Tesla founder Elon Musk has admitted that he was on the verge of bankruptcy. The stock market knew nothing of this. The question that remains is how long Tesla can continue to rely on the business model with the state bonuses.

It’s hard to believe, but the glamor boy of the global electric car scene actually spoke up a notch. Elon Musk, the head of Tesla, recently admitted frankly that it wasn’t long ago that Tesla nearly went bankrupt. A fact that dossierB has been describing over and over again for a long time. Musk openly stated on Twitter that it was pretty close.

In the electronic “twittering” with a conversation partner, he spoke of the fact that the company was “only one month before bankruptcy”, particularly because of the Model 3. Musk also reports on “stress and pain” because of the Model 3.

It was precisely this car that was described in advance by alleged market experts as a beacon of hope. But then the production and delivery hell broke over the car manufacturer, who wanted to become a mass manufacturer with this car.

Musk: “The start-up phase of the Model 3 was extremely stressful and painful for a long time – from mid-2017 to mid-2019. Hell for production and logistics. ”Here is a comparison of what makes a mass manufacturer in terms of numbers: The Volkswagen Group (VW, Audi, Seat, Skoda) sold around 2.9 million vehicles worldwide in the first half of 2020,

For a long time, Tesla focused on the production numbers of the Model 3 and was considered the measure of all things. In addition, a new factory was started up in Shanghai, which did not alleviate the problems.

Because hardly anyone outside the company was aware of the concerns, the share climbed to unimaginable heights – plus 400 percent – due to the mass manufacturer’s claim, which ultimately led to a share split in order to keep the paper reasonably affordable for small investors. In the meantime, this turbulence has subsided, but the figures are still far from promising.

Because although the quarterly balance sheet is officially in the black for the fifth quarter in a row, it should be noted that Tesla’s profit is mainly based on the sale of environmental certificates, as recently criticized by a US analyst. In the car for money business, however, not a penny is left in the till. The company continues to rely on the sale of regulatory credits in the United States that exist for the sale of electric cars.

These bonuses are nothing more than emission rights with which fines due to excessively high emission values can be reduced or avoided entirely. And because Tesla doesn’t offer any models with internal combustion engines, these government grants flow directly into the balance sheet.

It so happens that net income for the quarter ended September amounted to 331 million US dollars – an increase of 131 percent compared to the same quarter last year. But without the sale of these credits/emission rights to other car manufacturers with “dirty” engines, MarketWatch analyst Garrett Nelson criticizes, Tesla would not have been profitable.

Again, because it has been going on for a long time. Zachary Kirkhorn, Tesla’s Chief Financial Officer, told analysts in a conference call last quarter that that revenue from the sale of government credits will “roughly double” in 2020 compared to 2019. In the first nine months of 2020 alone, Tesla earned $ 1.179 billion in this way, according to Kirkhorn. In all of 2019, it was $ 594 million.

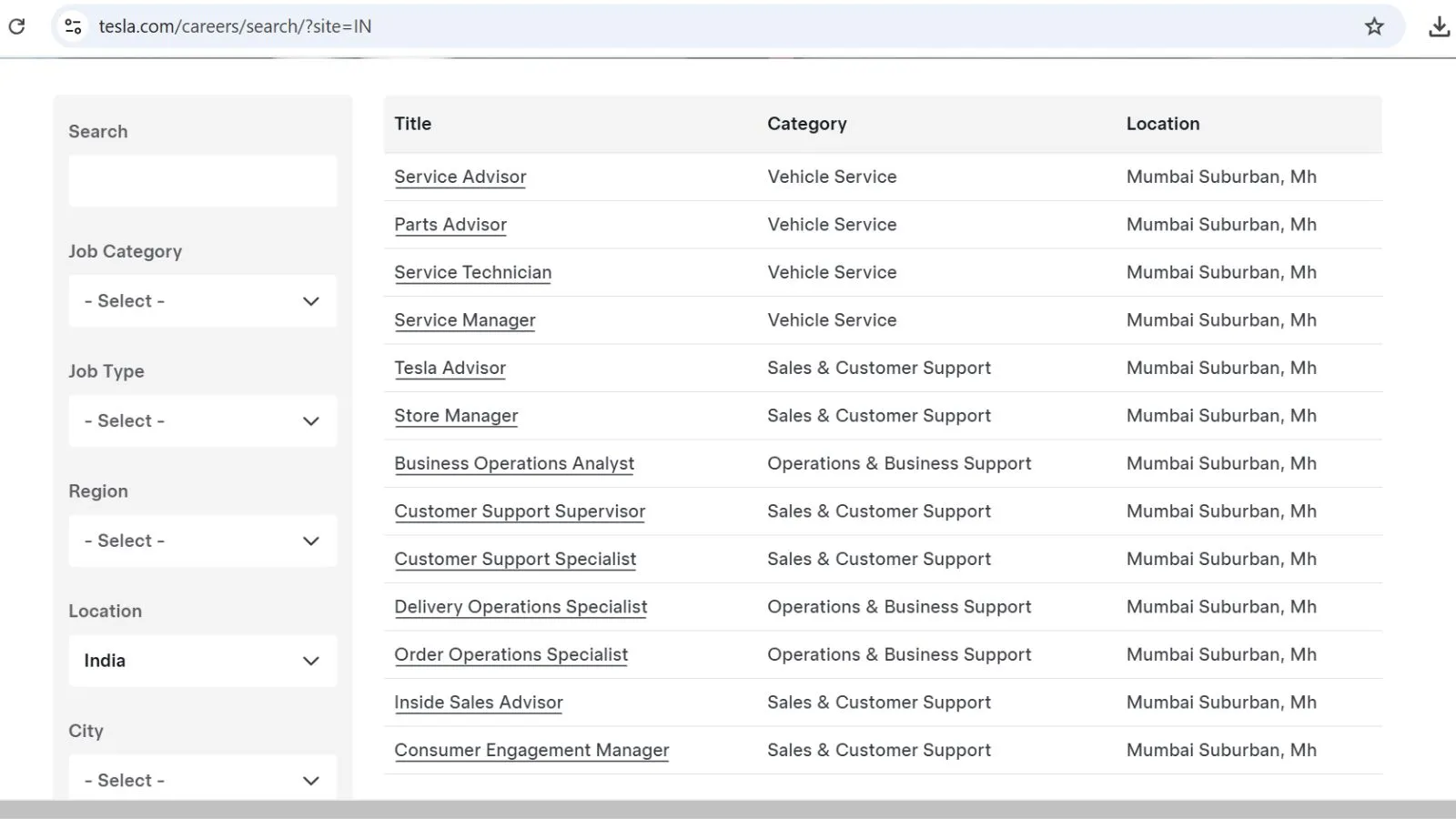

Here are the electric car sales worldwide in the first half of 2020

The question that remains is how long Tesla can continue to rely on the business model with the state bonuses. Because other car manufacturers have long since tackled the change to electromobility (see graphic above).

On the one hand, the competition in the e-car market will continue to grow, which on the other hand means that at Tesla, the million-dollar income from the sale of the credits will be less or will disappear completely, as other car manufacturers with electric vehicles on offer collect their own bonuses.

Already after the figures for the second quarter, analyst Gordon Johnson of GLJ Research indicated that the business model is based on “borrowed time” and that profits are likely to decline again soon, as the company has so far only been able to rely on government credits. Tesla is trying to counteract this with price cuts in order to be able to sell more cars in the event that these government grants are soon to become significantly fewer. The price for the Model S was recently revised downwards. And apparently, the automaker is considering lowering prices overall.