Safeguarding Your Finances: A Comprehensive Guide on Blocking Your SBI ATM Card

When it comes to a lost or stolen ATM card, immediate action is crucial to safeguard your finances. This comprehensive guide will walk you through the process of blocking your State Bank of India (SBI) ATM card. By following the MECE (Mutually Exclusive, Collectively Exhaustive) framework, you can approach the card-blocking process in an organized and efficient manner.

Understanding the Significance of Blocking an SBI ATM Card

Blocking your SBI ATM card promptly is of utmost importance to prevent potential financial losses and fraudulent activities. Failing to block a lost or stolen card can leave you vulnerable to unauthorized transactions and misuse of your funds. By taking immediate action, you can maintain financial security and enjoy peace of mind.

Step-by-Step Guide to Blocking an SBI ATM Card

Gathering Essential Information

Before initiating the card-blocking process, it is crucial to gather all the necessary information related to your card. This includes your card number, account details, and any other relevant information. It is important to keep this information safe and secure to prevent unauthorized access.

Contacting SBI Customer Care

When you discover that your SBI ATM card is lost or stolen, the first step is to contact SBI Customer Care immediately. You can reach out to them through their toll-free helpline, which is available 24/7. The toll-free number ensures quick assistance and guidance in blocking your card.

Verifying Your Identity

During the card-blocking process, you will need to verify your identity to ensure the security of your account. This involves providing the required account and personal details accurately. Additionally, you may be asked security questions or receive a One-Time Password (OTP) for further verification.

Step-By-Step Guide to Blocking an SBI ATM Card

Gathering Essential Information

Before initiating the card-blocking process, it is crucial to gather all the necessary information related to your SBI ATM card. This includes your card number, account details, and any other relevant information. It is important to keep this information safe and secure to prevent unauthorized access to your account.

Contacting SBI Customer Care

When you discover that your SBI ATM card is lost or stolen, it is essential to contact SBI Customer Care immediately. The toll-free helpline provided by SBI is available 24/7 and ensures quick assistance in blocking your card. By reporting the loss or theft promptly, you can minimize the risk of any unauthorized transactions.

Explaining the Toll-Free Helpline

The first and most convenient method to report a lost or stolen card is by calling the SBI toll-free helpline. The toll-free number ensures that you can seek immediate assistance without incurring any charges. It is important to have the helpline number saved in your phone or written down in a safe place for quick access during emergencies.

Alternative Contact Methods

In addition to the toll-free helpline, SBI provides alternative channels to report a lost or stolen ATM card. These include online options, such as the SBI website or mobile banking app, email, and visiting your nearest SBI branch. Choose the method that is most convenient for you and ensures a prompt response to block your card.

Verifying Your Identity

During the card-blocking process, SBI will require you to verify your identity to ensure the security of your account. This step is crucial to prevent unauthorized access to your funds. You will be asked to provide your account and personal details accurately. It is important to provide the correct information to avoid any delays in blocking your card.

Account and Personal Details

When verifying your identity, SBI may ask for a specific account and personal details. These may include your account number, registered mobile number, date of birth, and other relevant information. Ensure that you have this information readily available to provide accurate details during the verification process.

Security Questions and OTP

As an additional security measure, SBI may ask you security questions or provide a One-Time Password (OTP) during the verification process. The security questions are designed to confirm your identity, and the OTP is usually sent to your registered mobile number. Answer the security questions correctly and enter the OTP promptly to proceed with blocking your card.

Reporting the Lost or Stolen Card

Once your identity is verified, you will need to report the loss or theft of your SBI ATM card. This step is crucial to inform SBI about the incident and request the immediate blocking of your card to prevent any unauthorized transactions.

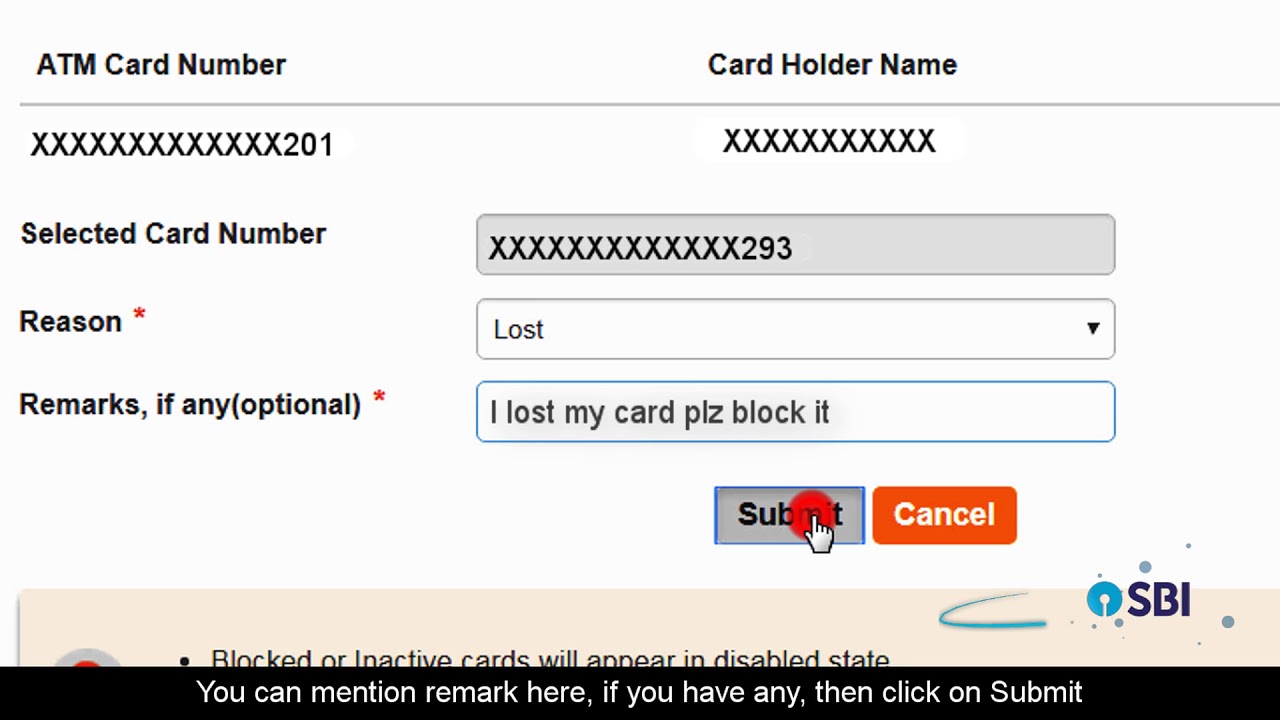

Providing Card Details

When reporting the loss or theft, you will be required to provide specific details about your card. This includes your card number, the type of card (debit or credit), and any other relevant information. The card number is particularly important for SBI to identify and block the correct card associated with your account.

Mentioning the Incident

While reporting the loss or theft, it is important to provide details about the incident. This includes the date, time, and location where the card was lost or stolen. Providing these details helps SBI track any suspicious activity on your account and take appropriate measures to safeguard your finances.

Requesting Card Blocking

When reporting the loss or theft, clearly state the need for immediate card blocking. Emphasize the urgency of the situation to ensure that SBI takes prompt action to block your card and prevent any unauthorized transactions. Requesting card blocking is crucial to protect your funds and maintain financial security.

Follow-Up Actions

After successfully blocking your SBI ATM card, there are a few important follow-up actions to take to ensure the security of your finances.

Filing a Police Report

It is advisable to file a police complaint regarding the loss or theft of your SBI ATM card. This serves as a legal record of the incident and can be useful in case of any fraudulent activities or disputes. Contact your local police station and provide them with all the necessary details regarding the incident.

Monitoring Account Activity

After blocking your SBI ATM card, it is crucial to monitor the activity in your account regularly. This helps you detect any unauthorized transactions or suspicious activity. SBI provides various tools to monitor your account, such as mobile banking apps and online statements. Make it a habit to review your account statements and transaction history frequently to ensure the security of your finances.

Frequently Asked Questions

Q: Who is liable for unauthorized transactions on a blocked SBI ATM card?

A: Once you have reported the loss or theft of your SBI ATM card and it has been blocked, you are generally not liable for any unauthorized transactions that occur thereafter. However, it is important to report the incident as soon as possible to minimize any potential liability.

Q: How can I get a replacement for my blocked SBI ATM card?

A: After blocking your SBI ATM card, you can request a replacement by contacting SBI Customer Care or visiting your nearest SBI branch. They will guide you through the process of obtaining a new card and may require you to provide certain documents for verification.

Q: Can I temporarily block my SBI ATM card?

A: Yes, SBI provides the option to temporarily block your ATM card if you have misplaced it and wish to prevent any unauthorized transactions while you search for it. You can do this through the SBI website, mobile banking app, or by contacting SBI Customer Care.

Blocking your SBI ATM card promptly in case of loss or theft is crucial to safeguard your finances. By following the step-by-step guide provided in this comprehensive article, you can ensure a smooth and efficient blocking process. Remember to gather all necessary information, contact SBI Customer Care immediately, verify your identity, report the incident, and take necessary follow-up actions. Prioritizing your financial security and taking immediate action will help protect your funds and give you peace of mind.