The company reported to the Securities Exchange Commission that it sold about 4.7 million shares to an undisclosed investor for $4.25 per share. The funds received will be used for “corporate needs and working capital needs”

Intuitive Machines CEO Steve Altemus said the funding will help the company develop a series of lunar landers and begin work on a NASA contract to provide engineering services at Goddard Space Flight Center. Work on the contract, worth approximately $719 million over five years, is expected to begin in the fourth quarter.

Intuitive Machines chief financial officer Eric Sully said the company’s cash — $39.1 million at the end of the second quarter — along with revenue from the NASA contract and the lunar modules would be sufficient, even with an operating loss of $13.2 million for the quarter.

Intuitive Machines has a $50 million credit facility that can be used to provide additional cushion if needed. After announcing a $20 million stock sale, Intuitive Machines said it no longer plans to enter into a credit facility.

Lunar module developer Intuitive Machines announced $20 million in stock sales

“Based on the timing of payments contingent on the achievement of plans, we have decided to strengthen our financial position,” Sully said in a statement.

In the same session with investors, Intuitive Machines said it was withdrawing previously provided revenue and cash balance forecasts. Previous forecasts were based on delays in public procurement schedules and the uncertainty of the US federal budget, not the loss of any particular contract.

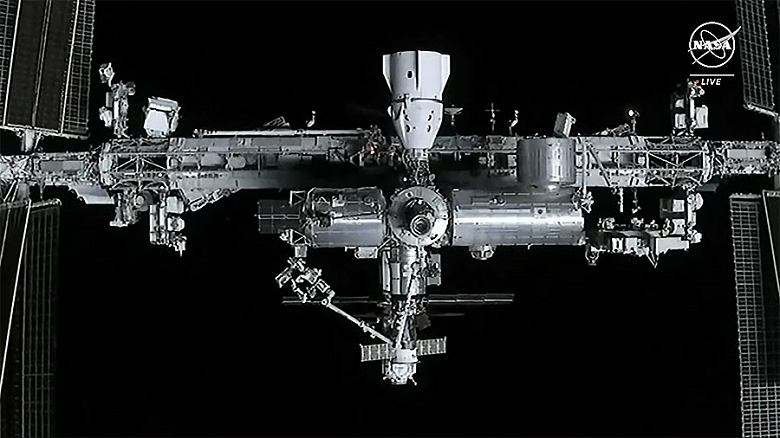

Intuitive Machines continues to work on its first lunar landing mission. IM-1 is scheduled to launch as early as November 15 on a SpaceX Falcon 9 rocket. Two additional launches, IM-2 and IM-3, are planned for 2024. All three missions carry payloads for NASA’s commercial lunar delivery program.

On August 31, the company’s share price settled at $4.76, falling 8.3% on the Nasdaq exchange.