Benefits of LLC vs Sole Proprietorship

When starting a business, one of the crucial decisions you need to make is choosing the right legal structure. Two popular options are Limited Liability Company (LLC) and Sole Proprietorship. In this article, we will explore the benefits of LLCs and compare them to sole proprietorships, helping you make an informed choice for your business.

Liability Protection

One of the key advantages of forming an LLC is the limited liability protection it offers. As a sole proprietor, you are personally responsible for all business debts and legal obligations. This means your assets are at risk in case of any lawsuits or financial issues. On the other hand, an LLC separates your assets from the business, providing a shield of protection. In the event of legal action or debt, your assets are generally not at risk.

Pass-Through Taxation

LLCs offer the benefit of pass-through taxation. This means that the income generated by the LLC is not taxed at the entity level. Instead, the profits and losses “pass through” to the individual owners, who report them on their tax returns. This can be advantageous as it avoids double taxation, which is a common occurrence for corporations. On the other hand, sole proprietors report their business income and expenses on their tax returns as well, simplifying the tax process.

Flexibility in Management

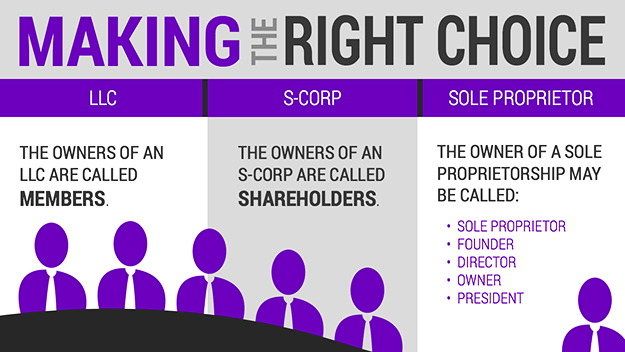

LLCs provide flexibility in the management structure. While sole proprietorships are solely owned and managed by one individual, an LLC allows for multiple owners, known as members. Members can be individuals, corporations, or other LLCs. This flexibility allows for the distribution of management responsibilities and can attract investors or partners to the business.

Perpetual Existence

Unlike a sole proprietorship, an LLC has a perpetual existence. This means that the business continues to exist even if one of the members leaves or passes away. The LLC can be transferred or sold to new members without disrupting the operations. In contrast, a sole proprietorship is directly tied to the individual owner and ceases to exist upon their death or retirement.

Enhanced Credibility

Forming an LLC can enhance the credibility of your business. It demonstrates a level of professionalism and commitment to the venture. Many clients and business partners prefer to work with LLCs due to the limited liability protection and formalized structure. This can open doors to new opportunities and help establish trust in the marketplace.

Choosing between an LLC and a sole proprietorship is a critical decision that depends on various factors such as your business goals, risk tolerance, and long-term plans. While sole proprietorships offer simplicity and ease of setup, LLCs provide liability protection, tax advantages, flexibility, perpetual existence, and enhanced credibility. Consider consulting with a legal or tax professional to determine the best option for your specific circumstances. Remember, making an informed choice can set the foundation for a successful business journey.

Frequently Asked Questions

1. What is an LLC?

An LLC, or Limited Liability Company, is a legal entity that provides limited liability protection to its owners, known as members.

2. What is a sole proprietorship?

A sole proprietorship is a business owned and operated by a single individual, with no legal distinction between the business and the owner.

3. What are the benefits of forming an LLC?

By forming an LLC, you can enjoy limited liability protection, which means your assets are separate from the business’s liabilities. Additionally, an LLC offers flexibility in management and taxation options.

4. What are the benefits of a sole proprietorship?

A sole proprietorship is easy and inexpensive to set up and maintain. It provides complete control and decision-making power to the owner.

5. Can a sole proprietorship be converted into an LLC?

Yes, a sole proprietorship can be converted into an LLC. This conversion offers the advantages of limited liability protection and potential tax benefits.

6. Are there any tax advantages to forming an LLC?

Yes, an LLC can choose how it wants to be taxed, either as a sole proprietorship, partnership, or corporation. This flexibility allows for potential tax savings and optimization.

7. Do I need to hire a lawyer to form an LLC?

While it’s not required, it is recommended to consult with a lawyer or use online services specializing in LLC formation to ensure compliance with legal requirements.

8. Can an LLC have multiple owners?

Yes, an LLC can have multiple owners, called members. This allows for shared responsibilities, resources, and potential growth opportunities.

9. What happens to an LLC if one of the members leaves?

If a member leaves an LLC, the remaining members may choose to continue the business by amending the operating agreement or dissolving the LLC, depending on the circumstances.

10. Can an LLC be sued?

Yes, an LLC can be sued. However, the liability of the members is generally limited to the amount of their investment in the LLC, protecting their assets.