The Benefits of VA Loans

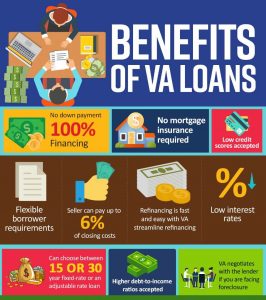

When it comes to obtaining a home loan, there are various options available to borrowers. One such option that stands out is the VA loan. VA loans are specifically designed to provide financial assistance to veterans, active-duty service members, and eligible surviving spouses. In this article, we will explore the numerous benefits of VA loans and why they are an excellent choice for those who qualify.

Flexible and Favorable Loan Terms

VA loans offer borrowers flexible and favorable loan terms that make homeownership more accessible. These loans typically have lower interest rates compared to conventional loans, allowing borrowers to save money over the life of the loan. Additionally, VA loans do not require a down payment, which is a significant advantage for those who may not have substantial savings. This feature makes homeownership more attainable for eligible individuals and helps reduce the financial burden associated with buying a home.

No Private Mortgage Insurance (PMI) Requirement

Unlike conventional loans, VA loans do not require borrowers to pay for private mortgage insurance (PMI). PMI is typically required for borrowers who provide a down payment of less than 20% of the home’s purchase price. By eliminating the need for PMI, VA loans can save borrowers a substantial amount of money each month. This allows borrowers to allocate their funds towards other expenses or save for the future.

Flexible Credit Requirements

Another significant benefit of VA loans is the flexible credit requirements. While traditional loans often have strict credit score requirements, VA loans are more lenient in this regard. Borrowers with less-than-perfect credit scores may still be eligible for a VA loan, making it an attractive option for those who have faced financial challenges in the past. However, it is essential to note that individual lenders may have their credit score requirements.

No Prepayment Penalty

VA loans provide borrowers with the freedom to pay off their mortgages ahead of schedule without incurring any prepayment penalties. This allows borrowers to save on interest payments and potentially become mortgage-free sooner. The absence of prepayment penalties is a significant advantage for those who wish to accelerate their mortgage payments and achieve financial freedom.

Assistance in Avoiding Foreclosure

In challenging times, such as economic downturns or unexpected financial hardships, VA loans offer assistance to borrowers in avoiding foreclosure. The Department of Veterans Affairs (VA) provides various resources and support to help borrowers stay in their homes and overcome financial difficulties. These resources include loan forbearance, loan modifications, and other foreclosure avoidance options. The VA’s commitment to supporting veterans and service members during tough times is a testament to the benefits of VA loans.

VA loans provide numerous benefits that make homeownership more accessible and affordable for eligible individuals. With flexible loan terms, no PMI requirement, lenient credit requirements, no prepayment penalties, and assistance in avoiding foreclosure, VA loans stand out as an excellent option for veterans, active-duty service members, and eligible surviving spouses. If you qualify for a VA loan, it is worth exploring this option and taking advantage of the benefits it offers.

Frequently Asked Questions about VA Loan Benefits

1. What is a VA loan?

A VA loan is a mortgage loan program offered by the Department of Veterans Affairs (VA) that is designed to provide home financing options to eligible veterans, active-duty service members, and surviving spouses.

2. What are the benefits of a VA loan?

The benefits of a VA loan include no down payment requirement, lower interest rates, no private mortgage insurance (PMI) requirement, and flexible credit requirements.

3. Who is eligible for a VA loan?

Eligibility for a VA loan is determined by specific military service requirements. Generally, veterans, active-duty service members, National Guard members, and surviving spouses may be eligible for a VA loan.

4. Can I use a VA loan to purchase a second home?

No, VA loans are intended for primary residences only. They cannot be used to purchase vacation homes or investment properties.

5. Are there any income limits for VA loan eligibility?

No, there are no income limits for VA loan eligibility. However, lenders may have their income requirements to ensure borrowers can afford the mortgage payments.

6. Can I refinance my existing mortgage with a VA loan?

Yes, VA loans offer refinancing options such as the VA Interest Rate Reduction Refinance Loan (IRL) or the VA Cash-Out Refinance Loan. These programs allow eligible borrowers to refinance their current mortgage with a VA loan.

7. Are VA loans assumable?

Yes, VA loans are assumable, which means that if you sell your home, the buyer may be able to take over your existing VA loan and its favorable terms, subject to VA approval.

8. Do I need to pay closing costs with a VA loan?

While VA loans generally have lower closing costs compared to conventional loans, borrowers are still responsible for paying certain closing costs. However, sellers can contribute towards the buyer’s closing costs in a VA loan transaction.

9. Can I use a VA loan multiple times?

Yes, if you have full entitlement available, you can use a VA loan multiple times, either for purchasing a new home or refinancing an existing VA loan.

10. Can I use a VA loan for home improvements?

Yes, VA loans offer the option to include up to $6,000 for qualified home improvements or energy-efficient upgrades as part of the loan amount, provided the appraiser determines the value will increase accordingly.