Benefits of Buying a House

When it comes to investing in real estate, buying a house offers numerous benefits that can significantly impact your financial stability and quality of life. In this article, we will explore the advantages of purchasing a house and why it is a wise decision for many individuals and families.

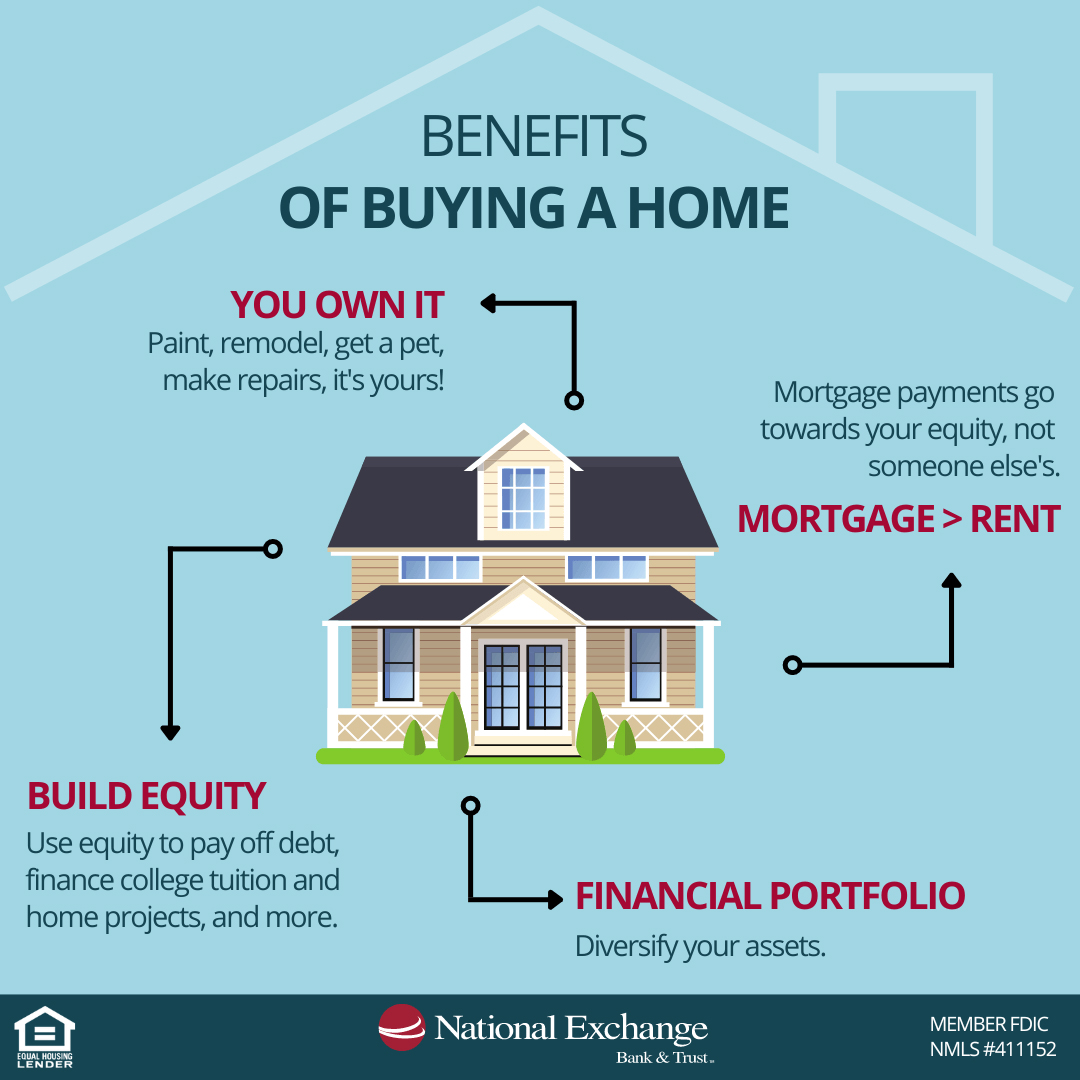

Building Equity

One of the primary benefits of buying a house is the opportunity to build equity. Unlike renting, where monthly payments only provide temporary accommodation, homeownership allows you to invest in an asset that appreciates over time. As you make mortgage payments, you gradually increase your ownership stake in the property, building equity that can be utilized in the future.

Stability and Security

Owning a house provides stability and security for you and your family. When you have a place to call your own, you can establish roots in a community, build relationships with neighbors, and create a sense of belonging. Additionally, homeownership offers protection against rising rental costs and provides a stable living environment for you and your loved ones.

Tax Benefits

Another advantage of buying a house is the potential for tax benefits. Homeowners can often deduct mortgage interest payments and property taxes from their annual tax returns, reducing their overall tax liability. These deductions can result in significant savings and increase your disposable income.

Freedom to Customize

When you own a house, you have the freedom to customize and personalize your living space according to your preferences. From painting the walls to renovating the kitchen, you can make changes that reflect your unique style and create a home that truly represents you. This level of freedom is often limited in rental properties.

Long-Term Investment

Buying a house is a long-term investment that can provide financial security in the future. As property values appreciate, you can potentially sell your house at a higher price than what you initially paid, resulting in a profit. Real estate has historically been a reliable investment, and by purchasing a house, you can take advantage of its potential long-term returns.

In conclusion, buying a house offers numerous benefits, including the opportunity to build equity, stability and security, tax advantages, freedom to customize, and a long-term investment. By becoming a homeowner, you can enjoy the pride of ownership, create a stable living environment, and potentially increase your wealth over time. If you are considering investing in real estate, purchasing a house can be a wise decision that provides both financial and personal rewards.

Frequently Asked Questions

1. What are the benefits of buying a house?

There are several benefits of buying a house, including:

Building equity over time

Stable housing costs

Freedom to personalize and make changes to the property

Potential tax advantages

Long-term investment

2. How does buying a house help in building equity?

When you buy a house, you are essentially investing in an asset that typically appreciates over time. As you make mortgage payments, you build equity, which is the difference between the property’s market value and the outstanding loan balance.

3. Can buying a house provide stable housing costs?

Yes, buying a house can provide stable housing costs. Unlike renting, where landlords can increase rent annually, homeowners with fixed-rate mortgages have predictable monthly payments, allowing for better budgeting and financial planning.

4. How does buying a house offer freedom to personalize?

When you own a house, you have the freedom to personalize and make changes to the property according to your preferences. You can renovate, decorate, and modify the house to suit your needs and style without seeking permission from a landlord.

5. Are there any potential tax advantages to buying a house?

Yes, homeownership can offer potential tax advantages. For example, you may be able to deduct mortgage interest payments and property taxes from your taxable income, potentially reducing your overall tax liability.

6. Is buying a house a long-term investment?

Yes, buying a house is generally considered a long-term investment. Over time, real estate tends to appreciate, allowing homeowners to build wealth. However, it’s important to carefully consider market conditions and location when making a purchasing decision.

7. Can buying a house provide stability for families?

Yes, buying a house can provide stability for families. Owning a home often provides a sense of security and permanence, allowing families to establish roots in a community and potentially provide stability for children.

8. Are there any downsides to buying a house?

While there are many benefits, there are also potential downsides to buying a house. These can include the responsibility of maintenance and repairs, the commitment to a specific location, and the upfront costs associated with purchasing a property.

9. Can buying a house be a good investment for retirement?

Yes, buying a house can be a good investment for retirement. By the time you retire, your mortgage may be paid off, providing you with a valuable asset and potentially reducing your housing expenses. Additionally, you may choose to downsize or use the property as a source of rental income.

10. How can I determine if buying a house is right for me?

Determining if buying a house is right for you involves considering various factors such as your financial situation, long-term goals, stability, and personal preferences. It may be helpful to consult with a financial advisor or a real estate professional to evaluate your options and make an informed decision.