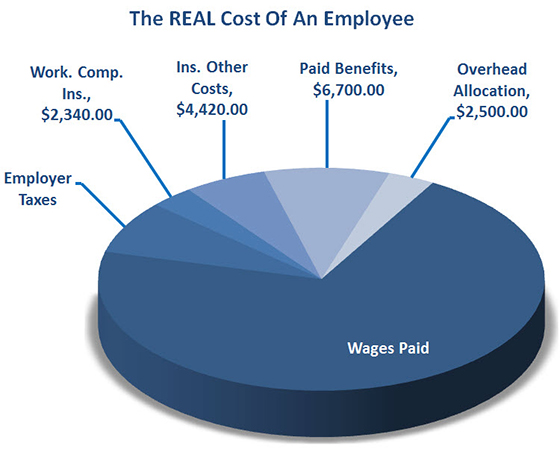

To truly grasp the average cost of benefits per employee, it’s essential to dissect the various components that make up a comprehensive benefits package. From healthcare and retirement plans to additional perks like wellness programs or flexible work arrangements, each benefit type carries its cost implications. By understanding the intricacies of these components, businesses can tailor their offerings to meet the diverse needs of their workforce while managing costs effectively.

Recent Trends in Employee Benefit Costs

The landscape of employee benefits is ever-evolving, shaped by societal changes, economic factors, and workforce preferences. Current trends play a significant role in influencing benefit costs. In a world where remote work is becoming more prevalent, and employee well-being takes center stage, businesses need to adapt their benefit offerings accordingly. Explore the latest trends shaping benefit expenditures and how businesses are responding to meet the evolving expectations of their employees.

Calculating and Managing Benefit Costs Effectively

Practical strategies for calculating and managing benefit costs are essential for businesses aiming to strike the right balance between employee satisfaction and financial sustainability. From understanding the cost per employee to implementing cost-sharing models, this section will provide actionable insights. Learn how businesses can optimize their benefit offerings to ensure a competitive edge in talent acquisition and retention while keeping costs in check.

Industry-Specific Insights: Variances and Considerations

The average cost of benefits per employee varies significantly across industries, each with its unique challenges and opportunities. In this section, we’ll delve into industry-specific insights, examining how sectors such as technology, healthcare, and finance approach benefit costs. Understanding these variances is crucial for businesses looking to tailor their benefits strategy to align with industry norms and remain competitive in talent acquisition.

Navigating Regulatory Compliance in Benefit Costs

The regulatory landscape surrounding employee benefits is intricate and subject to change. Navigating compliance requirements is crucial for businesses to avoid legal ramifications and financial penalties. This section will explore the compliance considerations associated with benefit costs, offering guidance on staying abreast of regulatory changes and ensuring that benefit programs adhere to legal standards.

Case Studies: Real-world Insights into Benefit Cost Management

Real-world case studies provide tangible examples of how businesses effectively manage and optimize their average cost of benefits per employee. By examining these scenarios, readers can glean practical insights and learn from the successes and challenges faced by others in the realm of benefit-cost management. Dive into these case studies to extract valuable lessons for enhancing your benefit-cost strategies.

Future Outlook: Adapting to Evolving Benefit Cost Dynamics

The employee benefits landscape is continuously evolving, influenced by global events, economic shifts, and societal changes. In this final section, we’ll explore the anticipated changes in benefit costs and offer insights into how businesses can proactively adapt to these dynamics. By staying ahead of the curve, businesses can position themselves to attract top talent while effectively managing their average cost of benefits per employee.

Frequently Asked Questions About the Average Cost of Benefits Per Employee

1. What constitutes the average cost of benefits per employee?

The average cost includes expenses for healthcare, retirement plans, and additional perks beyond basic salary.

2. How do factors like company size and industry influence benefit costs?

Company size and industry play a role in determining benefit costs, with larger companies and certain industries often incurring higher expenses.

3. Why is benchmarking important in managing benefit costs?

Benchmarking allows businesses to compare their benefit costs to industry standards, aiding in competitive compensation strategies.

4. Can you break down the types of benefits contributing to the average cost?

Yes, benefits range from healthcare and retirement plans to wellness programs, each carrying its cost implications.

5. What recent trends are impacting the average cost of employee benefits?

Trends such as remote work, changing demographics, and a focus on employee well-being are influencing benefit costs.

6. How can businesses calculate the average cost of benefits per employee effectively?

Strategies include understanding cost per employee, implementing cost-sharing models, and optimizing benefit offerings.

7. Why do benefit costs vary across different industries?

Industries have unique challenges and opportunities, that influence how they approach benefit costs and workforce compensation.

8. What compliance considerations are associated with benefit costs?

Navigating legal standards and staying abreast of regulatory changes is crucial to ensure compliance in benefit program management.

9. Can you provide real-world examples of effective benefit cost management?

Case studies offer insights into how businesses successfully manage and optimize their average cost of benefits per employee.

10. How can businesses prepare for the future dynamics of benefit costs?

Staying informed, embracing adaptability, and proactively responding to anticipated changes are key to future-proofing benefit-cost strategies.

Conclusion:

In the realm of human resources and workforce management, understanding the average cost of benefits per employee is not just a financial exercise; it’s a strategic imperative. As we conclude this comprehensive guide, reflect on the insights gained— from dissecting benefit types to navigating regulatory compliance, and from industry-specific considerations to real-world case studies.

In today’s dynamic business environment, where talent is a critical asset, optimizing your average cost of benefits per employee is more than a cost-saving measure—it’s an investment in your workforce’s well-being and satisfaction. By staying attuned to trends, embracing adaptability, and leveraging the experiences of others through case studies, your organization can position itself as an employer of choice.