Tax Benefits of Sole Proprietorship

As a proficient SEO and high-end copywriter, we understand the importance of crafting exceptional content that can surpass other websites in search rankings. In this article, we will delve into the tax benefits of sole proprietorship, providing you with detailed and comprehensive information to help you make informed decisions for your business.

Understanding Sole Proprietorship

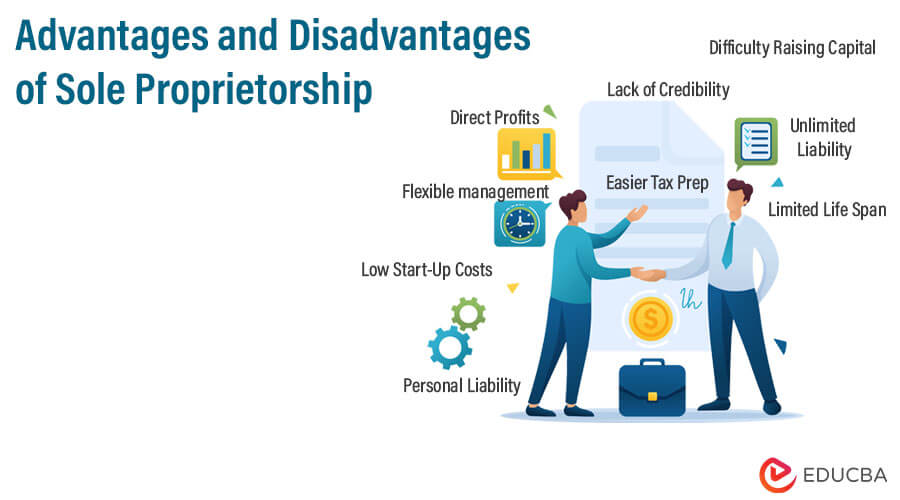

A sole proprietorship is the simplest form of business structure where an individual operates their business as the sole owner. Unlike other business structures such as partnerships or corporations, a sole proprietorship does not create a separate legal entity. Instead, the business and the owner are considered as one.

Tax Advantages of Sole Proprietorship

Simplified Tax Filing: One of the significant advantages of sole proprietorship is the simplicity of tax filing. Unlike corporations or partnerships, sole proprietors are not required to file a separate business tax return. Instead, business income and expenses are reported on the owner’s tax return (Form 1040) using Schedule C.

Pass-Through Taxation: A sole proprietorship enjoys pass-through taxation, meaning the business itself is not taxed separately. Instead, all profits and losses are “passed through” to the owner’s tax return and taxed at their tax rate. This eliminates the issue of double taxation faced by corporations.

Deductible Business Expenses: As a sole proprietor, you can deduct legitimate business expenses from your taxable income. These may include office rent, utilities, supplies, marketing expenses, travel expenses, and more. Deducting these expenses can significantly reduce your overall tax liability.

Self-Employment Tax Deductions: Sole proprietors are responsible for paying self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes. However, the good news is that you can deduct the employer portion of these taxes when calculating your adjusted gross income, reducing your overall tax liability.

Qualifying for Sole Proprietorship Tax Benefits

To qualify for the tax benefits mentioned above, you need to meet certain criteria:

Business Structure: Your business must be structured as a sole proprietorship. Ensure you have the necessary licenses and permits to operate legally.

Business Intent: You must have a genuine intention to operate a business and not just engage in a hobby or sporadic activities.

Separate Business Accounts: Maintain separate bank accounts and financial records for your business to ensure clear separation between personal and business finances.

Accurate Record-Keeping: Keep detailed records of your business income and expenses. This will not only help you claim legitimate deductions but also assist in case of an audit.

Sole proprietorship offers several tax benefits, including simplified tax filing, pass-through taxation, deductible business expenses, and self-employment tax deductions. By understanding and leveraging these benefits, you can optimize your tax situation and potentially save a significant amount of money. However, it is essential to consult with a qualified tax professional or accountant to ensure compliance with tax laws and maximize your tax advantages.

Frequently Asked Questions about Tax Benefits of Sole Proprietorship

1. What are the tax benefits of operating as a sole proprietor?

As a sole proprietor, you have the advantage of reporting business income and expenses on your tax which simplifies the tax filing process.

2. Can I deduct business expenses as a sole proprietor?

Yes, you can deduct ordinary and necessary business expenses, such as office supplies, advertising costs, and travel expenses, which can help lower your taxable income.

3. Are there any specific deductions available for sole proprietors?

Yes, sole proprietors can take advantage of deductions like the home office deduction, self-employment tax deduction, and health insurance deduction, among others.

4. Do I need to pay self-employment taxes as a sole proprietor?

Yes, as a sole proprietor, you are responsible for paying self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes.

5. Can I contribute to a retirement plan as a sole proprietor?

Absolutely! Sole proprietors have several retirement plan options, such as Simplified Employee Pension (SEP) IRA, Solo 401(k), and SIMPLE IRA, allowing them to save for retirement while enjoying potential tax advantages.

6. Are there any tax credits available for sole proprietors?

While sole proprietors may not have specific tax credits, they can still benefit from general tax credits like the Earned Income Tax Credit (EITC) or the Child and Dependent Care Credit if they meet the eligibility criteria.

7. How does the pass-through taxation feature benefit sole proprietors?

Sole proprietors enjoy pass-through taxation, meaning business profits and losses are “passed through” to the owner’s tax return, avoiding double taxation typically faced by corporations.

8. Can I carry forward business losses as a sole proprietor?

Yes, if your business incurs a loss, you may be able to carry it forward to future tax years, offsetting any future profits and potentially reducing your tax liability.

9. Do I need to make estimated tax payments as a sole proprietor?

Generally, sole proprietors are required to make quarterly estimated tax payments to cover their income and self-employment taxes, ensuring they stay current with their tax obligations.

10. Are there any limitations on deducting business losses as a sole proprietor?

Yes, the IRS imposes certain limitations on deducting business losses, including the at-risk rules and the passive activity loss rules, which may restrict the amount of losses you can claim against other income.