Benefits of a Health Savings Account

A Health Savings Account (HSA) is a powerful financial tool that offers numerous benefits to individuals and families. In this article, we will explore the advantages of having an HSA and how it can positively impact your health and financial well-being.

Tax Advantages

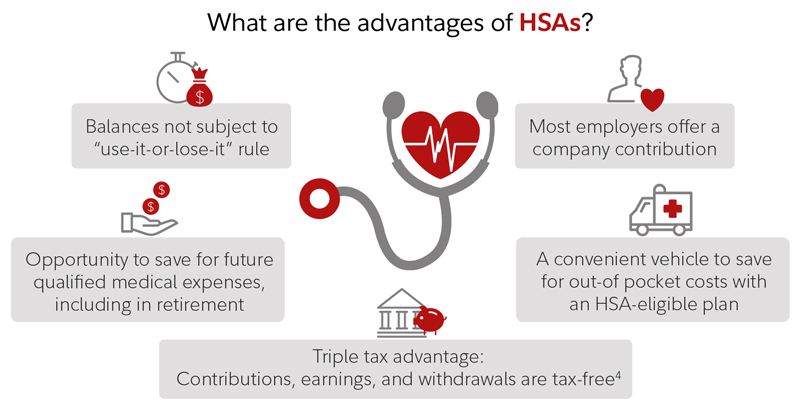

One of the key benefits of a Health Savings Account is the tax advantages it provides. Contributions made to an HSA are tax-deductible, reducing your taxable income. Additionally, any interest or investment earnings within the account grow tax-free. Withdrawals from the HSA for qualified medical expenses are also tax-free. This triple tax advantage makes an HSA an attractive option for individuals looking to save on taxes while managing their healthcare expenses.

Control Over Healthcare Costs

By having a Health Savings Account, you gain greater control over your healthcare costs. With an HSA, you can save pre-tax dollars specifically for medical expenses. This allows you to budget for healthcare needs and have funds readily available when needed. Unlike other healthcare plans, an HSA allows you to carry over unused funds from year to year, providing a long-term solution for managing healthcare expenses.

Flexibility and Portability

Another advantage of a Health Savings Account is its flexibility and portability. Unlike traditional health insurance plans, an HSA is not tied to a specific employer. This means that even if you change jobs or become self-employed, you can keep your HSA and continue to benefit from its advantages. Furthermore, the funds in your HSA are yours to keep, even if you switch healthcare plans or retire.

Investment Opportunities

Health Savings Accounts offer investment opportunities that can help your savings grow over time. Once your HSA balance reaches a certain threshold, you can invest the excess funds in a variety of investment options, such as mutual funds or stocks. This allows you to potentially earn higher returns on your savings and maximize the benefits of your HSA.

Long-Term Savings for Healthcare

One of the often-overlooked benefits of a Health Savings Account is its potential for long-term savings. As you contribute to your HSA over the years, the funds can accumulate and serve as a valuable resource for future healthcare expenses. This can be particularly beneficial during retirement when healthcare costs tend to increase. By utilizing an HSA, you can ensure that you have a dedicated savings account specifically designated for healthcare needs.

A Health Savings Account offers a wide range of benefits, including tax advantages, control over healthcare costs, flexibility, investment opportunities, and long-term savings. By taking advantage of these benefits, you can not only manage your healthcare expenses more effectively but also secure your financial future. Consider opening an HSA today and start reaping the rewards it has to offer.

Frequently Asked Questions

1. What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account that allows individuals to set aside money for qualified medical expenses.

2. What are the benefits of having a Health Savings Account?

Some benefits of having an HSA include:

Contributions are tax-deductible

Earnings grow tax-free

Withdrawals for qualified medical expenses are tax-free

Unused funds roll over from year to year

Portability – the account stays with you even if you change jobs or health insurance plans

3. Who is eligible to open an HSA?

To be eligible for an HSA, you must:

Be covered by a high-deductible health plan (HDHP)

Not be enrolled in Medicare

Not be claimed as a dependent on someone else’s tax return

4. How much can I contribute to my HSA?

In 2021, the maximum contribution limits are $3,600 for individuals and $7,200 for families. Those aged 55 or older can contribute an additional $1,000 as a catch-up contribution.

5. Are there any penalties for using HSA funds for non-medical expenses?

Yes, if you withdraw funds for non-qualified expenses before the age of 65, you will have to pay income tax on the amount withdrawn plus a 20% penalty.

6. Can I invest my HSA funds?

Yes, many HSA providers offer investment options once your account balance reaches a certain threshold. This allows you to potentially grow your savings over time.

7. Can I use my HSA to pay for my dependents’ medical expenses?

Yes, you can use your HSA funds to pay for qualified medical expenses for your spouse and dependents, even if they are not covered by your HDHP.

8. Can I use my HSA to pay for health insurance premiums?

In most cases, you cannot use HSA funds to pay for health insurance premiums. However, there are some exceptions, such as COBRA continuation coverage, long-term care insurance, and certain types of Medicare premiums.

9. What happens to my HSA if I change jobs or retire?

Your HSA is portable, meaning it stays with you even if you change jobs or retire. You can continue to use the funds for qualified medical expenses, and if you have a new HDHP, you can make new contributions.

10. Can I have both an HSA and a Flexible Spending Account (FSA)?

Yes, you can have both an HSA and an FSA, but there are some restrictions. If you have a general-purpose FSA, you cannot contribute to an HSA. However, you can have a limited-purpose FSA that only covers dental and vision expenses while still contributing to an HSA.