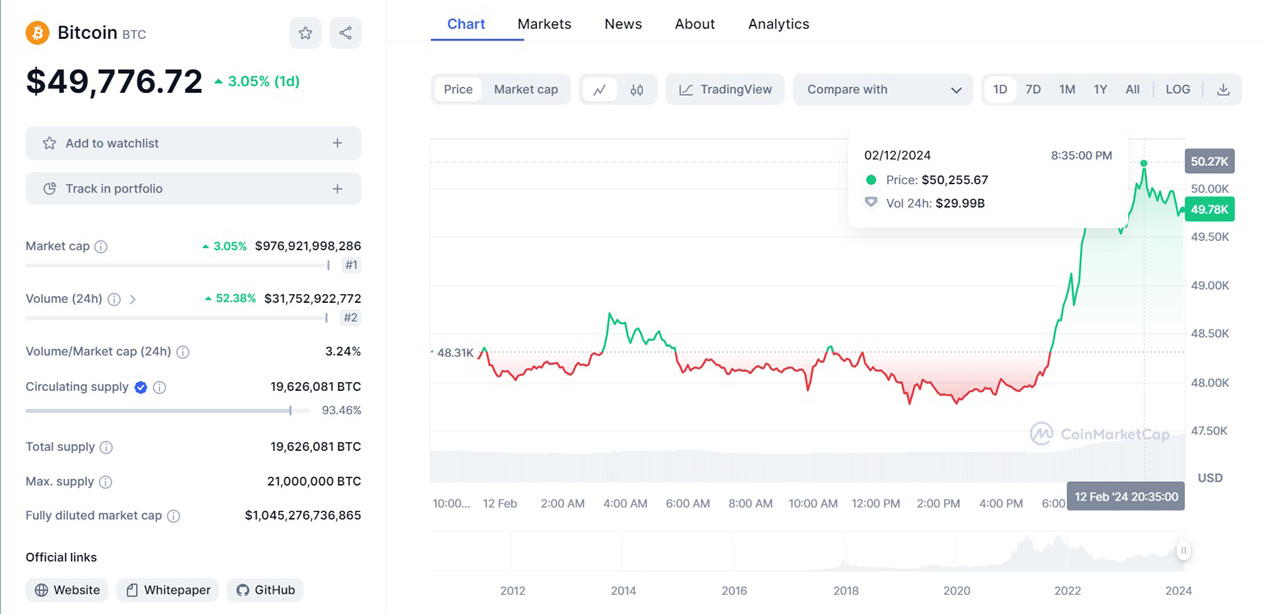

Cryptocurrency market collapsed by more than $ 200 billion in one day due to Bitcoin falling below $ 50,000

Bitcoin and other digital currencies crashed on Friday as US President Joe Biden’s proposed capital gains tax hike led to a wave of high-value asset sales. Bitcoin fell by 11% per day – a unit of cryptocurrency began to cost $ 48.4 thousand. This is the first time since early March that Bitcoin has traded below $ 50,000. Ethereum fell to $ 2,211, more than 12%. XRP, the fifth-largest cryptocurrency, fell nearly 19%.

According to CoinMarketCap, the drop has reduced the total value of the entire cryptocurrency market by more than $ 200 billion. “Overall, the market has grown quite a lot, and it is probably cooling down before the next phase of growth,” the head of the cryptocurrency development department told CNBC in an email Luno Exchange Vijay Ayyar.

President Biden is expected to raise the long-term capital gains tax for the richest Americans to 43.4%, including an additional income tax. This will be higher than the maximum federal payroll tax rate. The new rate will apply to income from assets held in taxable accounts and sold more than a year later.

This triggered a sell-off in stock markets overnight, and all three major US indices ended Thursday’s session in the red. Analysts say fears over Joe Biden’s capital gains tax proposal could extend to crypto investors who have had a great year as Bitcoin’s value has grown more than sixfold in the past 12 months.

However, Biden can provide a service to the industry. “It would open the way for the popularity of the oldest smart book trick on managing your finances: borrowing money against your assets to avoid capital gains taxes,” said co-founder of crypto lender Nexo, Anthony Trenches. ” And what could be better than collateral, which – despite today’s price drop, probably caused by the aforementioned proposal – is becoming more expensive like bitcoin?” Indeed: in 2021 alone, Bitcoin grew by 66%, while Ethereum grew by more than 200%.

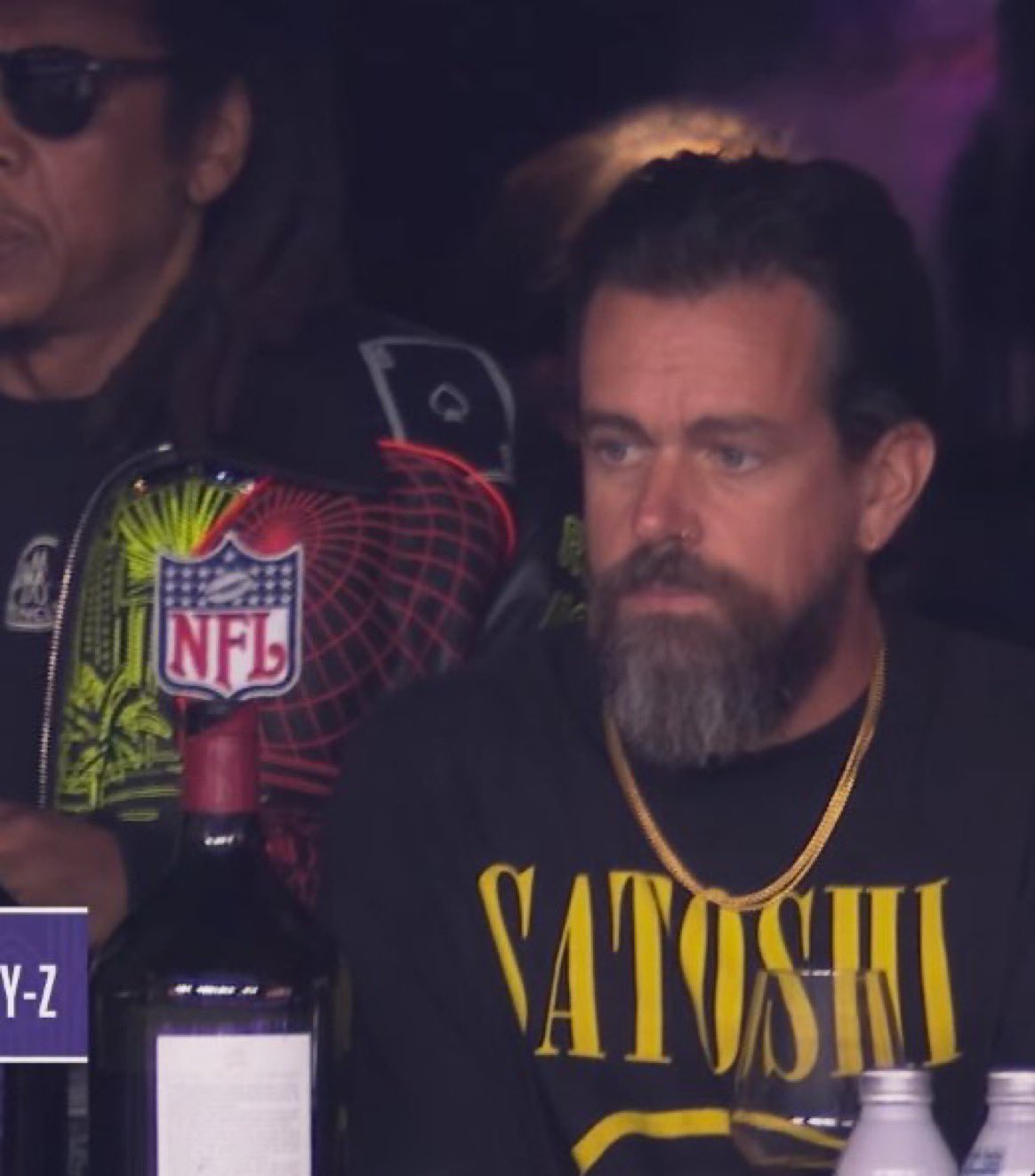

This was driven in part by billions of dollars in bitcoin purchases from companies like Tesla and Square. Banks are also trying to allow their clients to participate in the cryptocurrency market. However, concerns about the regulatory crackdown on cryptocurrencies continue to cloud the market environment. Jesse Powell, chief executive of major cryptocurrency exchange Kraken, warned that governments could restrict the use of bitcoin and other cryptocurrencies. India plans to introduce legislation banning trade or even possession of cryptocurrencies. In February, US Treasury Secretary Janet Yellen called Bitcoin a highly speculative asset and said she was worried about potential losses for investors. Authorities around the world are thinking about how to regulate bitcoin. For example,