The Benefits of a Brokerage Account: A Comprehensive Guide

In today’s dynamic financial landscape, understanding the advantages of a brokerage account is a pivotal step towards financial empowerment. This comprehensive guide aims to unravel the multifaceted benefits, providing insights into wealth accumulation, investment flexibility, and tax efficiency. Get ready to embark on a journey that could redefine your approach to wealth building.

Wealth Accumulation and Investment Opportunities

Diversification for Long-Term Growth

In the world of finance, the age-old adage “Don’t put all your eggs in one basket” holds. A brokerage account offers a gateway to diversification, a strategy essential for long-term wealth growth.

Spreading Risk through Asset Diversification

Diversification involves investing in various assets to mitigate risk. A brokerage account facilitates the diversification process, allowing investors to spread their investments across stocks, bonds, mutual funds, and more.

Capitalizing on Various Investment Opportunities

With a brokerage account, investors gain access to a plethora of investment options. From individual stocks to Exchange-Traded Funds (ETFs), the flexibility to capitalize on various opportunities is unparalleled.

Flexibility and Accessibility

The traditional image of stock trading depicted frantic activity on a crowded exchange floor. Today, the reality is vastly different, thanks to the convenience of online trading platforms.

Accessible Anytime, Anywhere

Brokerage accounts empower investors with the ability to monitor and execute trades from the comfort of their homes. Whether it’s early morning or late at night, the market is accessible, transcending time zones and geographical constraints.

User-Friendly Platforms for Seamless Transactions

Modern brokerage platforms prioritize user experience. Intuitive interfaces, real-time data, and easy navigation make transactions seamless, even for those new to the world of investing.

Tax Efficiency and Financial Planning

Tax Benefits of Brokerage Accounts

Understanding the tax implications of investment is crucial for maximizing returns. Brokerage accounts offer several tax advantages that savvy investors can leverage.

Capitalizing on Tax-Advantaged Accounts

Certain brokerage accounts, such as Individual Retirement Accounts (IRAs) and 401(k)s, provide tax advantages. Contributions to these accounts may be tax-deductible, and earnings can grow tax-deferred until withdrawal.

Integrating Brokerage Accounts into a Comprehensive Financial Plan

A holistic financial plan encompasses investment goals, risk tolerance, and tax considerations. Brokerage accounts, when strategically integrated, become a valuable tool in achieving financial objectives while optimizing tax efficiency.

Brokerage Account vs. Other Investment Vehicles

Contrasting Features and Benefits

Investors often face the dilemma of choosing between various investment vehicles. This section navigates the comparative landscape, highlighting the distinctive features and benefits that set brokerage accounts apart.

Comparing Brokerage Accounts with Savings Accounts

While savings accounts offer security, brokerage accounts provide an opportunity for higher returns. Contrasting the two sheds light on the risk-return spectrum, helping investors make informed decisions based on their financial goals.

Evaluating the Advantages Of Traditional Investment Options

Brokerage accounts offer flexibility and control that traditional investment options may lack. By evaluating these advantages, investors can make choices aligned with their risk tolerance and financial aspirations.

Real-Life Success Stories

Showcasing Positive Outcomes

The impact of a brokerage account is best understood through real-life success stories. This section presents narratives of individuals who strategically leveraged brokerage accounts to achieve financial milestones.

Illustrating Wealth Growth through Practical Examples

From modest beginnings to substantial wealth accumulation, practical examples illustrate the transformative power of brokerage accounts. These narratives inspire and offer tangible insights for aspiring investors.

Frequently Asked Questions (FAQs) About Brokerage Accounts

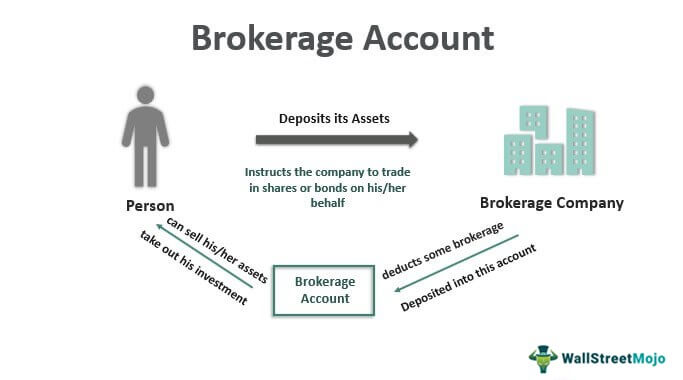

1. Q: What is a brokerage account, and how does it differ from a regular savings account?

A brokerage account is a platform that allows investors to buy and sell financial assets like stocks and bonds. Unlike a savings account, it offers a broader range of investment options with potentially higher returns.

2. Q: Are brokerage accounts only for experienced investors?

No, brokerage accounts cater to investors of all experience levels. Many platforms provide user-friendly interfaces, educational resources, and guidance to help beginners navigate the investment landscape.

3. Q: What are the advantages of diversification, and how does a brokerage account facilitate it?

Diversification involves spreading investments across various assets to reduce risk. A brokerage account allows investors to diversify easily by offering access to a wide range of investment options such as stocks, bonds, and mutual funds.

4. Q: Are there tax benefits associated with brokerage accounts?

Yes, certain brokerage accounts, like IRAs and 401(k)s, offer tax advantages. Contributions may be tax-deductible, and earnings can grow tax-deferred, providing potential tax benefits for investors.

5. Q: Can I lose money in a brokerage account?

Yes, as with any investment, there is a risk of loss in a brokerage account. However, strategic investment decisions, diversification, and staying informed can help manage and mitigate these risks.

6. Q: How do I choose the right brokerage platform for my needs?

Consider factors such as fees, available investment options, user interface, and customer support. Evaluate your investment goals and preferences to choose a platform that aligns with your needs.

7. Q: Are there any age restrictions for opening a brokerage account?

Generally, there are no strict age restrictions. However, individuals under 18 may need a custodial account, and some platforms may have specific age requirements.

8. Q: Can I trade stocks and manage my brokerage account from my mobile phone?

Yes, many brokerage platforms offer mobile apps that allow users to trade stocks, monitor their portfolios, and manage their accounts conveniently from their mobile devices.

9. Q: How often should I review my brokerage account portfolio?

Regular portfolio reviews are advisable, especially during significant life changes or shifts in financial goals. However, the frequency may vary based on individual preferences and market conditions.

10. Q: Are there any hidden fees associated with brokerage accounts?

It’s crucial to understand the fee structure of your chosen brokerage platform. While some fees are transparent, others may exist, such as transaction fees or account maintenance fees. Reviewing the platform’s fee schedule is recommended.

Conclusion:

As we conclude this comprehensive guide, it’s evident that a brokerage account is more than a financial tool; it’s a pathway to financial empowerment. From wealth accumulation and tax efficiency to navigating market trends, the benefits are vast. Now, armed with knowledge, take the next steps toward realizing your financial goals.