The Benefits of Using Direct Deposit

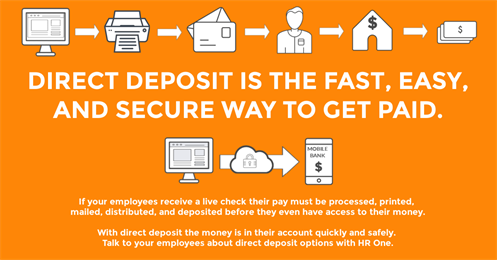

Welcome to our comprehensive guide on the benefits of using direct deposit. In today’s fast-paced world, direct deposit has become an increasingly popular method for receiving payments. Whether you are an employee or a business owner, direct deposit offers numerous advantages that can simplify your financial transactions and enhance your overall banking experience.

Convenience and Time-Saving

One of the primary benefits of using direct deposit is the convenience it provides. With direct deposit, you no longer need to make regular trips to the bank to deposit your checks. Instead, your payments are automatically deposited into your bank account, saving you valuable time and effort. This eliminates the need to wait in long lines or worry about misplaced or lost checks.

Improved Security

Direct deposit offers enhanced security compared to traditional paper checks. When you receive your payments through direct deposit, the risk of your checks being lost, stolen, or forged is significantly reduced. This provides peace of mind, knowing that your hard-earned money is safely deposited into your bank account without any physical documents that can be easily misplaced or tampered with.

Instant Access to Funds

Another major advantage of direct deposit is the immediate access to funds. Once your payments are deposited into your bank account, you can access the funds instantly. This eliminates the need to wait for checks to clear or worry about delays in receiving your money. With direct deposit, you can have immediate access to your funds, allowing you to manage your finances more efficiently.

Cost Savings

Direct deposit also offers cost savings for both individuals and businesses. For individuals, it eliminates the need to spend money on check-cashing fees, as the funds are directly deposited into their bank accounts. For businesses, direct deposit reduces the costs associated with printing and distributing paper checks. This not only saves money but also contributes to a more environmentally friendly approach by reducing paper waste.

Automatic Payments and Budgeting

Using direct deposit allows you to set up automatic payments for bills and other financial obligations. This can help you stay organized and ensure that your payments are made on time. Additionally, direct deposit enables you to easily allocate funds to different accounts, making it easier to budget and manage your money effectively.

Direct deposit offers a wide range of benefits, including convenience, improved security, instant access to funds, cost savings, and the ability to set up automatic payments. By utilizing direct deposit, you can streamline your financial transactions, save time and money, and have greater control over your finances. Make the switch to direct deposit today and experience the numerous advantages it has to offer.

Frequently Asked Questions – Direct Deposit

1. What is direct deposit?

Direct deposit is an electronic payment method that allows funds to be transferred directly into your bank account.

2. How does direct deposit work?

When you sign up for direct deposit, your employer or the payer of funds will electronically transfer the money directly into your bank account.

3. What are the benefits of using direct deposit?

Using direct deposit offers several advantages:

Convenience: No need to visit the bank to deposit your checks.

Time-saving: Eliminates the need to wait in long lines to cash or deposit checks.

Security: Reduces the risk of lost or stolen checks.

Reliability: Ensures that your funds are deposited on time, even if you are unable to visit the bank.

Cost-saving: Avoids check-cashing fees charged by some financial institutions.

4. How can I set up direct deposit?

To set up direct deposit, you need to provide your employer or the payer with your bank account number and the routing number of your bank. They will handle the rest.

5. Is direct deposit safe?

Yes, direct deposit is considered safe. It eliminates the risk of lost or stolen checks and ensures that your funds are deposited directly into your account.

6. Can I split my direct deposit into multiple accounts?

Yes, many employers allow you to split your direct deposit into multiple accounts. You can allocate a certain percentage or amount to different accounts.

7. How long does it take for direct deposit to take effect?

The time it takes for direct deposit to take effect depends on your employer’s payroll processing. It usually takes one to two pay cycles for the direct deposit to start.

8. Can I cancel or change my direct deposit?

Yes, you can cancel or change your direct deposit by informing your employer or the payer and providing them with the updated information.

9. Are there any fees associated with direct deposit?

In most cases, direct deposit is free. However, some financial institutions may charge a nominal fee for certain types of accounts or services.

10. Can I use direct deposit for government benefits?

Yes, direct deposit is commonly used for receiving government benefits, such as Social Security or unemployment payments. Contact the relevant government agency to set it up.