Benefits of Balance Transfer

Welcome to our comprehensive guide on the benefits of balance transfer. In this article, we will explore the advantages of transferring your credit card balance to another card or financial institution. By understanding the potential benefits, you can make informed decisions about managing your finances and optimizing your credit card usage.

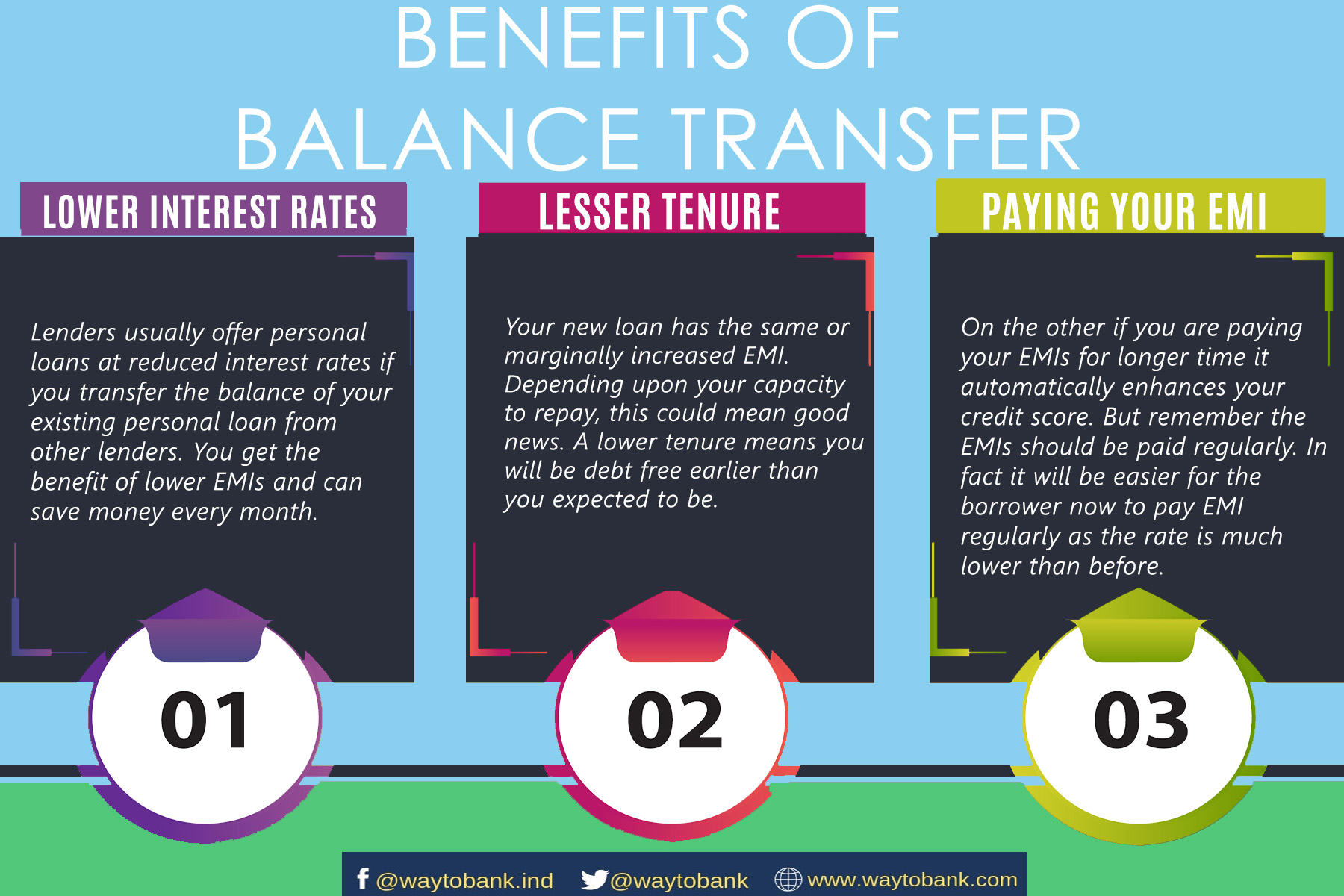

Lower Interest Rates

One of the primary benefits of balance transfer is the opportunity to secure a lower interest rate on your credit card debt. Many credit card companies offer promotional periods with low or even 0% APR (Annual Percentage Rate) on balance transfers. By taking advantage of these offers, you can reduce the amount of interest you pay on your outstanding balance, saving you money in the long run.

Consolidation of Debt

Balance transfer also allows you to consolidate multiple credit card debts into a single account. Instead of managing multiple payment due dates and interest rates, you can simplify your finances by transferring all your balances to one card. This consolidation can make it easier to track your payments and potentially save on any annual fees associated with multiple cards.

Pay Off Debt Faster

By taking advantage of a balance transfer, you can accelerate your debt repayment journey. With lower interest rates, more of your payment goes towards reducing the principal balance rather than being eaten up by interest charges. This can help you pay off your debt faster and become financially free sooner.

Opportunity to Improve Credit Score

Another benefit of balance transfer is the potential to improve your credit score. By consolidating your debt and making regular payments, you can demonstrate responsible credit behavior. Timely payments and a lower credit utilization ratio can positively impact your credit score over time.

Flexibility and Convenience

Balance transfer offers flexibility and convenience in managing your credit card debt. You have the freedom to choose the repayment terms that suit your financial situation. Additionally, most balance transfer processes can be completed online, saving you time and effort.

Considerations Before Transferring

While balance transfer can offer numerous benefits, it is essential to consider a few factors before making a decision:

Balance transfer fees: Some credit card companies charge a fee for transferring your balance. It’s important to evaluate whether the potential interest savings outweigh these fees.

Promotional period length: Understand the duration of the promotional APR period. After this period ends, the interest rate may increase, impacting your savings.

Eligibility requirements: Ensure you meet the eligibility criteria set by the credit card company or financial institution before initiating a balance transfer.

In conclusion, balance transfer can provide several benefits, including lower interest rates, debt consolidation, faster debt repayment, improved credit score, and flexibility in managing your finances. However, it is crucial to carefully evaluate the terms and conditions, fees, and eligibility requirements before proceeding with a balance transfer. By making informed decisions, you can take control of your credit card debt and work towards a more secure financial future.

Frequently Asked Questions about Benefits of Balance Transfer

1. What is a balance transfer?

A balance transfer is the process of moving an existing credit card debt from one card to another, usually with a lower interest rate.

2. What are the benefits of a balance transfer?

The benefits of a balance transfer include:

Reducing interest payments

Consolidating multiple debts into one

Potentially improving credit score

3. How can a balance transfer help me save money?

By transferring your balance to a card with a lower interest rate, you can reduce the amount of interest you pay each month, saving you money in the long run.

4. Are there any fees associated with balance transfers?

Yes, some credit card companies may charge a balance transfer fee, usually a percentage of the amount being transferred. It’s important to consider these fees when deciding if a balance transfer is right for you.

5. Can I transfer balances from multiple credit cards?

Yes, in most cases you can transfer balances from multiple credit cards onto one card, simplifying your debt repayment process.

6. Will a balance transfer affect my credit score?

In the short term, a balance transfer may cause a slight dip in your credit score. However, in the long term, it can help improve your credit score by reducing your overall debt and improving your credit utilization ratio.

7. How long does a balance transfer take?

The duration of a balance transfer can vary depending on the credit card company and the amount being transferred. Typically, it takes around 7-14 days to complete the transfer.

8. Can I transfer a balance from a personal loan or mortgage?

No, balance transfers are generally only applicable to credit card debt. Personal loans or mortgages cannot be transferred using this method.

9. Can I still use my old credit card after a balance transfer?

Yes, you can continue using your old credit card after a balance transfer. However, it’s recommended to avoid adding new charges to it to prevent further debt accumulation.

10. How often can I do a balance transfer?

There is no specific limit on how often you can do a balance transfer. However, it’s important to consider any fees associated with each transfer and to use balance transfers responsibly.