Tax Benefit of 529 – A Comprehensive Guide

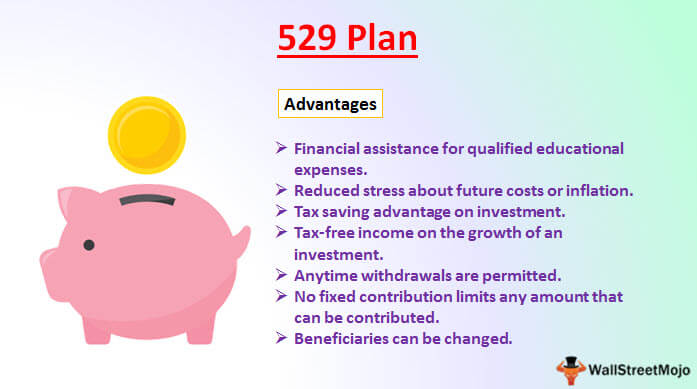

Welcome to our comprehensive guide on the tax benefits of 529 plans. In this article, we will delve into the various advantages offered by 529 plans and how they can help you save for education expenses while enjoying tax benefits.

Understanding 529 Plans

529 plans are tax-advantaged savings plans designed to encourage families to save for future education expenses. These plans are named after Section 529 of the Internal Revenue Code, which governs their operation.

Types of 529 Plans

There are two main types of 529 plans:

College Savings Plans:

These plans allow you to save money for qualified education expenses, such as tuition, fees, books, and room and board. The funds in these plans can be used at any eligible educational institution.

Prepaid Tuition Plans:

These plans enable you to prepay tuition at eligible educational institutions at today’s rates, which can help protect against future tuition increases.

Tax Benefits of 529 Plans

Now, let’s explore the tax advantages associated with 529 plans:

Tax-Free Earnings

One of the key benefits of 529 plans is that the earnings on your contributions grow tax-free. This means that you don’t have to pay federal taxes on the investment gains as long as the funds are used for qualified education expenses.

Tax-Free Withdrawals

When you withdraw money from a 529 plan to pay for qualified education expenses, the withdrawals are also tax-free. This includes both the contributions you made and the earnings on those contributions.

State Tax Benefits

In addition to federal tax benefits, many states offer their own tax incentives for 529 plans. These can include deductions for contributions, tax credits, or even exemption from state income tax on earnings. It’s important to check with your state’s specific rules to understand the tax benefits available to you.

Eligible Education Expenses

529 plans can be used to cover a wide range of qualified education expenses. Some examples include:

Tuition and fees

Books and supplies

Room and board (for students enrolled at least half-time)

Computers and related technology

Special needs services

Contributions and Limits

529 plans have contribution limits, which vary by state. These limits can be quite high, allowing you to save a substantial amount for education expenses. Additionally, anyone can contribute to a 529 plan on behalf of a beneficiary, such as parents, grandparents, or even friends.

529 plans offer significant tax benefits and a flexible way to save for education expenses. By taking advantage of these plans, you can ensure that you are financially prepared for future educational needs. Remember to consult with a financial advisor or tax professional to determine the best approach for your specific situation.

Frequently Asked Questions about Tax Benefits of 529 Plans

1. What is a 529 plan?

A 529 plan is an education savings plan that offers tax advantages when used for qualified education expenses.

2. What are the tax benefits of a 529 plan?

Contributions made to a 529 plan are not tax-deductible on the federal level, but many states offer tax deductions or credits for contributions. Additionally, the earnings on the investments in a 529 plan grow tax-free, and withdrawals used for qualified education expenses are also tax-free.

3. Can anyone open a 529 plan?

Yes, anyone can open a 529 plan. Parents, grandparents, other relatives, or even friends can open an account and contribute to it.

4. Are there any income limitations to open a 529 plan?

No, there are no income limitations for opening a 529 plan. It is available to individuals of all income levels.

5. Can I use the funds from a 529 plan for K-12 education expenses?

Yes, starting from 2018, you can use up to $10,000 per year from a 529 plan for qualified K-12 education expenses.

6. What happens if the beneficiary does not use all the funds in the 529 plan?

If the beneficiary does not use all the funds in the 529 plan, you have several options. You can change the beneficiary to another eligible family member, save the funds for future educational expenses, or withdraw the funds (subject to taxes and penalties on the earnings portion).

7. Can I have multiple 529 plans for the same beneficiary?

Yes, you can have multiple 529 plans for the same beneficiary. However, the total contributions to all plans for the same beneficiary cannot exceed the maximum limit set by the state.

8. What happens if I use the funds from a 529 plan for non-qualified expenses?

If you use the funds from a 529 plan for non-qualified expenses, the earnings portion of the withdrawal will be subject to federal income tax and a 10% penalty.

9. Can I transfer funds from one 529 plan to another?

Yes, you can transfer funds from one 529 plan to another for the same beneficiary once per 12-month period without incurring taxes or penalties.

10. Are there any age restrictions for using the funds from a 529 plan?

No, there are no age restrictions for using the funds from a 529 plan. The funds can be used at any age for qualified education expenses.