Benefits of FSA Account: Maximizing Your Healthcare Savings

At our company, we understand the importance of optimizing your healthcare savings and making the most of every dollar you spend. That’s why we’re here to guide you through the benefits of a Flexible Spending Account (FSA) and help you understand how it can significantly impact your financial well-being. In this comprehensive article, we will delve into the advantages of an FSA and how you can leverage it to your advantage.

What is an FSA Account?

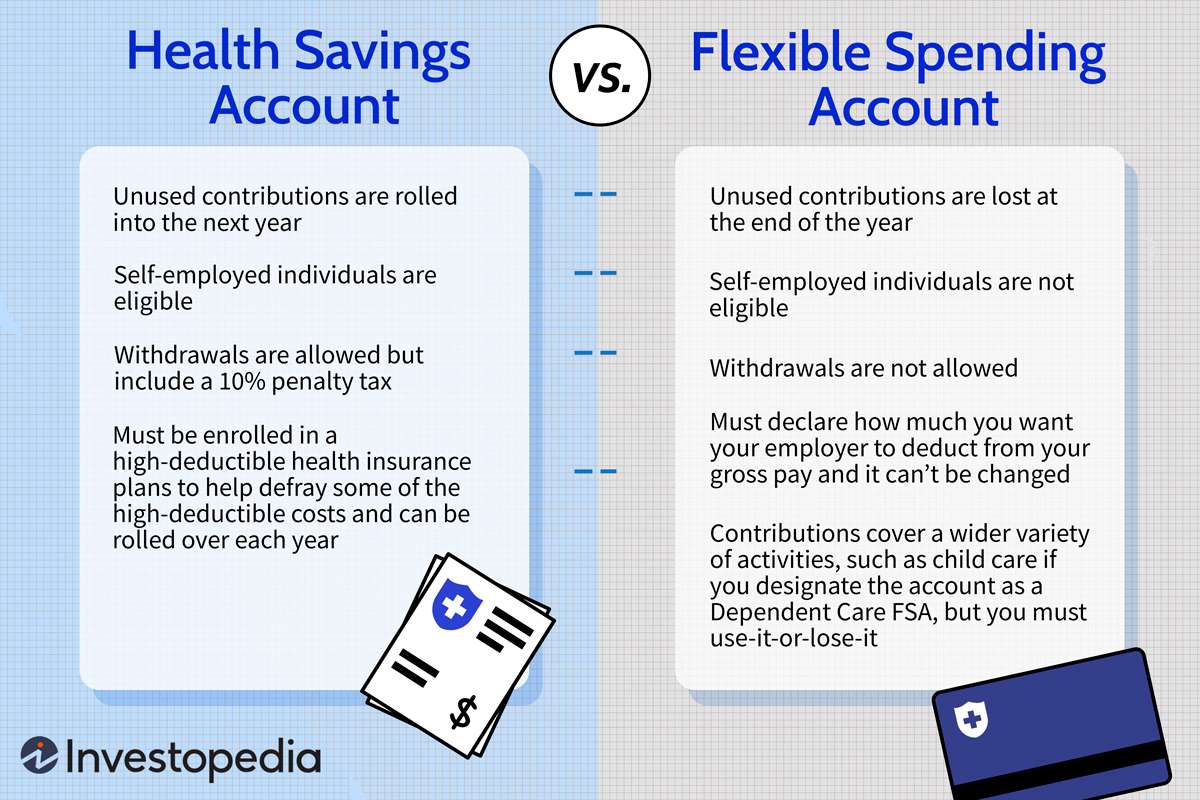

An FSA account is a tax-advantaged savings account offered by employers to their employees. It allows you to contribute pre-tax dollars from your paycheck to cover eligible medical expenses. By setting aside a portion of your income before taxes, you reduce your taxable income, which in turn lowers your overall tax burden.

The Power of Pre-Tax Contributions

One of the key benefits of an FSA account is the ability to contribute pre-tax dollars. This means that the money you allocate to your FSA is deducted from your paycheck before taxes are calculated. By doing so, you effectively lower your taxable income, resulting in potential savings on both federal and state income taxes.

Maximize Your Savings

With an FSA account, you have the opportunity to maximize your healthcare savings. By planning and estimating your annual medical expenses, you can contribute an appropriate amount to your FSA. This allows you to set aside money specifically for healthcare-related costs, ensuring you have funds readily available when needed.

Wide Range of Eligible Expenses

An FSA account covers a wide range of eligible medical expenses. These include but are not limited to:

Prescription medications

Doctor’s office visits

Dental and vision expenses

Medical supplies and equipment

Approved over-the-counter medications

By utilizing your FSA funds for these expenses, you can effectively reduce your out-of-pocket costs and save money in the long run.

Use It or Lose It? Not Anymore!

In the past, many FSAs operated on a “use it or lose it” basis, meaning any unused funds at the end of the plan year would be forfeited. However, recent changes in regulations now allow employers to offer a carryover option or a grace period. This means you can roll over up to $500 of unused funds into the following plan year or have a grace period of up to 2.5 months to use the remaining balance. These changes provide greater flexibility and ensure that your hard-earned money doesn’t go to waste.

Save on Taxes and Increase Take-Home Pay

Contributing to an FSA account not only helps you save on taxes but also increases your take-home pay. By reducing your taxable income, you effectively lower the amount of income tax withheld from your paycheck. This means more money in your pocket to cover other expenses or save for the future.

Easy Access to Funds

Accessing your FSA funds is convenient and hassle-free. Most employers provide a debit card or reimbursement process, allowing you to easily pay for eligible expenses. Simply swipe your FSA debit card or submit a reimbursement claim, and the funds will be used to cover the approved costs.

An FSA account offers numerous benefits for individuals and families alike. By contributing pre-tax dollars, maximizing your savings, and taking advantage of the wide range of eligible expenses, you can significantly reduce your healthcare costs. Additionally, the recent changes in regulations provide greater flexibility and ensure that your hard-earned money doesn’t go to waste. So, take control of your healthcare savings today and make the most of your FSA account!

Frequently Asked Questions – Benefits of FSA Account

1. What is an FSA account?

An FSA (Flexible Spending Account) is a tax-advantaged account that allows you to set aside pre-tax dollars to pay for eligible medical expenses.

2. How does an FSA account benefit me?

Using an FSA account can help you save money on healthcare expenses by allowing you to pay for eligible expenses with pre-tax dollars, reducing your taxable income.

3. What expenses can I use my FSA funds for?

You can use your FSA funds for a wide range of eligible medical expenses, including doctor visits, prescription medications, dental care, vision care, and more. However, cosmetic procedures are generally not eligible.

4. How much can I contribute to my FSA account?

The maximum contribution limit for an FSA account is set by the IRS each year. For 2021, the limit is $2,750.

5. Can I carry over unused funds in my FSA account?

It depends on your employer’s plan. Some employers allow a carryover of up to $550 from one year to the next, while others may offer a grace period of 2.5 months to use the remaining funds.

6. Are FSA contributions subject to payroll taxes?

No, FSA contributions are exempt from federal income tax, Social Security tax, and Medicare tax.

7. Can I use my FSA funds for over-the-counter medications?

Yes, you can use your FSA funds to purchase eligible over-the-counter medications without a prescription, as long as they are for medical purposes.

8. Can I use my FSA funds for my spouse or dependents?

Yes, you can use your FSA funds to pay for eligible medical expenses of your spouse and dependents, even if they are not covered by your health insurance.

9. What happens to my FSA account if I change jobs?

If you change jobs, you may lose access to your FSA account, as it is typically tied to your employer’s benefits plan. However, some employers offer a grace period or allow you to continue coverage through COBRA.

10. Can I use my FSA funds for alternative therapies like acupuncture or chiropractic care?

Yes, if these therapies are considered eligible medical expenses and are prescribed by a qualified healthcare professional, you can use your FSA funds to pay for them.