Benefits of Home Equity Line of Credit

A home equity line of credit (HELOC) is a flexible financial tool that allows homeowners to leverage the equity they have built in their homes. In this article, we will explore the numerous benefits of a HELOC and how it can be advantageous for homeowners.

Access to Funds

One of the primary benefits of a home equity line of credit is the access to funds it provides. With a HELOC, homeowners can tap into the equity they have accumulated in their property and use it for various purposes. Whether you want to renovate your home, pay for education, consolidate debt, or cover unexpected expenses, a HELOC offers a convenient and cost-effective solution.

Lower Interest Rates

Compared to other forms of credit, such as credit cards or personal loans, a home equity line of credit typically offers lower interest rates. This is because the loan is secured by the value of your home, reducing the risk for lenders. By taking advantage of the lower interest rates of a HELOC, homeowners can save money on interest payments and potentially pay off their debt faster.

Flexible Repayment Options

A HELOC provides borrowers with flexible repayment options. Unlike traditional mortgages, which require fixed monthly payments, a home equity line of credit allows homeowners to choose how much they want to borrow and when they want to make payments. This flexibility allows borrowers to manage their finances more effectively and adapt to their changing financial circumstances.

Tax Deductibility

In many cases, the interest paid on a home equity line of credit is tax-deductible. This can provide homeowners with additional financial benefits. However, it is important to consult with a tax professional to understand the specific tax implications based on your circumstances.

Potential Appreciation

As homeowners make improvements to their property using funds from a HELOC, they may increase the value of their home. This potential appreciation can be advantageous when it comes to selling the property in the future. By using a home equity line of credit strategically, homeowners can potentially enhance their overall financial position.

A home equity line of credit offers numerous benefits for homeowners. From providing access to funds and offering lower interest rates to flexible repayment options and potential tax deductibility, a HELOC can be a valuable financial tool. By leveraging the equity in your home, you can take advantage of these benefits and improve your financial situation. Consider exploring a home equity line of credit and consult with a reputable lender to determine if it is the right option for you.

Frequently Asked Questions about Benefits of Home Equity Line of Credit

1. What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving line of credit that uses your home as collateral. It allows you to borrow against the equity you have built up in your home.

2. How can I benefit from a Home Equity Line of Credit?

A HELOC can provide you with a flexible source of funds that can be used for various purposes such as home improvements, debt consolidation, education expenses, or emergency expenses.

3. What are the advantages of a Home Equity Line of Credit?

The advantages of a HELOC include lower interest rates compared to other types of loans, potential tax benefits, easy access to funds, and the ability to borrow only what you need when you need it.

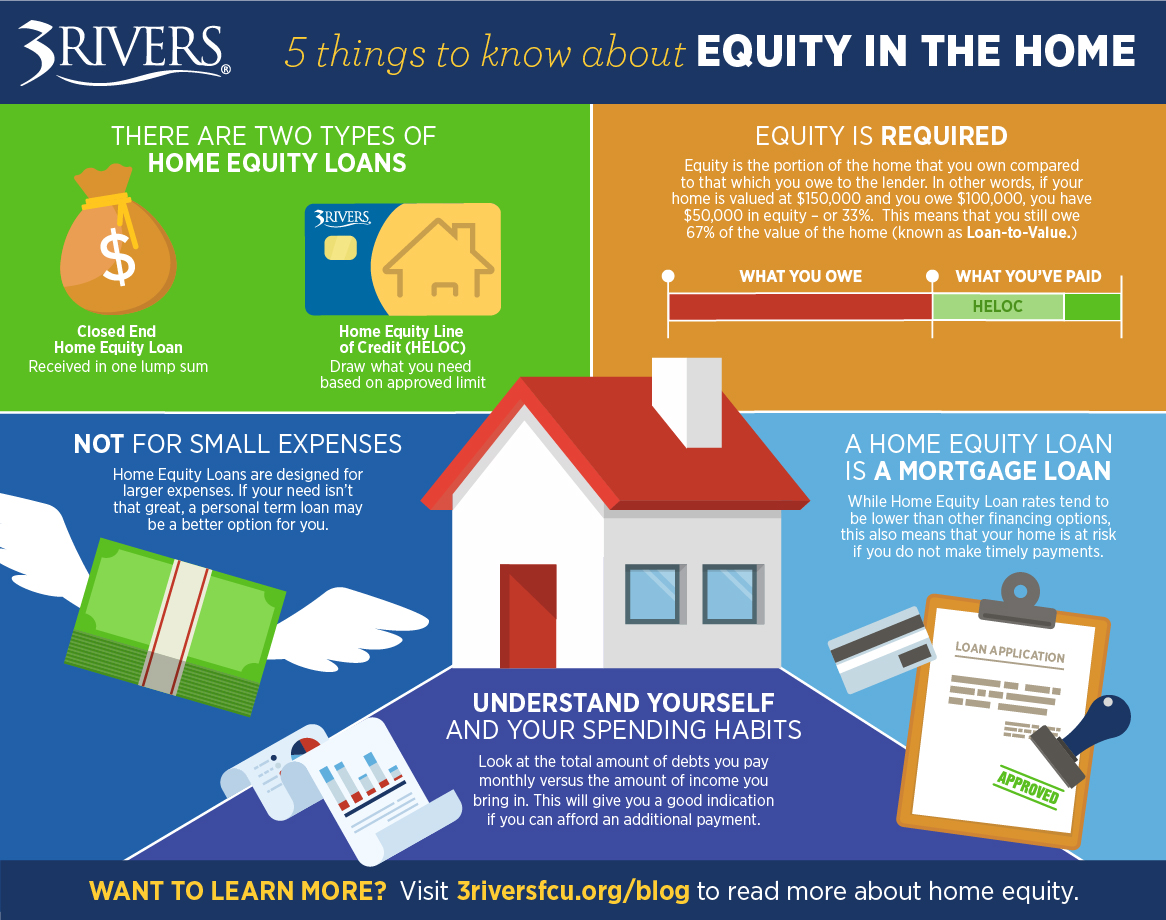

4. How does a Home Equity Line of Credit differ from a Home Equity Loan?

A Home Equity Line of Credit is a revolving line of credit, while a Home Equity Loan provides a lump sum of money upfront. With a HELOC, you can borrow and repay repeatedly, whereas a Home Equity Loan is a one-time loan.

5. How is the interest on a Home Equity Line of Credit calculated?

The interest on a HELOC is usually variable and is calculated based on the prime rate plus a margin determined by your lender. It is important to understand the terms and conditions of your specific HELOC agreement.

6. Can I use a Home Equity Line of Credit for investments?

While it is possible to use a HELOC for investments, it is important to consider the risks involved and consult with a financial advisor. Using your home as collateral for investments can be risky.

7. Are there any risks associated with a Home Equity Line of Credit?

Yes, there are risks associated with a HELOC. If you are unable to make the required payments, you could potentially lose your home. It is crucial to borrow responsibly and ensure you have a repayment plan in place.

8. Can I pay off my Home Equity Line of Credit early?

Yes, most HELOCs allow you to pay off the balance early without any prepayment penalties. However, it is recommended to review your specific loan agreement to understand the terms and conditions.

9. How long does it take to get approved for a Home Equity Line of Credit?

The approval process for a HELOC can vary depending on the lender and your financial situation. It typically takes a few weeks to complete the application, provide the necessary documentation, and receive approval.

10. What factors should I consider before applying for a Home Equity Line of Credit?

Before applying for a HELOC, consider factors such as your credit score, current debt levels, interest rates, repayment terms, and your ability to make timely payments. It is also important to compare offers from different lenders to find the best terms.