Tax Benefits of LLC vs Sole Proprietorship

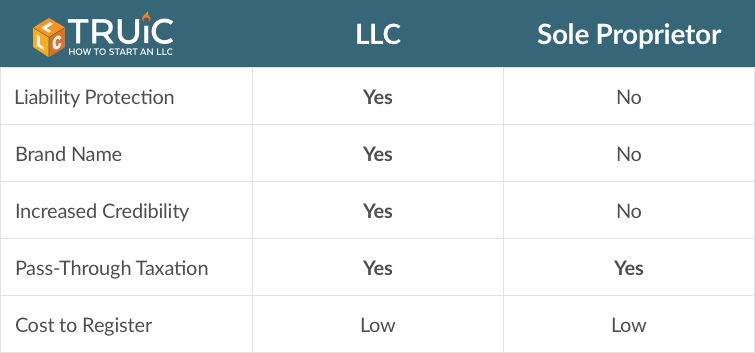

In this article, we will explore the tax benefits of forming a Limited Liability Company (LLC) compared to operating as a sole proprietorship. Understanding the tax implications of these business structures is crucial for entrepreneurs and small business owners.

LLC Tax Benefits

Pass-through Taxation:

An LLC is a pass-through entity, meaning that the business itself does not pay taxes. Instead, the profits and losses “pass through” to the owners, who report them on their personal tax returns. This eliminates the double taxation that corporations may face.

Self-Employment Tax Savings:

LLC owners, also known as members, can potentially save on self-employment taxes. While sole proprietors must pay self-employment taxes on all their business income, LLC members can choose to be taxed as a corporation, reducing their self-employment tax liability.

Deductible Business Expenses:

LLC owners can deduct various business expenses, such as office supplies, equipment, marketing costs, and professional fees. These deductions can help lower the taxable income of the LLC and potentially result in significant tax savings.

Sole Proprietorship Tax Considerations

Simplicity:

Operating as a sole proprietorship is straightforward in terms of taxation. The business owner reports all business income and expenses on their personal tax return using Schedule C. This simplicity can be advantageous for small businesses with low revenue and minimal expenses.

Self-Employment Taxes:

Sole proprietors are subject to self-employment taxes, which include Social Security and Medicare taxes. These taxes can be higher compared to LLC members who have the option to reduce their self-employment tax liability by electing corporate taxation.

Lack of Liability Protection:

Unlike an LLC, a sole proprietorship does not provide limited liability protection. This means that the business owner’s personal assets are at risk if the business faces legal or financial issues. However, it’s important to note that liability protection is a legal consideration rather than a direct tax benefit.

Choosing the Right Structure

When deciding between an LLC and a sole proprietorship, it is crucial to consider not only the tax benefits but also other factors such as legal liability, management structure, and future growth plans. Consulting with a qualified tax professional or business advisor can help you make an informed decision based on your specific circumstances.

In summary, forming an LLC offers several tax benefits compared to operating as a sole proprietorship. Pass-through taxation, potential self-employment tax savings, and the ability to deduct business expenses contribute to the advantages of an LLC. However, each business owner’s situation is unique, and it’s essential to weigh all the factors before choosing the most suitable business structure.

Frequently Asked Questions – Tax Benefits of LLC vs Sole Proprietorship

1. What are the tax benefits of forming an LLC instead of being a sole proprietor?

By forming an LLC, you can enjoy the benefit of limited liability protection while still being able to choose how your business income is taxed. This flexibility can help you optimize your tax strategy.

2. Can an LLC be taxed as a sole proprietorship?

Yes, if you are the sole owner of an LLC, you can choose to have your business taxed as a sole proprietorship. This means the business income and expenses will be reported on your personal tax return.

3. What are the advantages of being taxed as a sole proprietorship?

Being taxed as a sole proprietorship simplifies your tax filing process. You don’t need to file a separate tax return for your business, and there are no additional corporate taxes to pay.

4. Are there any self-employment tax differences between LLC and sole proprietorship?

No, both LLC owners and sole proprietors are subject to self-employment taxes, which include Social Security and Medicare taxes. The tax rate and calculation method are generally the same for both.

5. Can an LLC provide more tax deductions compared to a sole proprietorship?

Yes, an LLC can often offer more tax deductions compared to a sole proprietorship. LLCs can deduct business expenses such as rent, utilities, equipment, and healthcare costs, which can help reduce the overall tax liability.

6. Are there any specific tax benefits for LLCs?

LLCs can enjoy certain tax benefits, such as the ability to choose between being taxed as a partnership, an S corporation, or a C corporation. This flexibility allows owners to optimize their tax situation based on their specific needs.

7. Can an LLC owner save on self-employment taxes compared to a sole proprietor?

Yes, under certain circumstances, an LLC owner can save on self-employment taxes by electing to be taxed as an S corporation. This allows the owner to receive a reasonable salary and take the remaining profits as distributions, which are not subject to self-employment taxes.

8. Are there any limitations on the tax benefits of an LLC?

While an LLC offers various tax advantages, it’s important to note that the specific benefits can vary depending on your individual circumstances and the state where your LLC is registered. Consulting with a tax professional is recommended.

9. Can a sole proprietorship convert to an LLC for tax purposes?

Yes, a sole proprietorship can be converted into an LLC for tax purposes. This conversion allows the owner to gain the benefits of limited liability protection and choose a more advantageous tax structure.

10. How can I determine which business structure is best for my tax situation?

Choosing between an LLC and a sole proprietorship for tax purposes depends on various factors, including your income, expenses, potential risks, and long-term business goals. Seeking advice from a tax professional can help you make an informed decision.