Privately Issued Student Loans: Unlocking One Key Benefit

In the realm of higher education financing, there exists a diverse array of options for students seeking financial assistance. One such avenue is privately issued student loans, which offer a multitude of advantages to borrowers. In this article, we delve into the intricacies of these loans and shed light on one key benefit that sets them apart from other funding sources.

Understanding Privately Issued Student Loans

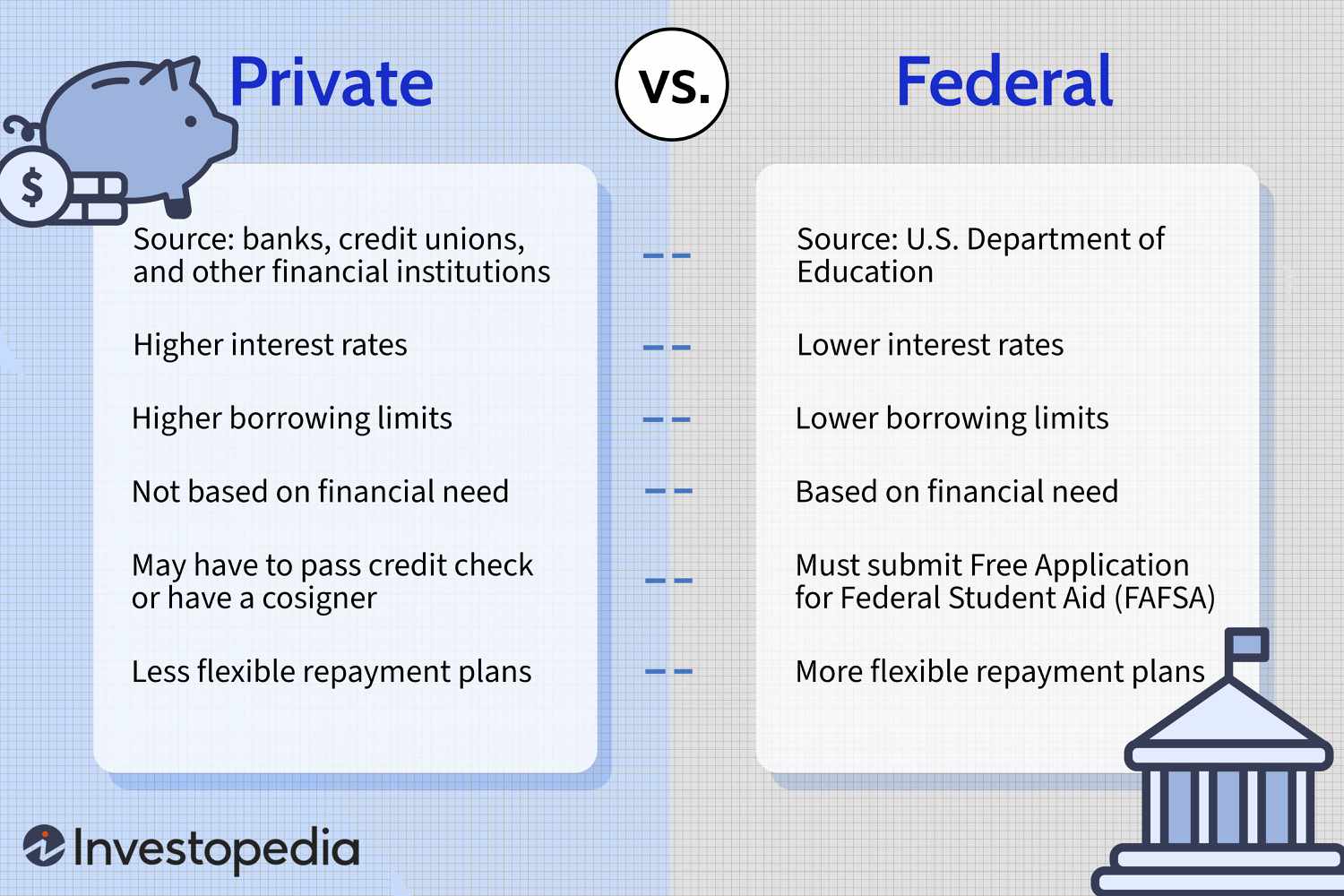

Privately issued student loans, as the name suggests, are loans provided by private financial institutions, such as banks or credit unions, to students pursuing their educational aspirations. These loans serve as an alternative to federal student loans, which are typically offered by the government. While federal loans come with their own set of advantages, privately issued student loans offer certain unique benefits that make them a viable option for many borrowers.

One Key Benefit: Greater Flexibility

When it comes to financing your education, flexibility plays a pivotal role in ensuring a smooth and hassle-free borrowing experience. Privately issued student loans excel in this aspect, providing borrowers with greater flexibility compared to their federal counterparts.

Customizable Loan Terms

Unlike federal student loans, which come with fixed interest rates and standardized repayment plans, privately issued student loans offer borrowers the ability to customize their loan terms. This means that you have the freedom to choose a repayment plan that aligns with your financial circumstances and goals. Whether you prefer a shorter repayment period with higher monthly payments or a longer duration with more manageable installments, privately issued student loans can cater to your specific needs.

Higher Loan Limits

Another notable advantage of privately issued student loans is the higher loan limits they offer. While federal loans have predefined borrowing limits, private lenders often provide more substantial loan amounts. This can be particularly beneficial for students attending institutions with higher tuition costs or pursuing advanced degrees that require additional funding beyond what federal loans can cover.

Streamlined Application Process

Applying for financial aid can sometimes be a complex and time-consuming process. However, privately issued student loans simplify this endeavor by streamlining the application process. Private lenders often have efficient online platforms that allow you to complete your application swiftly and conveniently. Additionally, their dedicated customer service teams are readily available to assist you throughout the process, ensuring a seamless experience from start to finish.

In conclusion, privately issued student loans offer a range of benefits that make them a compelling choice for students seeking financial assistance. With greater flexibility in terms of loan customization, higher borrowing limits, and a streamlined application process, these loans provide students with the tools they need to finance their education effectively. So, if you are considering financing your educational journey, exploring privately issued student loans could be a prudent step toward achieving your goals.

Frequently Asked Questions about Privately Issued Student Loans

1. What is one benefit of privately issued student loans?

Private student loans often offer more flexible repayment options compared to federal loans. They may have lower interest rates and allow borrowers to customize their repayment plans based on their financial situation.

2. Are privately issued student loans available to all students?

Yes, privately issued student loans are available to both undergraduate and graduate students. However, eligibility requirements may vary depending on the lender.

3. Can I use a privately issued student loan to cover all my education expenses?

Yes, you can use private student loans to cover various education-related expenses, including tuition fees, books, housing, and other educational supplies.

4. Are there any credit requirements for privately issued student loans?

Yes, most private lenders consider the borrower’s credit history and income when determining eligibility for a student loan. Having a good credit score and a steady income can increase your chances of approval.

5. Can I apply for a privately issued student loan without a cosigner?

Some private lenders offer student loans without requiring a cosigner, especially if the borrower has a strong credit history and a stable income. However, having a cosigner can improve your chances of getting approved and may lead to more favorable loan terms.

6. Are privately issued student loans eligible for loan forgiveness programs?

No, privately issued student loans are generally not eligible for federal loan forgiveness programs. However, some private lenders may offer their loan forgiveness options in certain cases.

7. Can I refinance my privately issued student loans?

Yes, many private lenders offer student loan refinancing options. By refinancing, you can potentially secure a lower interest rate, change your repayment terms, and even combine multiple loans into a single loan.

8. Do privately issued student loans have fixed or variable interest rates?

Both fixed and variable interest rate options are available for privately issued student loans. Fixed rates remain the same throughout the loan term, while variable rates may fluctuate based on market conditions.

9. Are there any fees associated with privately issued student loans?

Some private lenders may charge origination fees or application fees for their student loans. It’s important to carefully review the terms and conditions of each loan before applying.

10. Can I consolidate my privately-issued student loans?

Yes, private student loan consolidation is an option. By consolidating your loans, you can combine multiple loans into a single loan with a potentially lower interest rate and simplified repayment process.