Benefits of Private Banking

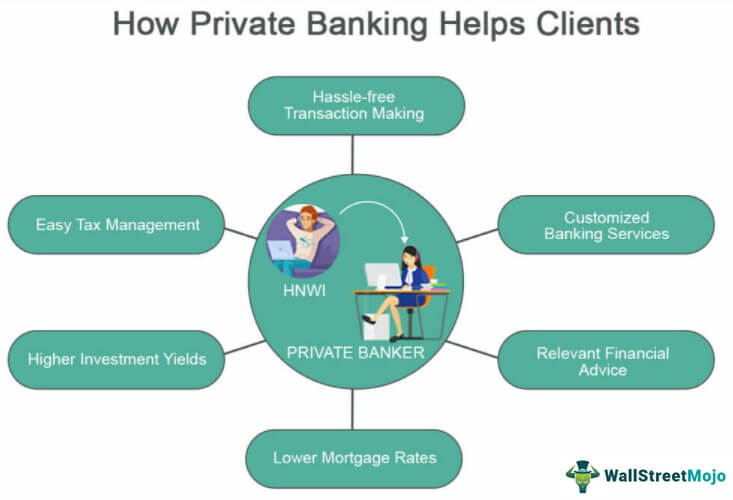

Private banking offers a range of exclusive services and benefits to high-net-worth individuals, providing personalized financial solutions tailored to their unique needs and goals. In this article, we will explore the various advantages of private banking and how it can enhance your financial well-being.

Enhanced Wealth Management

Private banking provides comprehensive wealth management solutions that go beyond traditional banking services. With a dedicated team of experienced professionals, private banks offer personalized investment strategies, asset allocation, and portfolio diversification. By leveraging their expertise and industry insights, private bankers can help you make informed decisions to grow and protect your wealth.

Tailored Financial Solutions

One of the key benefits of private banking is the availability of customized financial solutions. Private bankers take the time to understand your financial goals, risk appetite, and investment preferences. Based on this information, they create bespoke financial plans that align with your objectives. Whether you require assistance with estate planning, tax optimization, or philanthropic endeavors, private banking offers tailored solutions to meet your specific needs.

Access to Exclusive Investment Opportunities

Private banking provides access to exclusive investment opportunities that are not readily available to the general public. These opportunities may include private equity investments, venture capital funds, hedge funds, and real estate partnerships. By gaining access to these exclusive investments, you can diversify your portfolio and potentially achieve higher returns.

Personalized Banking Services

Private banking goes beyond traditional banking services by offering personalized solutions that cater to your unique requirements. Private bankers provide a range of services, including concierge banking, priority lending, and customized credit solutions. With a dedicated relationship manager, you can enjoy a seamless banking experience and receive priority treatment in all your financial transactions.

Confidentiality and Privacy

Privacy and confidentiality are paramount in private banking. Private banks prioritize the protection of your personal and financial information, ensuring that your affairs remain confidential. By maintaining strict confidentiality measures, private banking offers a secure and discreet environment for your financial transactions.

Global Reach and Expertise

Private banking provides access to a global network of experts and resources. Whether you require assistance with international investments, cross-border transactions, or wealth transfer, private bankers possess the knowledge and expertise to navigate complex financial landscapes. With their global reach, private banks can help you capitalize on opportunities around the world and expand your financial horizons.

Private banking offers a plethora of benefits that can significantly enhance your financial well-being. From personalized wealth management to exclusive investment opportunities, private banking provides tailored solutions to meet your unique needs and goals. With a focus on confidentiality, expertise, and personalized service, private banking is an excellent choice for high-net-worth individuals seeking comprehensive financial solutions.

Frequently Asked Questions about the Benefits of Private Banking

1. What is private banking?

Private banking refers to personalized financial services provided by banks to high-net-worth individuals.

2. What are the main benefits of private banking?

The main benefits of private banking include personalized financial advice, tailored investment strategies, access to exclusive investment opportunities, and dedicated relationship managers.

3. How can private banking help me manage my wealth?

Private banking can help you manage your wealth by providing expert advice on investment diversification, tax planning, estate planning, and risk management.

4. Do I need a certain amount of wealth to qualify for private banking services?

Yes, private banking services are typically available to individuals with a high net worth, often requiring a minimum investable asset threshold.

5. Can private banking help me with my personal financial goals?

Absolutely! Private banking focuses on understanding your financial goals and designing customized strategies to help you achieve them.

6. Are there any additional fees associated with private banking services?

Yes, private banking services often come with additional fees due to the personalized nature of the services provided. These fees can vary depending on the bank and the specific services required.

7. Will my information remain confidential with private banking?

Yes, confidentiality is a fundamental principle of private banking. Banks are legally obligated to protect their clients’ information and maintain strict privacy standards.

8. Can private banking help me with international investments?

Yes, private banking often offers expertise in international investments, including access to global markets, foreign currency accounts, and international tax planning.

9. What is the advantage of having a dedicated relationship manager in private banking?

A dedicated relationship manager in private banking provides personalized assistance, acts as a single point of contact, and ensures that your financial needs are met effectively and efficiently.

10. How do I choose the right private banking institution for me?

Choosing the right private banking institution involves considering factors such as reputation, expertise, range of services offered, fees, and the compatibility of their investment approach with your financial goals.