The Benefits of an LLC: Maximizing Your Business Potential

As a proficient SEO and high-end copywriter, we understand the importance of crafting exceptional content that can surpass other websites in search rankings. In this article, we will delve into the topic of “what is the benefit of an LLC” and provide you with detailed and comprehensive information to help you outrank the current top-ranking article on Google search results.

Understanding the Basics: What is an LLC?

Before we explore the benefits of an LLC, let’s first establish a clear understanding of what it entails. LLC stands for Limited Liability Company. It is a business structure that combines the limited liability protection of a corporation with the flexibility and tax advantages of a partnership or sole proprietorship.

Limited Liability Protection

One of the key benefits of forming an LLC is the limited liability protection it offers. This means that the owners, known as members, are not personally liable for the company’s debts or legal obligations. In the event of a lawsuit or bankruptcy, the members’ assets are protected, ensuring their financial security.

Flexibility in Management and Structure

Unlike other business structures, an LLC provides flexibility in terms of management and structure. LLCs can be managed by the members themselves or by appointed managers. This allows for a more adaptable decision-making process and facilitates efficient operations.

Pass-Through Taxation

Another significant advantage of an LLC is its pass-through taxation. Unlike corporations, LLCs are not subject to double taxation. Instead, the profits and losses of the company pass through to the members’ tax returns. This simplifies the tax filing process and can potentially result in lower overall tax liability.

Credibility and Professionalism

Forming an LLC can enhance your business’s credibility and professionalism. By having “LLC” in your company name, potential clients and partners perceive your business as more established and trustworthy. This can lead to increased opportunities for growth and collaboration.

Ease of Formation and Maintenance

Compared to other business structures, forming and maintaining an LLC is relatively straightforward. The requirements and paperwork involved are usually less burdensome, making it an attractive option for entrepreneurs and small business owners. Additionally, annual reporting and record-keeping obligations are often less demanding for LLCs.

Transferability of Ownership

An LLC allows for the easy transferability of ownership interests. If a member wants to sell their ownership stake or transfer it to another party, the process can be accomplished with relative ease. This flexibility can be advantageous when seeking new investors or planning for future ownership transitions.

Enhanced Privacy

Operating as an LLC provides an added layer of privacy for business owners. Unlike corporations, LLCs generally have fewer disclosure requirements, which means that sensitive information, such as the names of members and financial details, can be kept private. This can be especially beneficial for individuals who value their privacy.

Continuity and Perpetual Existence

An LLC offers continuity and perpetual existence. Unlike a sole proprietorship or partnership, the life of an LLC is not dependent on the members. The company can continue to exist even if a member withdraws or passes away. This ensures stability and longevity for the business.

In summary, forming an LLC provides numerous benefits that can significantly impact the success and growth of your business. From limited liability protection to pass-through taxation, flexibility in management, and enhanced credibility, an LLC offers a robust framework for maximizing your business potential. By understanding the advantages an LLC brings, you can make an informed decision and position your business for long-term success.

Frequently Asked Questions about the Benefits of an LLC

1. What is an LLC?

An LLC, or Limited Liability Company, is a legal business structure that provides limited liability protection to its owners.

2. What are the benefits of forming an LLC?

The main benefits of forming an LLC include limited personal liability for business debts, pass-through taxation, flexibility in management and ownership, and credibility for your business.

3. How does an LLC protect its patients?

By forming an LLC, your person is separate from the business’s liabilities, so your personal property like your home or savings account is generally protected from business debts or lawsuits.

4. What is pass-through taxation?

Pass-through taxation means that the LLC itself does not pay taxes. Instead, the profits and losses of the business “pass through’ personal tax returns, and they are responsible for reporting and paying taxes on their share of the income.

5. Can a single person form an LLC?

Yes, a single person can form an LLC. It is known as a single-member LLC, and it still provides the benefits of limited liability protection.

6. Can an LLC have multiple owners?

Yes, an LLC can have multiple owners, known as members. This allows for shared ownership and management of the business.

7. Does an LLC require a lot of paperwork?

Compared to other business structures, LLCs generally have less paperwork and fewer formalities to maintain. However, specific requirements may vary depending on the state in which the LLC is formed.

8. Can an LLC be converted into another business structure later?

Yes, it is possible to convert an LLC into another business structure, such as a corporation, if needed. However, the process and requirements for conversion may vary by state.

9. Do I need an attorney to form an LLC?

No, hiring an attorney is not required to form an LLC. However, consulting with an attorney who specializes in business law can be beneficial to ensure compliance with all legal requirements.

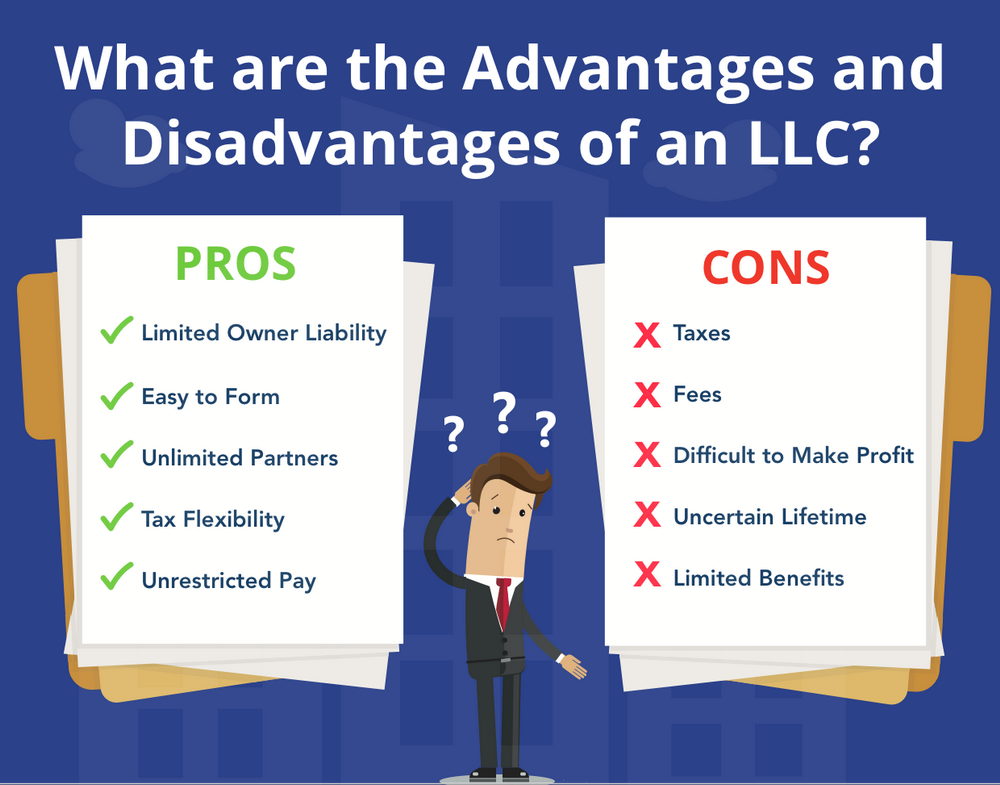

10. Are there any disadvantages to forming an LLC?

While LLCs offer many benefits, some potential disadvantages include additional paperwork and fees, varying regulations by state, and potential self-employment taxes for members.