100k Salary: How Much House Can I Afford?

In today’s real estate market, understanding how much house you can afford is crucial. With property prices soaring and interest rates fluctuating, it’s essential to have a clear financial picture before diving into homeownership. The $100k salary benchmark is often considered a significant milestone, but how does it translate into home affordability? This guide will provide insights into determining the ideal home price range based on a $100k salary and other influencing factors.

Factors Influencing Home Affordability

a. Debt-to-Income Ratio (DTI)

Your Debt-to-Income Ratio, commonly called DTI, plays a pivotal role in mortgage approvals. It’s a measure that compares your monthly debt payments to your monthly gross income. Lenders use this ratio to gauge your ability to manage monthly payments and repay borrowed money.

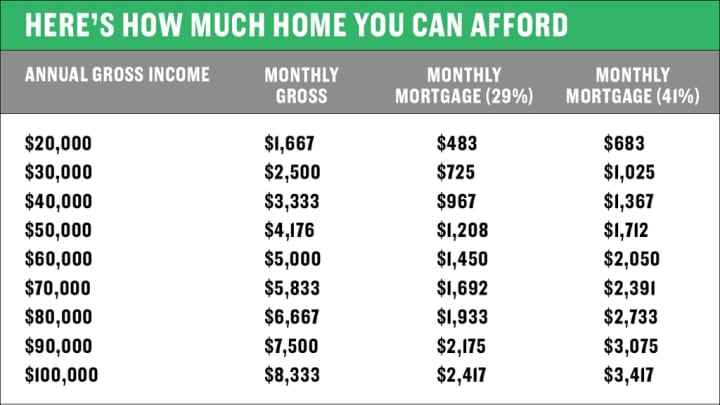

For instance, if you earn $100k annually, your monthly gross income is approximately $8,333. If your monthly debts (like car loans, credit card payments, and student loans) amount to $2,500, your DTI would be 30%. Most lenders prefer a DTI below 36%, with no more than 28% going towards housing costs.

b. Interest Rates

Interest rates can significantly impact your monthly mortgage payments. Even a slight change in rates can result in a substantial difference over the life of a loan. Currently, with the ever-evolving economic landscape, it’s essential to stay updated on interest rate trends. A lower rate can mean saving thousands of dollars throughout your mortgage. For someone with a $100k salary, securing a mortgage at a favourable interest rate can make homeownership more attainable and sustainable.

c. Down Payment

The down payment is often the most daunting aspect of buying a home. While traditional advice suggests putting down 20%, numerous loan programs are available that require much less. However, the amount you put down can influence your loan terms and interest rates.

For those earning $100k, setting aside money for a down payment can be challenging, especially with other financial obligations

in play. However, it’s essential to understand the long-term benefits. A larger down payment can:

- Reduce Monthly Payments: The more you put down initially, the less you’ll need to borrow. This can lead to lower monthly mortgage payments.

- Secure Better Interest Rates: Lenders often offer better interest rates to those who present less risk. A substantial down payment can indicate financial stability, potentially leading to more favourable loan terms.

- Eliminate Private Mortgage Insurance (PMI): If you can afford to put down 20% or more, you can avoid PMI—a monthly fee lenders charge to protect themselves if you default on the loan. This can save you a significant amount over time.

For someone with a $100k salary, it might be tempting to opt for lower down payment options to get into a home sooner. However, it’s crucial to weigh the immediate benefits against the long-term costs.

Calculating Home Affordability on a $100k Salary

Understanding your financial boundaries is the key to a stress-free home-buying experience. Here’s a step-by-step guide to help you determine your ideal home price range:

- Determine Your Monthly Income: Start by calculating your monthly take-home pay. If you’re earning $100k annually, divide that by 12 to get your monthly pre-tax income.

- List All Monthly Expenses: This includes all your debts, utilities, groceries, insurance, and any other recurring expenses.

- Factor in Future Homeownership Costs: Beyond the mortgage, consider property taxes, homeowner’s insurance, potential homeowner association (HOA) fees, and maintenance costs.

- Use Online Calculators: There are numerous online tools designed to help potential homeowners gauge how much they can afford. Input your details to get a ballpark figure. Remember, these are estimates and might not account for all individual factors.

- Consult with Financial Professionals: While online tools and personal calculations are helpful, consulting with a financial advisor or mortgage professional can provide a clearer picture. They can offer insights tailored to your unique financial situation.

In conclusion, while a $100k salary is a commendable milestone, various factors influence how much house it can genuinely afford. By understanding these elements and carefully evaluating your financial health, you can make informed decisions that pave the way for sustainable homeownership.

Other Financial Considerations

a. Property Taxes

One of the often overlooked aspects of homeownership is property taxes. These taxes can vary significantly based on your location. For instance, properties in urban areas or those with better amenities might have higher tax rates than those in more rural settings. When considering a home purchase on a $100k salary, it’s essential to research local property tax rates. These taxes can influence your monthly mortgage payments and should be factored into your overall budget.

b. Home Insurance

Protecting your investment is paramount. Home insurance covers potential damages to your property, whether from natural disasters, theft, or other unforeseen events. The cost of home insurance can vary based on the property’s value, location, and even its age. It’s advisable to get multiple quotes and understand the coverage details. Remember, the cheapest policy might not always offer the best protection.

c. Maintenance and HOA Fees

Owning a home comes with its set of responsibilities. Regular maintenance, such as roof repairs, plumbing issues, or landscaping, can add up over time. It’s wise to set aside a budget for these unexpected costs.

Additionally, if you’re considering a property within a community or complex, you might encounter Homeowners Association (HOA) fees. These fees cover communal amenities like security, swimming pools, and landscaping. While they offer added benefits, they also represent an additional monthly cost. Ensure you’re aware of any HOA fees and what they cover before finalizing your home purchase.

Benefits of Staying Within Budget

Financial discipline is the cornerstone of stress-free homeownership. While it might be tempting to stretch your budget for that dream home, the long-term implications can be daunting. Here’s why it’s beneficial to stay within your means:

- Financial Security: Living within your budget ensures you can comfortably meet all your financial obligations, from mortgage payments to other essential expenses.

- Flexibility for Future Investments: By not overextending yourself, you have the flexibility to invest in other ventures, be it education, travel, or even a new business.

- Peace of Mind: Financial strains can lead to undue stress. Knowing you can comfortably afford your home brings peace of mind, allowing you to enjoy your new space fully.

- Preparedness for Unforeseen Events: Life is unpredictable. Job losses, medical emergencies, or global economic downturns can impact your income. Staying within budget provides a safety net for such unforeseen events.

In essence, while a $100k salary provides a comfortable cushion, it’s the judicious use of these funds that ensures a balanced and fulfilling life. Homeownership is a significant milestone, and with careful planning and consideration, it can be a rewarding experience.

Frequently Asked Questions (FAQs)

Q: How does my credit score impact my ability to buy a home on a $100k salary?

A: Your credit score plays a pivotal role in determining the interest rates offered to you. A higher score can lead to more favourable rates, potentially saving you thousands over the life of your mortgage. Even with a $100k salary, a poor credit score can limit your buying power or increase your monthly payments.

Q: Are there specific mortgage programs tailored for those with a $100k income?

A: While there aren’t mortgage programs specifically for those earning $100k, there are various programs based on down payment ability, first-time homebuyer status, and more. It’s advisable to consult with a mortgage professional to explore all available options tailored to your financial situation.

Q: How can I prepare for unexpected homeownership costs on a $100k salary?

A: It’s wise to maintain an emergency fund. This fund should cover 3-6 months of living expenses, including your mortgage, utilities, and other essential costs. This cushion can be invaluable in case of unexpected repairs or changes in your financial situation.

Q: Can I afford a second property or vacation home on a $100k salary?

A: Affording a second property largely depends on your existing financial obligations, the equity in your primary residence, and potential rental income from the second property. While a $100k salary provides a solid foundation, other factors like savings, debts, and future financial goals play a significant role.

Conclusion

Understanding the intricacies of homeownership on a $100k salary requires a holistic approach. From the initial down payment to ongoing maintenance costs, various factors influence the true affordability of a home. By staying informed, seeking professional advice, and maintaining financial discipline, you can navigate the real estate market with confidence. Remember, a house is not just a financial investment but a space to create memories, making every effort towards informed decision-making truly worthwhile.