Delta Dental Explanation of Benefits – A Comprehensive Guide

Understanding Your Delta Dental Explanation of Benefits

At Delta Dental, we understand the importance of transparency and clarity when it comes to your dental insurance coverage. That’s why we provide you with an Explanation of Benefits (EOB) after each dental visit. In this guide, we will walk you through the key elements of your Delta Dental EOB, helping you better understand how to interpret and utilize the information provided.

What is an Explanation of Benefits (EOB)?

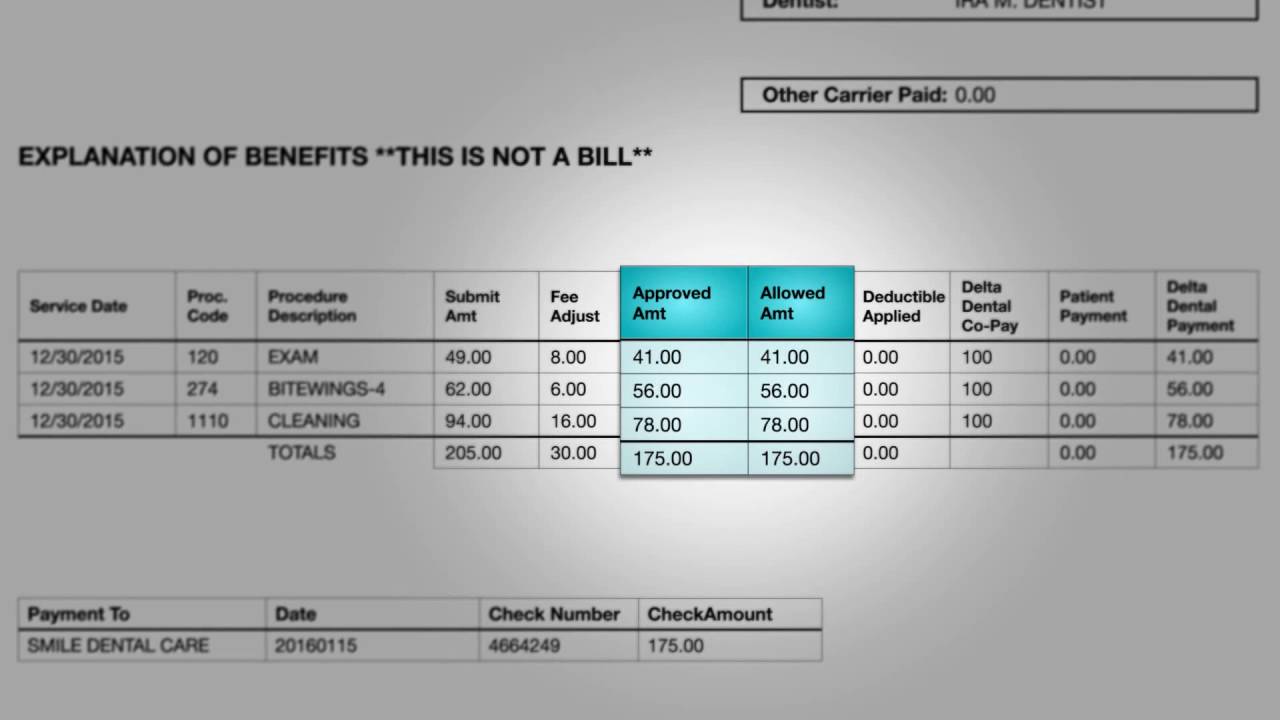

An Explanation of Benefits (EOB) is a document that outlines the details of a dental insurance claim. It provides a summary of the services rendered, the amount billed by the dental provider, the portion covered by your insurance, and any remaining balance that may be your responsibility.

Key Elements of a Delta Dental EOB

When you receive your Delta Dental EOB, it’s important to review it carefully to ensure accuracy and understand the information provided. Here are the key elements you’ll find in your EOB:

Patient and Provider Information

Your EOB will include your personal information, such as your name, policy number, and the name of the dental provider who rendered the services. Make sure to verify that the information is correct to avoid any confusion.

Date of Service

The EOB will specify the date when the dental services were provided. It’s important to keep track of this information for future reference and to ensure the accuracy of the claim.

Description of Services

The EOB will list the specific dental procedures or treatments you received during your visit. Each service will be accompanied by a procedure code, which helps identify the nature of the treatment provided.

Billed Amount

This section of the EOB displays the total amount billed by the dental provider for the services rendered. It represents the cost of the treatment before any insurance coverage is applied.

Covered Amount

The covered amount on your EOB represents the portion of the billed amount that Delta Dental will pay based on your insurance plan. This amount may vary depending on your plan’s coverage and any deductibles, co-pays, or coinsurance that apply.

Deductibles, Co-pays, and Coinsurance

If your dental plan includes deductibles, co-pays, or coinsurance, your EOB will outline the specific amounts you are responsible for paying. Deductibles are the initial out-of-pocket expenses you must meet before your insurance coverage kicks in. Co-pays are fixed amounts you pay for certain services, while coinsurance represents a percentage of the covered amount that you are responsible for.

Non-Covered Amount

In some cases, certain dental services may not be covered by your insurance plan. The EOB will indicate any non-covered amounts, which will be your responsibility to pay in full.

Provider Payments and Adjustments

The EOB will detail the payments made to the dental provider by Delta Dental, as well as any adjustments or write-offs applied. Adjustments may include negotiated discounts or contractual agreements between Delta Dental and the dental provider.

Patient Responsibility

This section of the EOB summarizes the total amount you are responsible for paying, including deductibles, co-pays, coinsurance, and any non-covered services. It’s crucial to review this section carefully to understand your financial obligations.

How to Utilize Your Delta Dental EOB

Now that you have a better understanding of the key elements of your Delta Dental EOB, let’s explore how you can effectively utilize this information:

Review for Accuracy

Always review your EOB for accuracy, ensuring that the services listed match those you received. If you notice any discrepancies or errors, contact Delta Dental immediately for clarification and resolution.

Understand Your Coverage

By carefully reviewing your EOB, you can gain insights into your dental insurance coverage. Take note of any deductibles, co-pays, or coinsurance amounts, as well as any non-covered services. Understanding your coverage will help you make informed decisions about your dental care.

Keep Track of Expenses

Use your EOB as a reference to keep track of your dental expenses. This will help you budget for future treatments and monitor your out-of-pocket costs.

Plan for Future Dental Visits

Based on the information provided in your EOB, you can anticipate the costs associated with future dental visits. This will allow you to plan and make necessary financial arrangements.

Understanding your Delta Dental Explanation of Benefits (EOB) is essential for maximizing the benefits of your dental insurance coverage. By familiarizing yourself with the key elements of your EOB and utilizing the information provided, you can make informed decisions about your dental care, effectively manage your expenses, and ensure transparency in your insurance claims process.

Delta Dental Explanation of Benefits FAQs

1. What is a Delta Dental Explanation of Benefits?

A Delta Dental Explanation of Benefits (EOB) is a document that provides a detailed breakdown of the dental services you have received, the amount billed by the dental provider, the amount covered by your dental insurance, and the amount you may owe.

2. How can I access my Delta Dental Explanation of Benefits?

You can access your Delta Dental Explanation of Benefits by logging into your online account on the Delta Dental website. From there, you can view and download your EOBs.

3. What information is included in a Delta Dental Explanation of Benefits?

A Delta Dental Explanation of Benefits typically includes the date of service, the dental procedure codes, the description of the services performed, the amount billed by the dental provider, the amount covered by your insurance, any deductible or copayment amounts, and the total amount you may owe.

4. How often will I receive a Delta Dental Explanation of Benefits?

You will typically receive a Delta Dental Explanation of Benefits after each dental visit or when a claim is processed by your dental insurance provider.

5. Can I dispute the information on my Delta Dental Explanation of Benefits?

If you believe there is an error or discrepancy in your Delta Dental Explanation of Benefits, you can contact Delta Dental customer service to discuss the issue and initiate a dispute if necessary.

6. Can I use my Delta Dental Explanation of Benefits to file a claim with my dental provider?

No, a Delta Dental Explanation of Benefits is not a claim form. It is a summary of the services and payments related to your dental visit. You should provide your dental provider with your insurance information separately to file a claim.

7. How long should I keep my Delta Dental Explanation of Benefits?

It is recommended to keep your Delta Dental Explanation of Benefits for at least one year. This will help you track your dental expenses, compare them with your dental insurance coverage, and resolve any potential billing issues.

8. Can I view my past Delta Dental Explanation of Benefits?

Yes, you can view your past Delta Dental Explanation of Benefits by accessing your online account on the Delta Dental website. The website typically provides access to a history of your EOBs.

9. Are Delta Dental Explanation of Benefits confidential?

Yes, Delta Dental Explanation of Benefits are confidential documents. The information contained in your EOBs is protected under privacy laws and should not be shared with unauthorized individuals.

10. How can I understand the codes and terms used in my Delta Dental Explanation of Benefits?

If you have questions about the codes or terms used in your Delta Dental Explanation of Benefits, you can refer to the glossary provided by Delta Dental on their website. The glossary explains common dental procedure codes and terms.