Advantages of a Sole Proprietorship

A sole proprietorship is a type of business structure where an individual operates and owns the business. It is the simplest form of business and has its own set of advantages. In this article, we will explore the various advantages of a sole proprietorship and why it can be a favorable choice for entrepreneurs.

Flexibility and Control

One of the key advantages of a sole proprietorship is the flexibility and control it offers. As the sole owner, you have complete control over all business decisions. You can make quick decisions without the need for extensive consultations or approvals from others. This allows for greater adaptability to market changes and customer demands.

Easy Setup and Low Costs

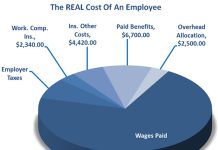

Setting up a sole proprietorship is relatively easy and inexpensive compared to other business structures. There are no complex legal requirements or formalities to fulfill. You can start your business quickly and with minimal paperwork. Additionally, the costs associated with running a sole proprietorship are generally lower since there are no fees or taxes specific to this structure.

Direct Profits

As the sole proprietor, you are entitled to all the profits generated by the business. Unlike partnerships or corporations where profits are distributed among multiple owners or shareholders, in a sole proprietorship, you keep all the earnings. This can be a significant advantage, especially in the early stages of your business when every penny counts.

Privacy and Confidentiality

Operating as a sole proprietorship provides a level of privacy and confidentiality that may not be available in other business structures. Since there are no legal requirements to disclose financial information or business strategies, you can maintain a higher level of secrecy. This can be particularly advantageous if you have unique trade secrets or proprietary information.

Easy Decision-Making

In a sole proprietorship, decision-making is streamlined and efficient. As the sole decision-maker, you can act swiftly and implement changes without the need for extensive deliberation or consensus. This agility allows you to respond promptly to market trends, customer preferences, and emerging opportunities.

Personal Connection with Customers

As a sole proprietor, you have the opportunity to build a strong personal connection with your customers. Since you are the face of the business, you can directly interact with your customers, understand their needs, and provide personalized services. This personal touch can lead to increased customer loyalty and satisfaction, giving you a competitive edge.

A sole proprietorship offers several advantages, including flexibility, control, easy setup, low costs, direct profits, privacy, easy decision-making, and a personal connection with customers. These advantages make it an attractive option for entrepreneurs looking to start their own business. Consider the benefits and challenges carefully before deciding on the most suitable business structure for your venture.

FAQs – Advantages of a Sole Proprietorship

1. What is a sole proprietorship?

A sole proprietorship is a business structure where an individual owns and operates the business as a single entity.

2. What are the advantages of a sole proprietorship?

Some advantages of a sole proprietorship include:

Simple and inexpensive to set up

Full control and decision-making power

Direct ownership of profits

Flexibility in managing the business

Easy tax filing

3. Is it easy to set up a sole proprietorship?

Yes, setting up a sole proprietorship is relatively simple and inexpensive compared to other business structures.

4. Can a sole proprietor have employees?

Yes, a sole proprietor can hire employees to help run the business.

5. Are sole proprietors personally liable for business debts?

Yes, as a sole proprietor, you are personally liable for all business debts and obligations.

6. What is the tax advantage of a sole proprietorship?

A sole proprietorship allows for easy tax filing as the business income is reported on the owner’s personal tax return.

7. Can a sole proprietorship have multiple owners?

No, by definition, a sole proprietorship is owned and operated by a single individual.

8. Are there any restrictions on operating a sole proprietorship?

There are generally no specific restrictions on operating a sole proprietorship, but certain industries may require licenses or permits.

9. How are profits taxed in a sole proprietorship?

Profits in a sole proprietorship are taxed at the individual income tax rate of the owner.

10. Can a sole proprietorship convert to a different business structure?

Yes, a sole proprietorship can be converted into a different business structure, such as a partnership or a corporation.

11. Are there any disadvantages of a sole proprietorship?

Some disadvantages of a sole proprietorship include unlimited personal liability, limited access to capital, and the burden of being solely responsible for the business.

12. Can a sole proprietorship own property?

Yes, a sole proprietorship can own property and other assets in the name of the business.

13. Can a sole proprietorship get a loan?

Yes, a sole proprietorship can obtain loans from banks and financial institutions, although it may be more challenging compared to other business structures.

14. Are there any reporting requirements for a sole proprietorship?

Generally, sole proprietorships have fewer reporting requirements compared to other business structures, but it is essential to keep accurate records for tax purposes.

15. Can a sole proprietorship be sold?

Yes, a sole proprietorship can be sold, but the process may differ from selling other types of businesses as the owner sells their assets and customer base.