The Benefits of Leasing a Car – Your Ultimate Guide

Welcome to our comprehensive guide on the benefits of leasing a car. At [Your Company Name], we understand the importance of making informed decisions when it comes to your transportation needs. In this article, we will explore the advantages of leasing a car and why it may be a suitable option for you. Lower Monthly Payments

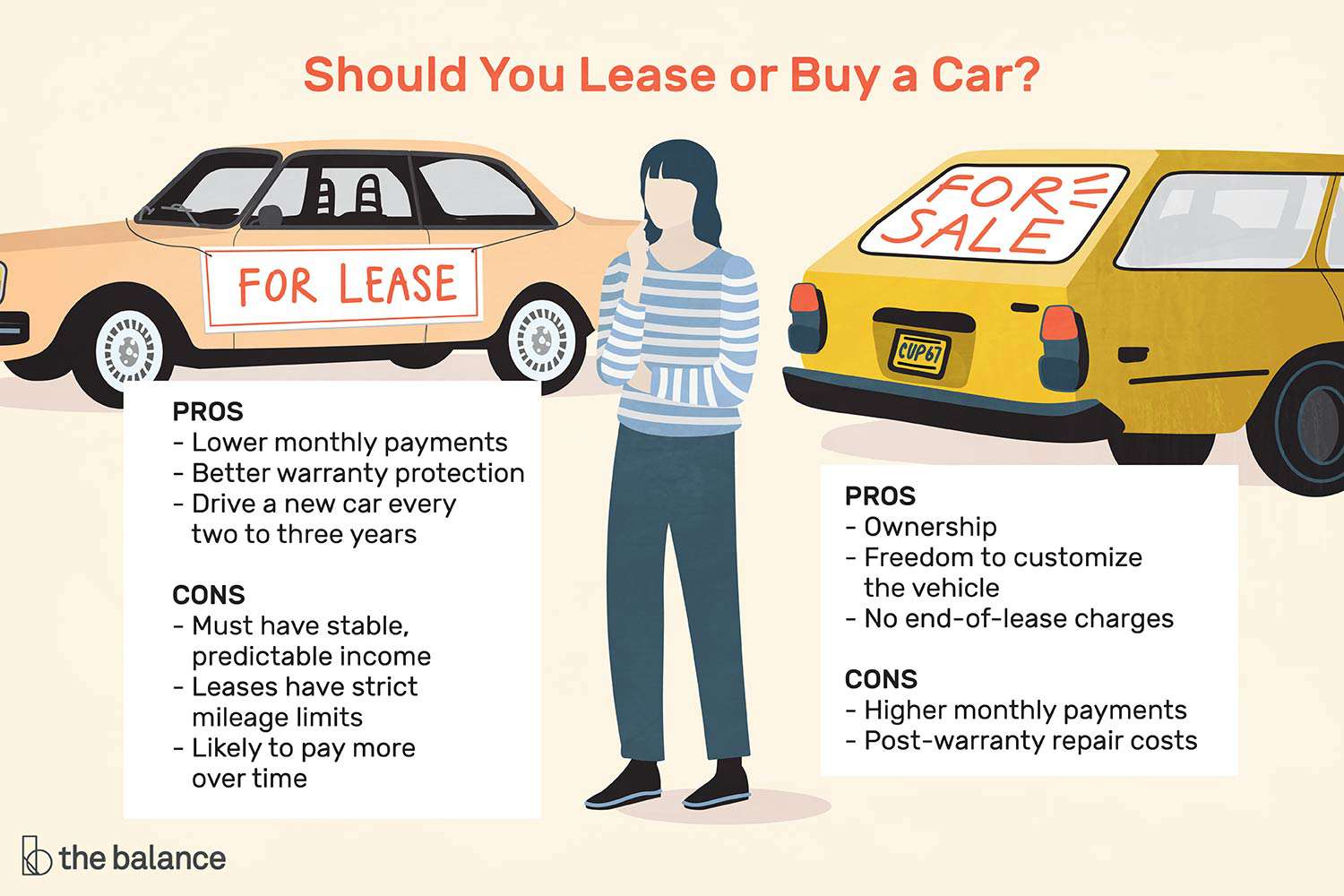

One of the primary benefits of leasing a car is the lower monthly payments compared to purchasing a vehicle. When you lease a car, you are essentially paying for the depreciation of the vehicle during the lease term, rather than the full purchase price. This can result in significantly lower monthly payments, allowing you to drive a higher-end vehicle for a more affordable price.

Reduced Maintenance Costs

Leasing a car often means that you will be driving a vehicle that is still under warranty. This can help reduce your maintenance costs as any repairs or regular servicing may be covered by the manufacturer’s warranty. Additionally, leased vehicles are typically newer and have lower mileage, which can further minimize the likelihood of unexpected repair expenses.

Flexibility and Variety

Leasing a car provides you with the flexibility to drive a new vehicle every few years. This is especially beneficial if you enjoy experiencing the latest automotive technologies and advancements. Leasing allows you to stay up-to-date with the newest models, ensuring that you always have access to the latest features, improved fuel efficiency, and enhanced safety systems.

No Long-Term Commitment

Unlike purchasing a car, leasing offers you the advantage of not being tied to a long-term commitment. Leases typically last for a few years, allowing you to easily transition to a different vehicle once the lease term ends. This can be particularly advantageous if your lifestyle or transportation needs change over time.

Tax Benefits

In some cases, leasing a car can provide tax benefits, especially for business owners or those who use the vehicle for work-related purposes. Depending on your country’s tax laws, you may be able to deduct a portion of your lease payments or claim tax credits for leasing a car. It is advisable to consult with a tax professional to understand the specific benefits available to you.

Lower Upfront Costs

Leasing a car often requires a lower upfront payment compared to purchasing a vehicle. While purchasing a car typically involves a substantial down payment, leasing may only require a security deposit, the first month’s payment, and other minimal fees. This can make leasing a more affordable option, especially if you prefer to allocate your finances elsewhere.

Avoiding Depreciation

One of the significant advantages of leasing a car is the ability to avoid the depreciation associated with vehicle ownership. When you purchase a car, its value typically decreases over time. However, when you lease a car, you can simply return it at the end of the lease term without worrying about its resale value. This can save you from potential financial losses associated with depreciation.

Peace of Mind

Leasing a car can provide peace of mind, knowing that you are driving a reliable vehicle that is under warranty. With a leased vehicle, you can focus on enjoying the driving experience without the constant worry of unexpected breakdowns or costly repairs. Additionally, many leasing agreements offer roadside assistance and other benefits, further enhancing your peace of mind.

Leasing a car offers numerous benefits, including lower monthly payments, reduced maintenance costs, flexibility, and variety. It allows you to avoid long-term commitments, enjoy potential tax benefits, and save on upfront costs. With leasing, you can also avoid depreciation and experience peace of mind with a reliable vehicle. Consider these advantages when deciding whether leasing a car is the right choice for you.

Frequently Asked Questions

Q1: What are the benefits of leasing a car?

A1: Leasing a car offers several advantages such as lower monthly payments, access to newer models, reduced maintenance costs, and the ability to drive a higher-priced vehicle for less money upfront.

Q2: How does leasing a car result in lower monthly payments?

A2: When you lease a car, you are only paying for the depreciation and the term of the lease, rather than the full value of the vehicle. This typically results in lower monthly payments compared to financing a car purchase.

Q3: Can I lease a car if I have bad credit?

A3: It may be more challenging to lease a car with bad credit, but it is not impossible. Some leasing companies offer options for individuals with less-than-perfect credit, although the terms and conditions may be less favorable.

Q4: What is the advantage of driving a newer car through leasing?

A4: Leasing allows you to drive a newer car with the latest features and technology. This ensures you have access to the most up-to-date safety features, improved fuel efficiency, and enhanced driving experience.

Q5: Are maintenance costs lower when leasing a car?

A5: Yes, maintenance costs are generally lower when leasing a car. Most lease agreements cover routine maintenance and repairs under warranty, reducing the financial burden on the lessee.

Q6: Can I negotiate the terms of a car lease?

A6: Yes, you can negotiate the terms of a car lease. Factors such as the down payment, monthly payments, mileage limit, and lease duration can be subject to negotiation, allowing you to tailor the lease to your needs.

Q7: What happens at the end of a car lease?

A7: At the end of a car lease, you can choose to return the vehicle, purchase it at the residual value, or lease a new car. The specific options depend on the terms of your lease agreement.

Q8: Are there any mileage restrictions when leasing a car?

A8: Yes, most car leases come with mileage restrictions. Exceeding the agreed-upon mileage limit may result in additional charges. However, you can often negotiate a higher mileage limit if needed.

Q9: Can I make modifications to a leased car?

A9: Generally, you cannot make significant modifications to a leased car. The vehicle must be returned to its original condition at the end of the lease. However, minor modifications such as adding accessories may be allowed with prior approval.

Q10: Is it possible to terminate a car lease early?

A10: Yes, it is possible to terminate a car lease early, but it can be costly. Early termination fees and remaining lease payments may apply. It is advisable to carefully review the terms of your lease agreement before considering early termination.