Living Benefits of Life Insurance

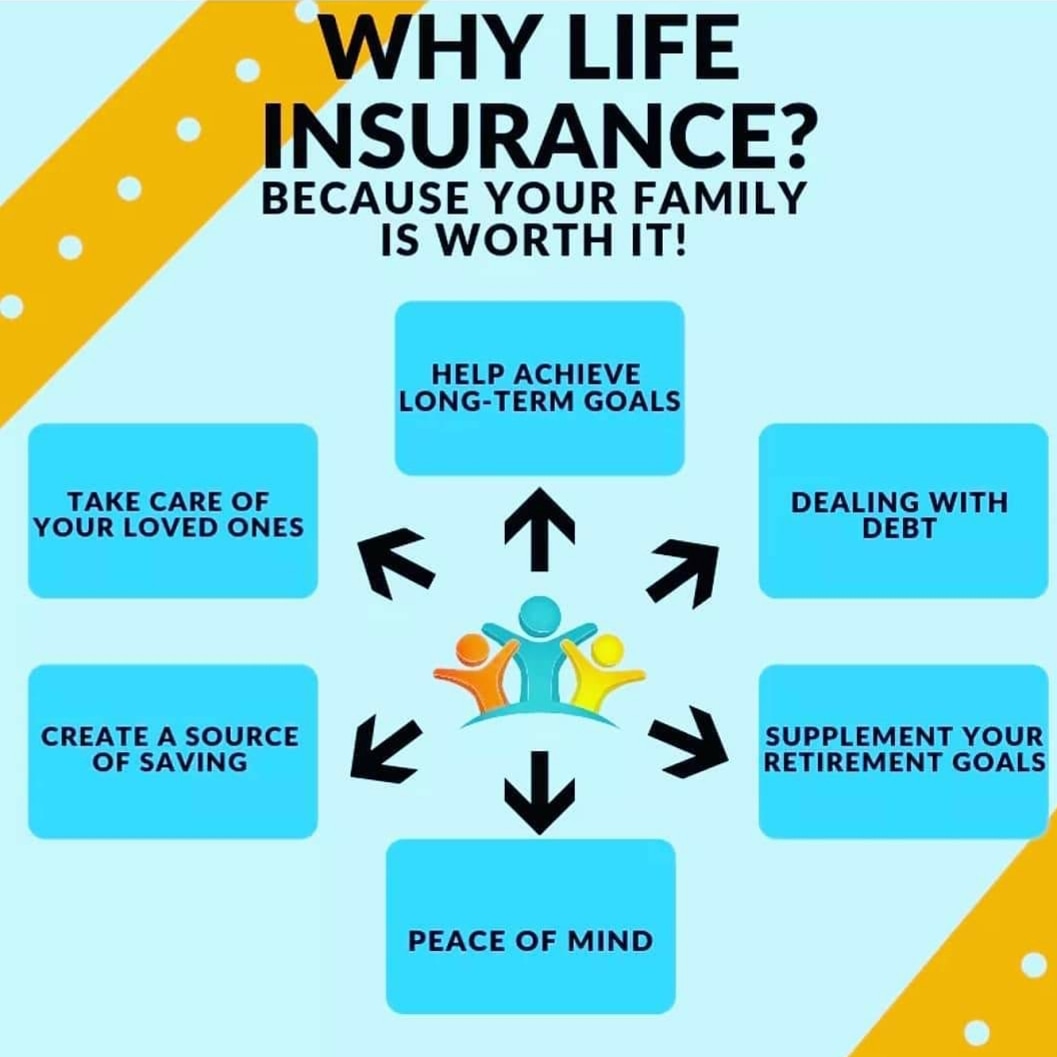

Life insurance is an essential financial tool that provides a safety net for your loved ones in the event of your untimely demise. However, many people are unaware of the additional benefits that life insurance can offer while they are still alive. In this article, we will explore the living benefits of life insurance and how it can provide financial security and peace of mind during your lifetime.

Cash Value Accumulation

One of the significant advantages of certain types of life insurance policies is the potential for cash value accumulation. Unlike term life insurance, which provides coverage for a specific period, permanent life insurance policies such as whole life or universal life insurance build cash value over time. This cash value grows tax-deferred and can be accessed during your lifetime.

Tax Advantages

Life insurance policies offer various tax advantages that can benefit policyholders. The death benefit paid to beneficiaries is generally income tax-free. Moreover, the cash value accumulation within permanent life insurance policies grows tax-deferred, meaning you won’t have to pay taxes on the growth until you withdraw the funds. This can be particularly advantageous when planning for retirement or other long-term financial goals.

Supplemental Retirement Income

Life insurance can serve as a source of supplemental retirement income. By leveraging the cash value accumulated within a permanent life insurance policy, you can take out loans or make withdrawals to supplement your retirement funds. This can be especially beneficial if you have maximized other traditional retirement accounts and are looking for additional income sources.

Emergency Fund

Life is full of unexpected events, and having an emergency fund is crucial to handle financial challenges that may arise. The cash value of a permanent life insurance policy can be used as an emergency fund, providing you with a source of readily available funds in times of need. This can help you avoid high-interest loans or debt and ensure financial stability during unforeseen circumstances.

Long-Term Care Expenses

Long-term care can be a significant financial burden for individuals and their families. Life insurance policies with living benefits can help cover long-term care expenses, such as nursing home care or in-home care services. These policies provide an added layer of financial protection and can alleviate the stress associated with funding long-term care needs.

Legacy Planning

Life insurance can be an essential tool for legacy planning. It allows you to leave a financial legacy for your loved ones or charitable organizations. The death benefit received by your beneficiaries can provide financial stability, pay off debts, or fund educational expenses. By incorporating life insurance into your estate planning, you can ensure that your legacy continues even after you are gone.

Business Continuity

For business owners, life insurance can play a vital role in ensuring business continuity. With the right policy, you can protect your business from financial hardships in the event of your death or the death of a key employee. Life insurance can provide the necessary funds to cover expenses, repay debts, or facilitate the smooth transfer of ownership.

Life insurance offers more than just a death benefit. The living benefits of life insurance can provide financial security, flexibility, and peace of mind during your lifetime. From cash value accumulation to tax advantages, supplemental retirement income, emergency funds, long-term care coverage, legacy planning, and business continuity, life insurance can be a versatile and valuable asset in your overall financial plan. Consider discussing your options with a trusted financial advisor to determine the best life insurance policy that suits your unique needs and goals.

Frequently Asked Questions – Living Benefits of Life Insurance

1. What are the living benefits of life insurance?

Living benefits of life insurance refer to the features that allow policyholders to access a portion of their policy’s death benefit while they are still alive, under certain circumstances such as critical illness, disability, or long-term care needs.

2. How do living benefits work?

Living benefits work by providing policyholders with financial support when they face a qualifying event, such as a critical illness diagnosis. The policyholder can receive a portion of the death benefit to cover medical expenses, loss of income, or other needs.

3. What types of living benefits are available in life insurance?

The most common types of living benefits in life insurance include accelerated death benefits, critical illness riders, long-term care riders, and disability income riders. These options vary among insurance providers and policies.

4. Can I use living benefits for any purpose?

Yes, you can typically use living benefits for any purpose you see fit. The funds can be used to cover medical bills, home modifications for long-term care, living expenses, or any other financial needs that arise due to a qualifying event.

5. Are there any restrictions on using living benefits?

Some policies may have certain restrictions on how living benefits can be used. It’s important to review the terms and conditions of your specific policy to understand any limitations or exclusions that may apply.

6. Will using living benefits affect the death benefit of my policy?

Yes, using living benefits will reduce the death benefit of your policy. The amount you receive as living benefits will be subtracted from the total death benefit payable to your beneficiaries upon your passing.

7. Are living benefits taxable?

In most cases, living benefits are not considered taxable income. However, it’s always recommended to consult with a tax professional to understand the tax implications specific to your situation.

8. Can I add living benefits to an existing life insurance policy?

It depends on your insurance provider and policy terms. Some policies may allow you to add living benefits through riders or endorsements, while others may require you to purchase a new policy with living benefits included.

9. How do I qualify for living benefits?

Qualification for living benefits depends on the terms and conditions of your life insurance policy. Typically, you must meet specific criteria, such as being diagnosed with a critical illness or becoming disabled, as outlined in your policy.

10. Are living benefits worth considering when purchasing life insurance?

Living benefits can provide valuable financial support during challenging times. Considering the potential benefits of accessing funds while alive, it’s worth exploring life insurance policies that offer living benefits to ensure you have additional protection beyond just the death benefit.