Navigating the Tax Benefits of LLC vs. S Corp

In the dynamic landscape of business, the choice between a Limited Liability Company (LLC) and an S Corporation (S Corp) goes beyond just structure—it significantly impacts taxation and overall financial outcomes. Let’s delve into the essentials, exploring why the selection of business structure matters and the profound effects it can have on taxation and beyond.

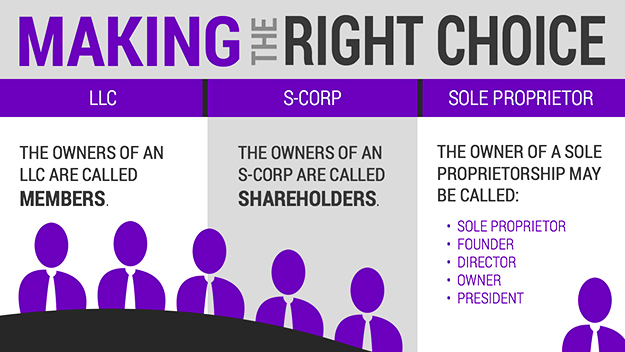

Breaking Down Business Structures: LLCs and S Corps Defined

At the core of this decision are the distinct features of LLCs and S Corps. Understanding these structures lays the foundation for informed choices, especially regarding taxation. This section will unravel the intricacies of LLCs and S Corps, providing a comprehensive overview to set the stage for further exploration.

Why Structure Matters: The Impact on Taxation and Beyond

Beyond the surface-level differences, the choice between an LLC and an S Corp has far-reaching consequences, particularly in the realm of taxation. This heading will explore why the selection of a business structure is a critical decision, impacting not only how you report income but also your overall financial strategies and goals.

Tax Advantages of LLCs: Unveiling the Benefits

Pass-Through Taxation: How LLCs Simplify Tax Filings

LLCs are renowned for their simplicity and flexibility, and one of the key tax advantages lies in pass-through taxation. This feature allows business profits to flow directly to the owners’ tax returns. Delving into the mechanics of pass-through taxation will illuminate how LLCs streamline the reporting process and potentially reduce tax burdens for business owners.

Flexibility in Allocation: Navigating Profit Distributions

Another distinctive benefit of LLCs is the flexibility in allocating profits among members. This section will explore how this flexibility empowers business owners to tailor profit distributions according to individual needs, potentially optimizing their tax positions while fostering a collaborative and adaptable business structure.

Self-Employment Tax Savings: A Key Advantage of LLCs

LLC members may enjoy self-employment tax savings compared to sole proprietors. By understanding the mechanisms at play, business owners can strategically position themselves to minimize this tax liability. This section will outline the specifics, empowering readers with insights to make tax-efficient decisions within the LLC structure.

S Corps and Tax Efficiency: Examining the Landscape

Pass-Through Taxation Redefined: S Corps in Focus

Shifting our focus to S Corporations, we explore how they redefine pass-through taxation. Unlike LLCs, S Corps has unique features that influence how income is reported and taxed. This section will dissect the nuances of S Corp pass-through taxation, providing clarity on its mechanisms and potential advantages for business owners.

Salary and Dividend Strategy: Optimizing for Tax Efficiency

One of the defining aspects of S Corps is the requirement for owners to receive a “reasonable” salary. Understanding how this salary, along with dividends, contributes to overall tax efficiency is crucial. This heading will guide readers through crafting a salary and dividend strategy within the S Corp structure, emphasizing the balance between compensation and distribution.

Avoiding Double Taxation: The S Corp Advantage

Double taxation can be a significant concern for business owners, but S Corps offers a unique advantage in this regard. This section will elucidate how S Corps mitigates the risk of double taxation, allowing business profits to flow through to shareholders without being taxed at the corporate level. The result is a potentially more tax-efficient structure for certain businesses.

Comparative Analysis: LLC vs. S Corp Tax Implications

Head-to-Head Comparison: Breaking Down Tax Structures

Now that we’ve explored the individual tax benefits of LLCs and S Corps, it’s time for a head-to-head comparison. This section will provide a comprehensive breakdown of the tax structures, emphasizing the specific advantages and considerations of each. Business owners can use this analysis as a practical guide to inform their structure selection.

Scenario-Based Analysis: Choosing the Right Fit

Every business is unique, and so are its tax needs. This heading will delve into scenario-based analyses, presenting hypothetical business situations and illustrating how the tax implications differ between LLCs and S Corps. This practical approach empowers readers to align their choices with the specific needs and goals of their businesses.

Real-Life Examples: Understanding Practical Tax Impacts

Concrete examples offer invaluable insights. Drawing from real-life scenarios, this section will showcase businesses that have thrived under both LLC and S Corp structures. Examining their journeys will provide readers with tangible examples of how tax choices can impact businesses in various industries and sizes.

Success Stories and Case Studies: Learning from Experience

Real Businesses, Real Tax Benefits: Case Studies in Action

Real-world examples provide valuable insights into the tangible benefits of choosing between an LLC and an S Corp. This section will showcase case studies of businesses that have strategically leveraged the tax advantages of their selected structures. Readers can draw inspiration and lessons from these practical success stories.

Navigating Challenges: Lessons from Successful Entrepreneurs

Success often involves overcoming challenges. Entrepreneurs who have successfully navigated the intricacies of tax benefits in LLCs and S Corps have valuable lessons to share. This part will highlight the challenges faced by these entrepreneurs and the strategies they employed to ensure tax optimization, offering guidance for others on a similar journey.

Practical Insights: Applying Strategies for Maximum Tax Advantage

Bringing it all together, this section will distill practical insights from the success stories and case studies. Readers will gain actionable strategies for applying tax advantages within their business contexts. From effective tax planning to strategic decision-making, these insights aim to empower businesses to maximize their tax advantage.

Common Pitfalls to Avoid: Safeguarding Your Tax Position

Missteps in Structure Selection: Common Errors

While understanding the benefits is crucial, avoiding common pitfalls is equally important. This section will highlight missteps in structure selection that businesses commonly make. By recognizing and steering clear of these errors, business owners can safeguard their tax positions and ensure they are on the right path to financial success.

Tax Compliance Pitfalls: Staying on the Right Side of the Law

Ensuring compliance with tax laws is paramount. This heading will shed light on common compliance pitfalls that businesses might encounter. From record-keeping challenges to issues with deductions, understanding and addressing these compliance concerns will help businesses stay on the right side of the law and maintain their tax benefits.

Mitigating Risks: Proactive Measures for Business Owners

Proactivity is the key to mitigating risks. This final sub-section will provide actionable measures for business owners to proactively address potential risks to their tax benefits. From staying informed about regulatory changes to regularly reviewing their tax strategies, these measures will empower businesses to navigate challenges effectively.

Frequently Asked Questions (FAQs) About Tax Benefits of LLCs vs. S Corps

1. Q: What are the main tax advantages of choosing an LLC over an S Corp?

A: LLCs offer pass-through taxation, flexible profit allocation, and potential self-employment tax savings, providing unique advantages for business owners.

2. Q: Can an S Corp provide any specific tax benefits that an LLC cannot?

A: Yes, S Corps can offer advantages such as avoiding double taxation through salary and dividend strategies, making them a preferred choice for certain businesses.

3. Q: How does the size of my business impact the tax benefits of choosing between an LLC and an S Corp?

A: The size of your business influences tax efficiency. Larger businesses may find S Corps beneficial, while smaller ones often benefit from the simplicity of LLCs.

4. Q: What role does risk tolerance play in selecting between an LLC and an S Corp for tax purposes?

A: Risk tolerance affects the choice between liability protection and tax benefits. Business owners need to balance these considerations when deciding on a structure.

5. Q: Are recent changes in tax laws more favorable to LLCs or S Corps?

A: Tax law changes can impact both structures differently. Staying informed about legislative updates is crucial for businesses to optimize their tax benefits.

6. Q: How can I adapt my business structure to recent tax law changes to maximize benefits?

A: Adapting to changes involves proactive tax planning, regular reviews of your financial plan, and adjusting strategies to align with the evolving tax landscape.

7. Q: In what scenarios is an LLC more advantageous for tax purposes compared to an S Corp?

A: LLCs are often preferred for simplicity, pass-through taxation, and when the business prioritizes flexibility in profit distribution among members.

8. Q: What are the common pitfalls to avoid when selecting between an LLC and an S Corp for tax benefits?

A: Missteps in structure selection and compliance pitfalls can jeopardize tax benefits. Understanding these common errors is essential for safeguarding your tax position.

9. Q: Can you provide examples of businesses that have successfully leveraged tax benefits in both LLCs and S Corps?

A: Yes, success stories showcase businesses thriving under each structure. Real-world examples offer practical insights into how tax benefits can impact different industries.

10. Q: How can I ensure compliance with tax laws to maintain the tax benefits of my chosen business structure?

A: Mitigating risks involves proactive measures, such as staying informed about regulatory changes, maintaining accurate records, and regularly reviewing your tax strategies.

Conclusion:

In conclusion, the journey through the tax benefits of LLCs vs. S Corps has been comprehensive. This section will summarize key takeaways, reinforcing the critical points for businesses to consider when making decisions about their structure for optimal tax efficiency. Empowerment comes from knowledge. The concluding part will emphasize the importance of making informed tax choices. Whether it’s understanding the tax advantages of each structure or learning from the experiences of others, business owners are encouraged to take charge of their financial future by making well-informed tax decisions.