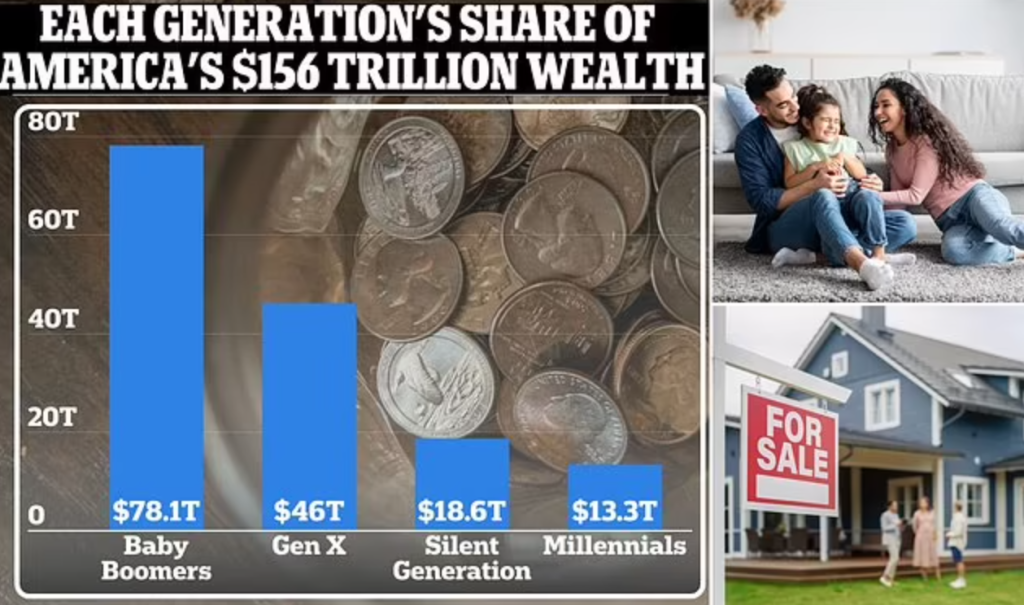

While many Millennials currently struggle with affording essential aspects of the “American Dream” like homeownership and steady careers, a recent report suggests they are poised to inherit a staggering $90 trillion in assets over the next two decades. This immense wealth transfer from the Silent Generation and Baby Boomers has the potential to make Millennials the richest generation in history, but with a significant caveat: the distribution is likely to be uneven, potentially exacerbating existing wealth inequality.

A Generational Chasm: Inheritance as the Key Factor

According to The Wealth Report by global property consultant Knight Frank, the significant wealth transfer will primarily occur through inheritance, with property and other assets changing hands between generations. This shift is expected to bring “seismic changes” in how wealth is used, as stated by Liam Bailey, global head of research at Knight Frank.

However, the report highlights a crucial point: whether a Millennial benefits from this wealth transfer largely depends on their family background. In simpler terms, it’s a wealth lottery determined by birth, potentially widening the already existing wealth gap.

Shifting Landscape: Beyond Traditional Wealth Building

The research also reveals a fascinating insight into the younger generation’s perspective on wealth creation. Affluent young people are increasingly looking beyond traditional methods like property investment for building wealth.

Factors like low-interest rates and skyrocketing housing prices in recent years have likely contributed to this shift. As Mike Pickett, director of Cazenove Capital, points out in the report, the current trends are unlikely to continue indefinitely.

This observation aligns with the emerging preferences of Gen Z, the generation following Millennials. The report suggests a growing comfort level with renting, car leasing, and subscription-based services among Gen Z, indicating a potential move away from traditional ownership models.

Pickett emphasizes that while wealth is being transferred to younger generations, there’s also a diversification of wealth creation methods. He highlights the rise of “first-generation wealth creation” through various entrepreneurial avenues, including the success of YouTubers who have amassed significant wealth.

Global Wealth Revival and the Rise of the Super-Wealthy

The report also delves into global wealth trends, revealing an increase in the number of super-wealthy individuals in 2023. This group, defined as those with a net worth of $30 million or more, saw a global growth of 4.3% compared to the previous year, reaching 626,619 individuals.

North America witnessed the most significant regional increase, with a 7.2% rise in the super-wealthy population. The Middle East and Africa followed suit with growth rates of 6.2% and 3.8%, respectively. Interestingly, Latin America was the only region to experience a decline, with a 3.6% drop in its ultra-wealthy population.

Factors like improving interest rates, a robust US economy, and a surge in the stock market are attributed to this global wealth creation, according to Bailey. The report further highlights the continued appeal of real estate investment among this group, with 19% planning to invest in commercial property and 22% looking to acquire residential property this year.

Looking ahead, the report predicts a 28% increase in the super-wealthy population over the next five years, albeit at a slower pace compared to the 44% growth witnessed in the previous five-year period ending in 2023. Notably, the report identifies Asia, specifically India, China, Malaysia, and Indonesia, as regions expected to experience significant growth in ultra-high-net-worth individuals.

Conclusion: A Complex Inheritance with Unforeseen Consequences

The prospect of inheriting a staggering $90 trillion might paint a rosy picture for Millennials, but the reality is likely to be far more nuanced. While some individuals will undoubtedly benefit significantly from this wealth transfer, the inherent dependence on family background raises concerns about further widening the wealth gap.

Furthermore, the changing perspectives on wealth creation methods among younger generations and the global rise of the super-wealthy add further complexity to the equation. It remains to be seen how these intertwined factors will ultimately shape the future of wealth distribution and its impact on society as a whole.