Maximizing Insights on the Benefits of 529 Education Savings Plans

In the realm of educational financial planning, the 529 Education Savings Plan stands out as a powerful tool. Delve into the intricacies of this savings vehicle and uncover the advantages that can pave the way for your loved one’s academic journey.

Decoding the Significance of 529 Plans

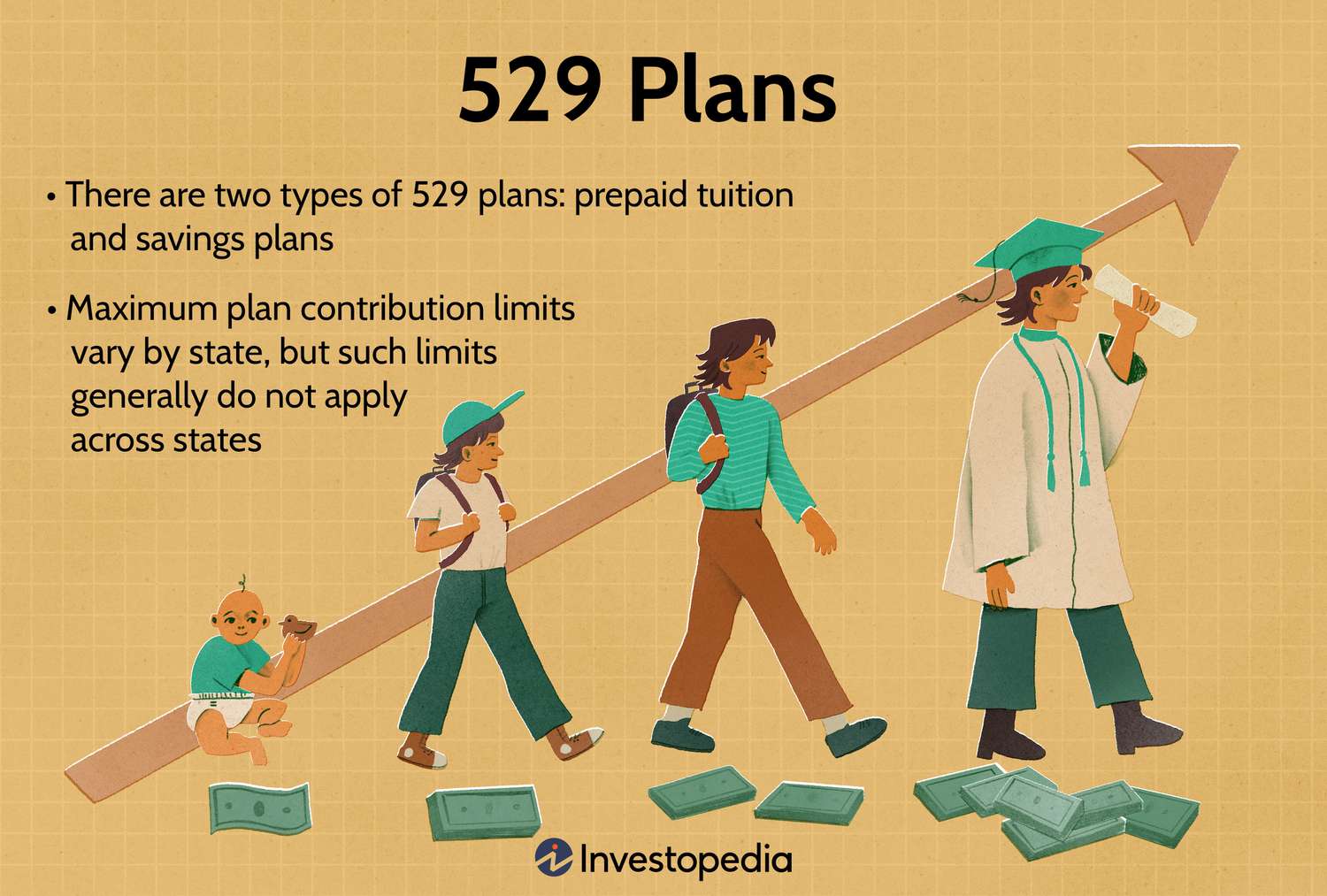

Navigating the path to higher education comes with its share of financial considerations. The 529 Education Savings Plan emerges as a strategic means to address these concerns. At its core, a 529 plan is designed to help families save and invest for future educational expenses. Whether you’re preparing for a child’s college education or contributing to your continuing education, understanding the benefits of a 529 plan is crucial.

Tax Benefits: Unveiling the Financial Advantages

One of the key draws of a 529 plan lies in the realm of tax benefits. Investors can enjoy tax advantages that make this savings tool a formidable choice. Contributions to a 529 plan grow tax-free, meaning the investment gains within the account are not subject to federal tax. Moreover, qualified withdrawals for educational expenses are also tax-free, providing a double benefit. This tax efficiency sets 529 plans apart, making them a valuable component of a comprehensive financial strategy.

Flexible Usage: Adapting to Educational Needs

Flexibility is a hallmark of the 529 Education Savings Plan, addressing the ever-evolving landscape of educational expenses. Funds from a 529 plan can be used for various qualified educational costs, including tuition, books, room and board, and even certain technology expenses. This adaptability ensures that the account can cater to the diverse needs of the account beneficiary, whether they pursue a traditional college education or other qualified post-secondary pursuits.

State-Specific Plans: Navigating Unique Offerings

While the fundamental concept of 529 plans remains consistent, it’s essential to recognize the nuances of state-specific offerings. Many states sponsor their own 529 plans, each with unique features and benefits. Residents often enjoy additional advantages, such as state income tax deductions for contributions. Understanding these state-specific nuances ensures that individuals can make informed decisions aligned with their financial goals and geographic considerations.

Contributions: Understanding Limits and Strategies

Contributions play a pivotal role in maximizing the benefits of a 529 plan. While there is no federal limit on contributions, individual states may impose their caps. It’s crucial to comprehend these limits and strategize contributions effectively. Exploring options like front-loading contributions (making larger contributions early on) and leveraging gift tax exclusions are strategies to consider. By optimizing contributions, individuals can harness the full potential of a 529 plan.

Financial Aid Impact: Minimizing Effects on Aid Eligibility

A common concern when considering a 529 plan is its potential impact on financial aid eligibility. However, the impact is generally minimal. Assets in a parent-owned 529 plan are typically treated with a lower assessment rate than other assets, and withdrawals for qualified educational expenses do not count as income on the Free Application for Federal Student Aid (FAFSA). Understanding these dynamics helps individuals make informed decisions without compromising financial aid opportunities.

Investment Options: Tailoring to Risk Tolerance

Within a 529 plan, investors are presented with various investment options catering to different risk tolerances and financial goals. These options often include age-based portfolios that automatically adjust asset allocation based on the beneficiary’s age, as well as static portfolios with fixed asset allocations. Understanding these choices allows account holders to tailor their investments to align with their risk preferences and financial objectives, fostering a personalized and effective approach to wealth accumulation.

Estate Planning Benefits: Beyond Education Funding

Beyond the immediate advantages of education funding, a 529 plan can serve as a valuable tool for estate planning. Contributions to a 529 plan are considered gifts for tax purposes, allowing for larger financial transfers without incurring gift taxes. This dual functionality positions 529 plans as a versatile instrument for individuals looking to concurrently support education goals and implement strategic estate planning initiatives.

Drawbacks: Addressing Potential Concerns

While the benefits of a 529 plan are substantial, it’s essential to acknowledge potential drawbacks. One consideration is the penalty for non-qualified withdrawals, where earnings may be subject to income tax and a 10% penalty. Additionally, the impact on financial aid eligibility, if not managed strategically, can be a concern. Addressing these potential drawbacks transparently ensures that individuals can make well-informed decisions aligned with their financial circumstances and objectives.

Frequently Asked Questions About the Benefits of 529 Education Savings Plans

1. What exactly is a 529 Education Savings Plan?

A 529 plan is a tax-advantaged savings tool designed to help families save and invest for future educational expenses.

2. How do tax benefits contribute to the appeal of 529 plans?

Contributions and withdrawals for qualified educational expenses in a 529 plan are typically tax-free, providing financial advantages.

3. Can I use funds from a 529 plan for various educational expenses?

Yes, a 529 plan offers flexibility, allowing funds to be used for tuition, books, room and board, and other qualified costs.

4. Do different states offer different types of 529 plans?

Yes, states sponsor their own 529 plans with unique features, and residents may enjoy state-specific benefits such as tax deductions.

5. Are there limits on contributions to a 529 plan?

While there is no federal limit, individual states may have their caps. Understanding and optimizing contributions is crucial.

6. How does a 529 plan impact eligibility for financial aid?

The impact on financial aid is generally minimal, and strategic management can help minimize any effects on aid eligibility.

7. What investment options are available within a 529 plan?

Investors can choose from various options catering to different risk tolerances, including age-based and static portfolios.

8. How can a 529 plan be utilized for estate planning?

Contributions to a 529 plan are considered gifts for tax purposes, providing a tool for larger financial transfers without gift taxes.

9. What potential drawbacks should be considered with 529 plans?

Considerations include penalties for non-qualified withdrawals and the impact on financial aid eligibility if not managed strategically.

10. What is the overarching benefit of a 529 plan beyond education funding?

Beyond education funding, a 529 plan serves as a versatile tool for estate planning and strategic financial transfers.

Conclusion:

In conclusion, the benefits of a 529 Education Savings Plan extend far beyond mere educational funding. From tax advantages to flexible usage and estate planning benefits, these plans offer a comprehensive approach to financial planning. By understanding the intricacies, maximizing contributions, and navigating potential concerns, individuals can leverage 529 plans to secure a brighter educational future for themselves or their loved ones.