Last updated on October 15th, 2023 at 10:09 am

Benefits of Direct Deposit

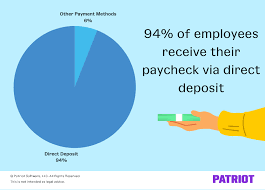

Direct deposit is a convenient and secure method of receiving payments directly into your bank account. In this article, we will explore the various benefits of direct deposit and how it can simplify your financial transactions.

Efficiency and Convenience

Direct deposit offers unparalleled efficiency and convenience. By eliminating the need for paper checks, you no longer have to visit the bank to deposit your payments manually. Instead, your funds are automatically deposited into your account, saving you time and effort.

Timely Payments

With direct deposit, you can say goodbye to worrying about lost or delayed payments. Your funds are deposited directly into your account on the scheduled payment date, ensuring that you receive your money promptly. This is particularly beneficial for individuals who rely on regular income, such as employees.

Security

Direct deposit is a secure method of receiving payments. By eliminating the need for physical checks, the risk of lost or stolen checks is minimized. Additionally, direct deposit reduces the chances of identity theft, as your financial information remains confidential and is not exposed to potential fraudsters.

Cost Savings

Direct deposit can lead to significant cost savings for both individuals and businesses. By eliminating the need for paper checks, you save on check printing costs, postage fees, and potential bank fees associated with check cashing. Moreover, businesses can streamline their payroll processes, reducing administrative costs.

Flexibility

Direct deposit offers flexibility in managing your finances. You can allocate your funds to different accounts, such as savings and checking, or split the deposit between multiple banks. This allows you to easily manage and allocate your funds according to your financial goals and needs.

Environmental Impact

By adopting direct deposit, you contribute to a greener environment. The reduction in paper usage and transportation associated with physical checks helps in conserving natural resources and reducing carbon emissions. Making the switch to direct deposit is a small step towards a more sustainable future.

FAQs about Benefits of Direct Deposit

1. What is direct deposit?

Direct deposit is an electronic payment method that allows funds to be transferred directly into your bank account.

2. How does direct deposit work?

When you set up direct deposit, your employer or the organization making the payment electronically transfers the funds directly into your bank account, eliminating the need for physical checks.

3. What are the benefits of direct deposit?

Direct deposit offers several benefits, such as:

Convenience: No need to visit the bank to deposit checks manually.

Time-saving: Eliminates the need to wait for checks to clear.

Security: Reduces the risk of lost or stolen checks.

Automatic: Ensures your funds are deposited on time, even when you’re away.

Cost-effective: Saves money on check printing and mailing.

4. How do I set up direct deposit?

To set up direct deposit, you typically need to provide your employer or the paying organization with your bank account number and routing number. They will guide you through the process.

5. Can I split my direct deposit into multiple accounts?

Yes, many employers allow you to split your direct deposit into multiple accounts, such as checking, savings, or retirement accounts.

6. Is direct deposit available for government benefits?

Yes, government benefits, including Social Security, disability, and veterans’ benefits, can be directly deposited into your bank account.

7. How long does it take for direct deposit to take effect?

The time it takes for direct deposit to take effect can vary, but it is usually processed within one to two pay cycles.

8. Can I cancel direct deposit?

Yes, you can cancel direct deposit by notifying your employer or the paying organization and providing them with an alternative payment method.

9. Are there any fees associated with direct deposit?

In most cases, direct deposit is free. However, some banks may charge fees for certain types of accounts or if you exceed a specified number of transactions.

10. Can I view my direct deposit transactions online?

Yes, most banks offer online banking services that allow you to view your direct deposit transactions, along with other account activities.

Direct deposit offers numerous benefits, including efficiency, convenience, timely payments, security, cost savings, flexibility, and environmental impact. By embracing direct deposit, you can simplify your financial transactions, save time and money, and contribute to a more sustainable world. Make the switch today and experience the advantages of direct deposit firsthand.