Benefits of 401k

At [Company Name], we understand the importance of making informed financial decisions for a secure future. In this article, we will delve into the benefits of a 401k retirement plan, highlighting its advantages and why it is a popular choice among individuals seeking long-term financial stability.

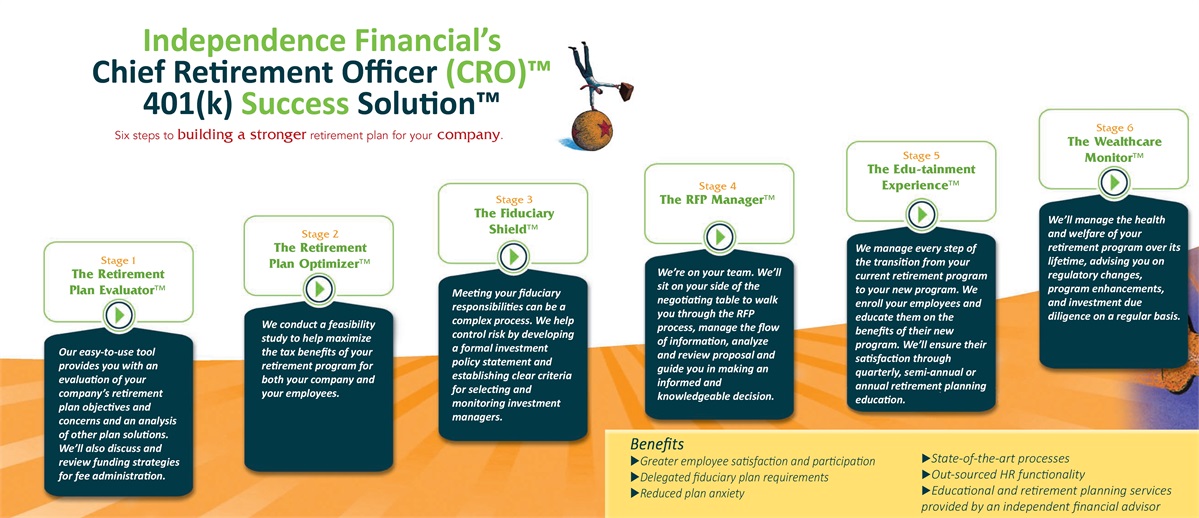

Tax Advantages

One of the primary benefits of a 401k is the tax advantages it offers. Contributions made to a traditional 401k are tax-deferred, meaning they are deducted from your taxable income in the year they are made. This reduces your overall tax liability, allowing you to keep more of your hard-earned money.

Furthermore, the earnings on your 401k investments grow tax-free until you start making withdrawals during retirement. This tax-deferred growth enables your investments to compound over time, potentially resulting in significant savings.

Employer Matching Contributions

Many employers offer a matching contribution to employees’ 401k plans, which is essentially free money. This employer match is typically a percentage of your contributions, up to a certain limit. It is crucial to take advantage of this benefit as it can significantly boost your retirement savings.

For example, if your employer offers a 50% match on contributions up to 5% of your salary, and you contribute 5% of your salary, your employer will contribute an additional 2.5% of your salary to your 401k. This match effectively doubles your savings rate and accelerates the growth of your retirement nest egg.

Pre-Tax Contributions

Contributions to a traditional 401k are made with pre-tax income, meaning the amount you contribute is deducted from your salary before taxes are applied. This reduces your taxable income, potentially placing you in a lower tax bracket and resulting in further tax savings.

By lowering your taxable income, you not only reduce your current tax burden but also have the opportunity to save more for retirement. This advantage allows you to allocate a larger portion of your income towards your 401k, maximizing your savings potential.

Flexible Investment Options

A 401k provides a range of investment options, allowing you to tailor your portfolio to suit your risk tolerance and financial goals. Typically, employers offer a selection of mutual funds, stocks, bonds, and other investment vehicles to choose from.

This flexibility empowers you to diversify your investments and potentially achieve higher returns. It is important to review and adjust your investment strategy periodically to ensure it aligns with your changing financial circumstances and retirement objectives.

Portability and Accessibility

Another advantage of a 401k is its portability. If you change jobs, you can typically roll over your 401k balance into an Individual Retirement Account (IRA) or your new employer’s retirement plan. This portability ensures that your retirement savings remain intact and continue to grow.

In addition, 401k plans often provide accessibility to your funds in case of financial emergencies or hardships. While early withdrawals may incur penalties and taxes, having the option to access your savings can provide a safety net during challenging times.

In summary, a 401k retirement plan offers numerous benefits that can significantly contribute to your long-term financial well-being. From tax advantages and employer matching contributions to flexible investment options and portability, a 401k provides a solid foundation for building a secure retirement.

At [Company Name], we encourage you to explore the advantages of a 401k and consider incorporating it into your retirement savings strategy. Remember, the earlier you start contributing, the more time your investments have to grow and compound, ensuring a comfortable retirement in the future.

Frequently Asked Questions about the Benefits of 401k

1. What is a 401k plan?

A 401k plan is a retirement savings account offered by employers that allows employees to contribute a portion of their salary on a pre-tax basis.

2. How does a 401k plan benefit me?

A 401k plan offers several benefits, including tax advantages, employer matching contributions, and the opportunity for the long-term growth of your retirement savings.

3. Can I contribute to a 401k plan if I already have a pension?

Yes, you can contribute to a 401k plan even if you have a pension. It provides an additional retirement savings option.

4. What is the maximum contribution limit for a 401k plan?

The maximum contribution limit for a 401k plan is $19,500 for individuals under the age of 50, and $26,000 for individuals aged 50 and above (as of 2021).

5. Are there any tax advantages to contributing to a 401k plan?

Yes, contributing to a 401k plan offers tax advantages. The contributions are made on a pre-tax basis, reducing your taxable income, and the earnings grow tax-deferred until withdrawal during retirement.

6. Can I withdraw money from my 401k before retirement?

Generally, you can withdraw money from your 401k before retirement, but it may be subject to penalties and taxes. It’s advisable to consult with a financial advisor before making early withdrawals.

7. What happens to my 401k if I change jobs?

If you change jobs, you have several options for your 401k. You can leave it with your previous employer, roll it over into your new employer’s 401k plan, roll it over into an Individual Retirement Account (IRA), or cash it out (subject to taxes and penalties).

8. What is an employer-matching contribution?

An employer matching contribution is when your employer matches a portion of your 401k contributions. It’s essentially free money that boosts your retirement savings.

9. Can I take a loan from my 401k?

Yes, you may be able to take a loan from your 401k, depending on your plan’s rules. However, it’s important to consider the potential impact on your retirement savings and the repayment terms.

10. What happens to my 401k if I pass away?

If you pass away, your 401k will typically be passed on to your designated beneficiary. They will have options to either receive the funds as a lump sum, set up an inherited IRA, or take periodic distributions.