Tax Benefits of 529 – A Comprehensive Guide

Welcome to our comprehensive guide on the tax benefits of 529 plans. In this article, we will provide you with detailed information on how 529 plans can help you save for education expenses while enjoying various tax advantages.

Understanding 529 Plans

529 plans are tax-advantaged savings accounts designed to encourage individuals to save for education expenses. These plans are named after Section 529 of the Internal Revenue Code, which governs their operation. They are sponsored by states, state agencies, or educational institutions, and they come in two main types: prepaid tuition plans and college savings plans.

Prepaid Tuition Plans

Prepaid tuition plans allow you to prepay a portion or all of the costs of an in-state public college education. These plans typically guarantee that the tuition and fees will be covered when the beneficiary attends the designated college or university. Prepaid tuition plans are a great way to lock in current tuition rates and protect against future tuition inflation.

College Savings Plans

College savings plans, also known as investment plans, allow you to contribute funds to an investment account that can be used to pay for qualified education expenses. The funds in these accounts can be used for tuition, fees, books, supplies, and even certain room and board expenses. The earnings in a college savings plan grow tax-free, and withdrawals are also tax-free as long as they are used for qualified education expenses.

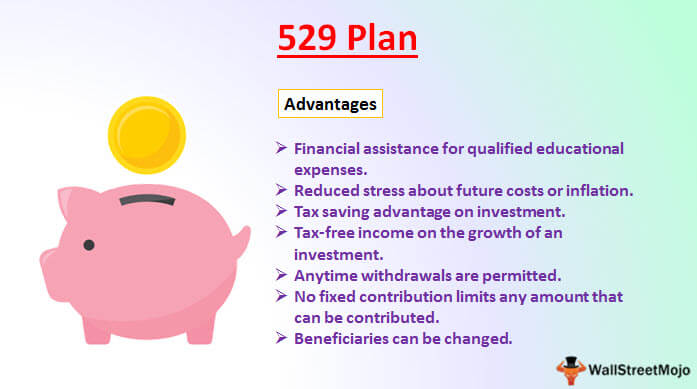

Tax Benefits of 529 Plans

Now, let’s dive into the tax benefits offered by 529 plans. These benefits can vary depending on the state and the specific plan, so it’s important to consult with a tax professional or financial advisor to understand the details specific to your situation.

Tax-Free Earnings

One of the primary advantages of 529 plans is the potential for tax-free earnings. When you contribute to a 529 plan, the investments grow tax-free. This means that any interest, dividends, or capital gains generated within the plan are not subject to federal income tax. Additionally, many states also offer tax-free growth and withdrawals for state income tax purposes.

Tax-Free Withdrawals

When it comes time to use the funds in your 529 plan for qualified education expenses, you can make tax-free withdrawals. This means that the money you withdraw from the plan to pay for tuition, fees, books, and other eligible expenses is not subject to federal income tax. It’s important to note that the expenses must be considered qualified by the IRS to be eligible for tax-free withdrawals.

Tax Deductions or Credits

In addition to tax-free earnings and withdrawals, some states offer tax deductions or credits for contributions made to a 529 plan. These deductions or credits can help reduce your state income tax liability, providing an additional incentive to save for education expenses using a 529 plan. The availability and amount of these deductions or credits vary by state, so it’s crucial to check the specific rules for your state.

Gift and Estate Tax Benefits

529 plans also offer gift and estate tax benefits. Contributions made to a 529 plan are considered completed gifts for federal gift tax purposes. This means that you can contribute a substantial amount to a 529 plan without incurring gift tax consequences, as long as the contribution is within the annual gift tax exclusion limit. Additionally, contributions to a 529 plan may also be eligible for state gift tax deductions or exclusions.

In conclusion, 529 plans provide numerous tax benefits that can greatly assist individuals in saving for education expenses. The tax-free growth, tax-free withdrawals for qualified expenses, and potential state tax deductions or credits make 529 plans an attractive option for families planning for future education costs. Remember to consult with a tax professional or financial advisor to fully understand the specific tax benefits and rules associated with 529 plans in your state.

Frequently Asked Questions about Tax Benefits of 529

1. What is a 529 plan?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education expenses.

2. Are contributions to a 529 plan tax-deductible?

Contributions to a 529 plan are not deductible on your federal income tax return, but some states offer tax deductions or credits for contributions.

3. Can I use funds from a 529 plan for K-12 education expenses?

Yes, the Tax Cuts and Jobs Act of 2017 expanded the use of 529 funds to include K-12 tuition expenses, up to $10,000 per year.

4. What are the tax benefits of a 529 plan?

The tax benefits of a 529 plan include tax-free growth of earnings, tax-free withdrawals for qualified education expenses, and potential state tax deductions or credits.

5. Can I use funds from a 529 plan for non-education expenses?

Using funds from a 529 plan for non-education expenses may result in taxes and penalties on the earnings portion of the withdrawal.

6. Can I change the beneficiary of a 529 plan?

Yes, you can change the beneficiary of a 529 plan to another eligible family member without incurring taxes or penalties.

7. What happens if the beneficiary does not use all the funds in a 529 plan?

If the beneficiary does not use all the funds, you can change the beneficiary to another family member or use the funds for your own education without incurring taxes or penalties.

8. Do I have to use a 529 plan from my own state?

No, you can choose a 529 plan from any state, but some states offer additional tax benefits for residents who invest in their own state’s plan.

9. Can I contribute to multiple 529 plans for the same beneficiary?

Yes, you can contribute to multiple 529 plans for the same beneficiary, but the total contributions cannot exceed the maximum limit set by the IRS.

10. Are there income limits for contributing to a 529 plan?

No, there are no income limits for contributing to a 529 plan. Anyone can contribute regardless of their income level.