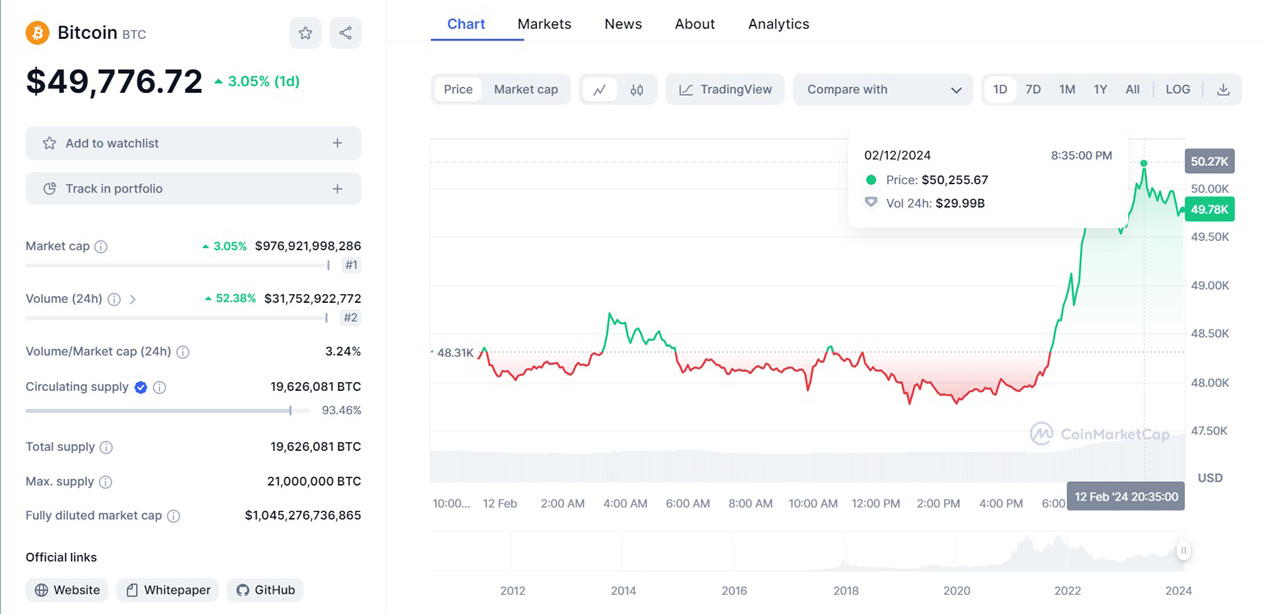

Bitcoin price: The rate hike is another test for Bitcoin

The price of bitcoin ( BTC ) and other crypto assets may face some headwinds in the coming months as central banks around the world prepare one by one to say goodbye to the ultra-loose monetary policies caused by the COVID pandemic. 19.

As the first central bank in a Western developed nation to do so since the start of the pandemic, Norway’s central bank, Norges Bank, raised its interest rate from 0% to 0.25% this week, citing the need to “start a gradual normalization of the official rate” while the economy is “normalizing”.

Norges Bank further justified the rate hike by stating that “the reopening of the company has led to a marked recovery of the Norwegian economy and activity is now above its pre-pandemic level”. He added that the rate will “most likely increase further in December”. And while the rate hike in Norway may be insignificant in itself, central banks tend to follow each other when it comes to interest rate policies, as pointed out by Nik Bhatia, bitcoin advocate and author of the book Layered Money:

Tightening cycles usually spread from one central bank to the next. First rate hikes in the West have started in Norway. https://t.co/Q4ofwdnq28

— Nik Bhatia (@timevalueofbtc) September 23, 2021

Also, setting the stage for tighter monetary policies, the Bank of England (BoE) warned on Thursday that “global inflationary pressures remained strong” while keeping rates unchanged. He also noted that “cost pressures may prove to be more persistent” than previously believed.

The Fed is keeping rates unchanged for now

Similarly, the US Federal Reserve (the Fed ) also decided to keep rates unchanged this week, although it noted in its statement that ” inflation is high” and that “it is on track to moderately exceed 2%. for some time”.

2% is the long-term inflation target stated by the Federal Reserve.

In comments to reporters, Fed Chairman Jerome Powell said tapering – which means a withdrawal of the central bank’s $ 120 billion in monthly bond purchases to support financial markets – could start as early as the next Fed meeting at early November, provided the labor market remains “reasonably strong”.

With a rising inflation rate and a tighter labor market, some analysts say the market now seems almost relieved that the Fed is moving towards tapering and rate hikes.

“The US economy no longer needs large amounts of liquidity. There is almost a sense of relief that the Fed is moving forward and returning to normal,” Paul Donovan, chief global economist at UBS Group AG , told Bloomberg on Thursday. Wealth Management.

Is rising rates a threat to Bitcoin?

And while high inflation is often assumed to be good for bitcoin, rising interest rates are seen as a headwind for assets like bitcoin and gold, as it makes bank deposits more attractive again.

It should be noted, however, that with the Fed’s inflation expectations ranging from 2.4% to 3.4% and interest rates potentially rising by a quarter of a percentage point from zero, real rates, i.e. the interest rate received after adjusting for inflation, they still remain deep in negative territory.

However, looking back on bitcoin’s recent price history, there is also talk of potential rate hikes, especially in the US, leading to losses for the number one cryptocurrency, with central bank meetings in April and June leading to sell-off between 2% and 5% over the next day.

Following this week’s decision in the US to keep rates unchanged, however, bitcoin reacted by trading higher over the next two days, until a China-triggered selloff occurred on Friday.

At 13:41 UTC, BTC was trading at USD 41,554 and was down 6% in one day and 13% in one week.