The State of Texas Retirement Benefits

Welcome to our comprehensive guide on the state of Texas retirement benefits. In this article, we will delve into the various retirement benefits available to individuals in the state of Texas. Whether you are a current employee, a retiree, or someone planning for retirement, understanding the retirement benefits offered by the state is crucial for making informed decisions about your financial future.

Types of Retirement Plans

There are several retirement plans available to employees of the state of Texas:

Texas Employees Retirement System (ERS)

The Texas Employees Retirement System (ERS) is a defined benefit retirement plan available to state employees. It provides a guaranteed monthly retirement benefit based on a formula that considers an employee’s years of service and average salary. The ERS also offers disability and survivor benefits to eligible participants.

Teacher Retirement System of Texas (TRS)

The Teacher Retirement System of Texas (TRS) is a retirement plan specifically designed for educators in Texas. It offers both a defined benefit plan and a defined contribution plan. The defined benefit plan provides a monthly retirement benefit based on a formula that considers an educator’s years of service and average salary. The defined contribution plan allows educators to contribute a portion of their salary to a retirement account, which is then invested for potential growth.

Optional Retirement Program (ORP)

The Optional Retirement Program (ORP) is available to certain employees of public institutions of higher education in Texas. It is an alternative retirement plan to the ERS and TRS. The ORP allows employees to choose from a variety of investment providers and offers portability, meaning employees can take their retirement account with them if they change employers within the ORP.

Retirement Eligibility

The eligibility requirements for retirement benefits vary depending on the specific retirement plan. Generally, to be eligible for retirement benefits, employees must meet the following criteria:

ERS Eligibility

To be eligible for retirement benefits through the ERS, employees must have at least five years of service credit. The minimum age for retirement varies depending on the employee’s hire date and years of service. For example, employees hired before January 1, 2007, can retire at age 60 with at least five years of service credit, while those hired after that date must be at least 65 years old with five years of service credit.

TRS Eligibility

Eligibility for retirement benefits through the TRS depends on the employee’s age and years of service. Generally, educators can retire with full benefits at age 65 with at least five years of service credit. However, there are early retirement options available for educators who meet specific age and service credit requirements.

ORP Eligibility

Eligibility requirements for retirement benefits through the ORP vary depending on the specific institution and the employee’s contract. Employees should consult their institution’s human resources department or retirement plan administrator for detailed eligibility information.

Retirement Benefit Calculation

The calculation of retirement benefits differs for each retirement plan:

ERS Benefit Calculation

The ERS calculates retirement benefits based on a formula that considers an employee’s years of service and average salary. The formula is as follows:

“`

Retirement Benefit = (Years of Service) x (Average Salary) x (Multiplier)

“`

The multiplier is determined by the employee’s age and years of service credit. The ERS provides a comprehensive guide and retirement estimator tool on its website to help employees estimate their retirement benefits accurately.

TRS Benefit Calculation

The TRS calculates retirement benefits based on a formula that considers an educator’s years of service and average salary. The formula is as follows:

“`

Retirement Benefit = (Years of Service) x (Average Salary) x (Percentage)

“`

The percentage is determined by the employee’s age and years of service credit. The TRS also provides an online retirement calculator to assist educators in estimating their retirement benefits.

Additional Retirement Benefits

In addition to the primary retirement plans mentioned above, the state of Texas offers various additional retirement benefits:

Health Insurance

Retirees from the ERS and TRS may be eligible for continued health insurance coverage through the Texas Employees Group Benefits Program (GBP). The GBP provides access to a range of health insurance plans, including medical, dental, and vision coverage.

Deferred Compensation Plans

The state of Texas offers deferred compensation plans, such as the Texa$aver 401(k) and 457 plans, to help employees save for retirement. These plans allow employees to contribute a portion of their salary on a pre-tax or after-tax basis, depending on the plan, and invest those contributions for potential growth.

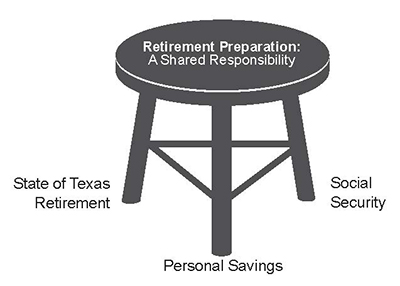

Social Security

Employees who have paid into the Social Security system may be eligible for Social Security benefits in addition to their state retirement benefits. The Social Security Administration provides detailed information on eligibility and benefit calculations.

Understanding the state of Texas retirement benefits is essential for individuals planning for retirement or currently working for the state. By familiarizing yourself with the available retirement plans, eligibility requirements, benefit calculations, and additional benefits, you can make informed decisions to secure a financially stable retirement. Remember to consult with the respective retirement plan administrators or financial advisors for personalized guidance based on your specific circumstances.

Frequently Asked Questions about Texas Retirement Benefits

Q1: What are the retirement benefits available in the state of Texas?

A1: The state of Texas offers various retirement benefits, including the Employees Retirement System (ERS) and the Teacher Retirement System (TRS).

Q2: How do I qualify for retirement benefits in Texas?

A2: To qualify for retirement benefits in Texas, you generally need to be a member of the ERS or TRS and meet the specific eligibility criteria set by each system.

Q3: When can I start receiving retirement benefits in Texas?

A3: The age at which you can start receiving retirement benefits in Texas depends on the specific retirement system you are enrolled in. Generally, it ranges from 60 to 65 years.

Q4: How much will I receive as retirement benefits in Texas?

A4: The amount of retirement benefits you receive in Texas is based on various factors, including your years of service, average salary, and the specific retirement system you are enrolled in.

Q5: Can I receive retirement benefits from both ERS and TRS in Texas?

A5: If you have worked in both state employment covered by ERS and public education covered by TRS, you may be eligible to receive retirement benefits from both systems.

Q6: Are Texas retirement benefits taxable?

A6: Yes, Texas retirement benefits are subject to federal income tax, but they are generally exempt from state income tax.

Q7: Can I withdraw my retirement contributions in Texas?

A7: Depending on the retirement system, you may have options to withdraw your retirement contributions, but it is advisable to consult with the respective system for detailed information.

Q8: Can I continue working while receiving retirement benefits in Texas?

A8: Yes, you can continue working while receiving retirement benefits in Texas, but there may be certain restrictions on the amount of income you can earn without affecting your benefits.

Q9: Are there any healthcare benefits included in Texas retirement plans?

A9: Yes, both the ERS and TRS offer healthcare benefits to eligible retirees, including medical, dental, and vision coverage.

Q10: How can I contact the Texas retirement systems for more information?

A10: You can contact the Employees Retirement System (ERS) at 1-877-275-4377 and the Teacher Retirement System (TRS) at 1-800-223-8778 for more information regarding retirement benefits in Texas.