Benefits of LTD

In this article, we will explore the various benefits of a limited company (LTD) and how it can be advantageous for businesses. As a proficient SEO and high-end copywriter, we have crafted this content to provide you with detailed and comprehensive information on the topic.

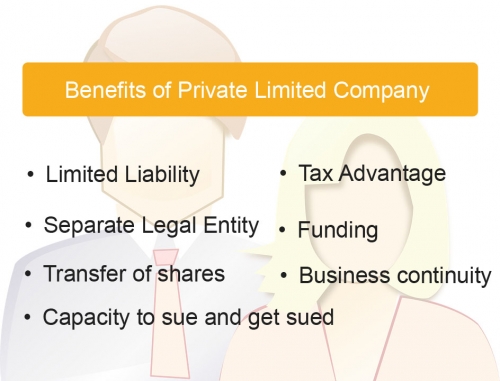

Enhanced Credibility and Professionalism

One of the key benefits of forming a limited company is the enhanced credibility and professionalism it brings to your business. By operating as an LTD, you create a separate legal entity that is distinct from its owners. This separation helps to build trust among customers, suppliers, and investors, as it demonstrates a commitment to long-term business operations.

Limited Liability Protection

Another significant advantage of an LTD is the limited liability protection it offers to its owners. As a shareholder or director of a limited company, your assets are separate from the company’s finances. In the event of financial difficulties or legal issues, your assets are generally protected, limiting your liability to the amount invested in the company.

Tax Benefits

Limited companies often enjoy various tax benefits compared to other business structures. For example, profits generated by an LTD are subject to corporation tax, which is typically lower than personal income tax rates. Additionally, limited companies have the flexibility to manage their tax affairs more efficiently, taking advantage of tax allowances, deductions, and reliefs available to them.

Access to Funding and Investment Opportunities

Operating as an LTD can open doors to funding and investment opportunities that may not be available to other business structures. Limited companies can issue shares, allowing them to raise capital from investors. This can provide the necessary funds for business expansion, research and development, or other strategic initiatives. Furthermore, investors and lenders often perceive limited companies as more secure and reliable, increasing the likelihood of securing external funding.

Continuity and Succession Planning

A limited company offers greater continuity and succession planning options. Unlike sole proprietorships or partnerships, the existence of an LTD is not dependent on the owners. This means that the business can continue to operate even if shareholders or directors change. This stability is particularly beneficial for businesses with long-term goals, as it ensures the continuity of operations and minimizes disruptions.

In summary, forming a limited company (LTD) brings numerous benefits that can significantly impact the success of your business. From enhanced credibility and limited liability protection to tax benefits and access to funding opportunities, an LTD can provide a solid foundation for growth and long-term sustainability. Consider the unique advantages of an LTD when deciding on the most suitable business structure for your enterprise.

Frequently Asked Questions – Benefits of LTD

1. What is LTD?

LTD stands for Long-Term Disability. It is an insurance policy that provides income replacement for individuals who are unable to work due to a long-term illness or injury.

2. How does LTD work?

When you have an LTD policy, if you become disabled and are unable to work, the insurance company will pay you a portion of your pre-disability income every month to help cover your expenses.

3. What are the benefits of having LTD?

Having LTD insurance offers several benefits, including:

– Financial security during a period of disability

– Income replacement to cover your daily living expenses

– Peace of mind knowing that you are protected in case of long-term illness or injury

4. Who is eligible for LTD benefits?

Eligibility for LTD benefits varies depending on the insurance policy. Generally, individuals who are employed and have an LTD policy through their employer are eligible for benefits if they become disabled and meet the policy’s definition of disability.

5. How long do LTD benefits last?

The duration of LTD benefits depends on the terms of your insurance policy. Some policies provide benefits until you reach retirement age, while others have a specific time limit, such as two or five years.

6. Are LTD benefits taxable?

In most cases, LTD benefits are taxable. However, if you paid the premiums for the policy with after-tax dollars, a portion of the benefits may be tax-free. It is recommended to consult with a tax professional for specific advice.

7. Can I receive LTD benefits if I have other sources of income?

It depends on the terms of your LTD policy. Some policies have a provision that reduces your benefits if you receive income from other sources, such as Social Security Disability Insurance or workers’ compensation.

8. Is there a waiting period before I can receive LTD benefits?

Most LTD policies have a waiting period, also known as an elimination period, before you can start receiving benefits. This waiting period can range from 30 days to several months, during which you are responsible for your financial support.

9. Can I purchase LTD insurance on my own?

Yes, you can purchase LTD insurance on your own if it is not provided by your employer. Individual LTD policies are available through insurance companies, and the coverage and benefits can vary.

10. What happens if my LTD claim is denied?

If your LTD claim is denied, you have the right to appeal the decision. It is recommended to review the denial letter carefully, gather any additional supporting documentation, and work with an attorney or disability advocate who specializes in LTD claims to navigate the appeals process.